| « Back to article | Print this article |

How mobile apps make banking easier

Bangalore-based network security professional Ashish Rao started using mobile banking earlier this year, and he has largely transacted through the ICICI Bank's mobile banking application (app) since then.

"Be it sending money to parents or to any of my other account(s), I largely transfer funds through the mobile. I also shop on e-commerce sites and book movie tickets through the mobile, as it can be done anywhere, anytime," explains Dilip.

He has spread the word among colleagues and friends. Three of eight have followed suit. "Most of us have smartphones and these are supposed to be used for all the facilities they give. Importantly, these applications work very well on smartphones, then why not transact through them," says Dilip's colleague Aniket Dave.

Click NEXT to read more...

How mobile apps make banking easier

Banking experts advocate mobile banking. Take the example of the National Payments Corporation of India (NPCI), set up by the Reserve Bank of India (RBI), which launched the inter-bank mobile payment service (IMPS) for all merchants.

This means you can pay any kind of bill through your mobile, including that of the neighbourhood kirana store. With this, NPCI hopes to increase mobile-based transactions from 0.2 million to one million by 2013.

According to an RBI report released on August 23, 13 million individuals used mobile banking services in 2011-12. The report said 49 banks saw 25.6 million mobile banking transactions, worth Rs 1,820 crore, in the same period. The transactions had grown 200 per cent in volume and 175 per cent in value.

Click NEXT to read more...

How mobile apps make banking easier

All banks have cashed in on this and have a mobile banking app in place. You can transfer up to Rs 50,000 a day using the app. Smaller payments of up to Rs 5,000 can use the bank's SMS facility.

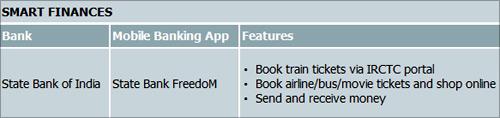

The country's largest lender State Bank of India (SBI) has an app that helps you book train tickets via the IRCTC (Indian Railway Catering and Tourism Corporation) portal.

You need to get the one-time password (OTP) before you log into the portal through mobile banking. Given that booking last minute through IRCTC gets difficult, this platform can be useful.

Click NEXT to read more...

How mobile apps make banking easier

You will be charged Rs 5 (over and above the tickets and IRCTC charges) if the ticket cost is up to Rs 5,000, and Rs 10 if over Rs 5,000. You can also book airline/bus/movie tickets, shop online and send/receive money to/in SBI accounts or others.

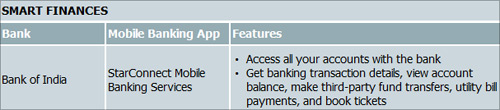

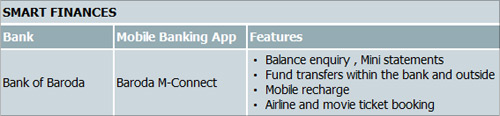

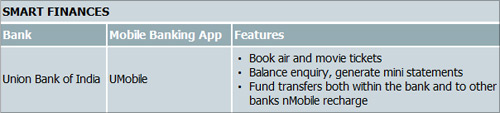

Features offered by other public sector banks like Bank of India and Union Bank of India are similar. There are extra benefits, like mini-statement generation, mobile recharge and utility bill payment.

The latter is a feature that can be of great help as people don't find time to go to the state electricity board's office and stand in a queue for hours to pay the bill.

Click NEXT to read more...

How mobile apps make banking easier

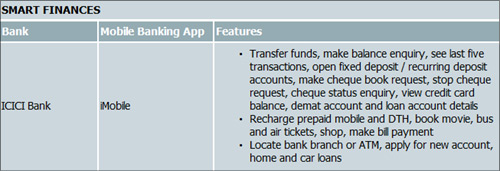

The country's largest private bank, ICICI Bank, has gone a step ahead, allowing you to open new savings bank account, fixed deposit, recurring deposit and demat account through the mobile banking app.

Also, you can apply for home, car loan and view loan account details. More, you can recharge the direct-to-home (DTH) connection along with the mobile's.

HDFC Bank's mobile banking facility through ngpay helps search for shows and seats too. For travel tickets, the bank has a tie-up with IRCTC, Kingfisher Airline, MakeMyTrip, Yatra, redBus, Ticketvala and Savaari.

Click NEXT to read more...

How mobile apps make banking easier

The bank's HDFC Bank Visa Debit Card on mChek is a card issued on your mobile through which you can pay for mobile, utility bills, book movie and air tickets, and shop. You need not carry a debit card or share card details with merchants or portals.

Mobile banking solutions company, Monitise, a joint venture of LSE-listed Movida and Visa, signed an agreement with HDFC Bank this year to introduce a mobile payment service. It will go live next month. It is also aimed at basic phone users.

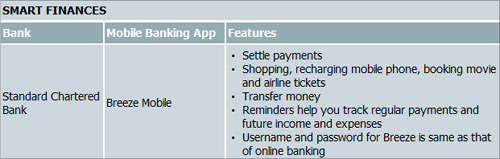

Standard Chartered Bank's mobile banking app, Breeze Mobile, helps you by issuing reminders on payments, future income and expenses.

Click NEXT to read more...

How mobile apps make banking easier

It also relieves you from the headache of remembering a new username and password, as those are the same as that of online banking.

To register for mobile banking, GPRS-activated phones need to download the app to the handset from the browser application of the bank, and key in the username and password to start transacting.

Click NEXT to read more...

How mobile apps make banking easier

It can also be downloaded through the PC, and transferred to the mobile via bluetooth or data cable. Those using low-end handsets can initiate transactions through text messages.

Those using Android phones need to download apps from Google Play (or the android market). iPhone users can download those from the Apple App Store.