Photographs: Bobby Yip/Reuters Lalit K Jha in Washington

Apple, the top US computer and smart phone manufacturer, used a complex web of offshore entities to avoid billions in taxes, a Senate panel has alleged.

The electronics giant's rootless subsidiaries had just one purpose: to funnel much of the company's global profits and dodge billions of dollars in US tax obligations, according to the report by the Permanent Subcommittee on Investigations.

One of Apple's Irish affiliates reported profits of $30 billion between 2009 and 2012, but because it did not technically belong to any country, it paid no taxes to any government.

Another paid a tax rate of 0.05 per cent in 2011 on $22 billion in earnings, according to the report.

The panel said that Apple exploited the gap between the two nations, the US and Ireland, through three of its subsidiaries the company claims are not tax resident in any nation, to avoid paying taxes.

...

Apple used subsidiaries to dodge billions in taxes

Image: Apple store in New York.Photographs: Reuters

"Exploiting the gap between the two nations' tax laws, Apple Operations International has not filed an income tax return in either country, or any other country, for the past five years. From 2009 to 2012, it reported income totalling $30 billion," the Senate panel said.

The report found Apple's three subsidiaries had no official tax residence, which made them pay little or no taxes.

"Apple's claim that three key offshore companies are not tax residents of Ireland, where they are incorporated, or of the United States, where Apple executives manage and control the companies. One of those Irish subsidiaries has paid no income taxes to any national tax authority for the past five years," it said.

"Apple wasn't satisfied with shifting its profits to a low-tax offshore tax haven. Apple sought the Holy Grail of tax avoidance," Senator Carl Levin said.

...

Apple used subsidiaries to dodge billions in taxes

Image: A view of the Apple store in New York.Photographs: Reuters

"It has created offshore entities holding tens of billions of dollars, while claiming to be tax resident nowhere," he alleged.

The bipartisan Senate panel alleged in its report that Apple is using a so-called cost sharing agreement to transfer valuable intellectual property assets offshore and shift the resulting profits to a tax haven jurisdiction.

It alleged that Apple is taking advantage of weaknesses and loopholes in tax law and regulations to "disregard" offshore subsidiaries for tax purposes, shielding billions of dollars in income that could otherwise be taxable in the US.

The Senate panel alleged that Apple is negotiating a tax rate of less than two per cent with the government of Ireland - significantly lower than that nation's 12 per cent statutory rate - and using Ireland as the base for its extensive network of offshore subsidiaries.

...

Apple used subsidiaries to dodge billions in taxes

Image: Apple laptops are seen on display inside the newest Apple Store in New York City's Grand Central Station.Photographs: Reuters

"Apple claims to be the largest US corporate taxpayer, but by sheer size and scale, it is also among America's largest tax avoiders," said John McCain said.

"A company that found remarkable success by harnessing American ingenuity and the opportunities afforded by the US economy should not be shifting its profits overseas

to avoid the payment of US tax, purposefully depriving the American people of revenue," McCain alleged.

"It is important to understand Apple's byzantine tax structure so that we can effectively close the loopholes utilised by many US multinational companies, particularly in this era of sequestration," the Senator said.

The Senate Panel alleged that in addition to standard multinational tactics, Apple established at the apex of its offshore network an offshore holding company that it says is not tax resident in any nation.

...

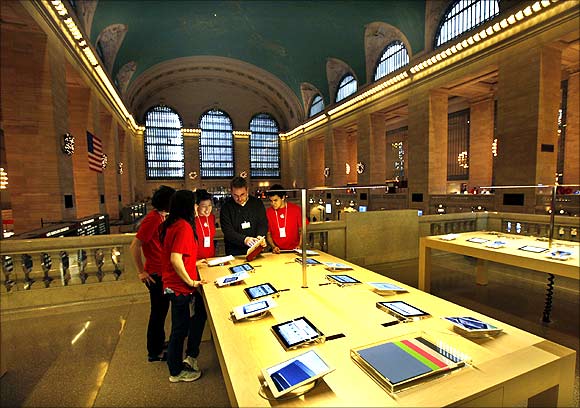

Apple used subsidiaries to dodge billions in taxes

Image: Employees look at iPad tablets on display inside the newest Apple Store in New York City's Grand Central Station.Photographs: Reuters

Apple Operations International, the subsidiary of Apple, has no employees and no physical presence, but keeps its bank accounts and records in the US and holds its board meetings in California.

It was incorporated in Ireland in 1980, and is owned and controlled by the US parent company, Apple Inc.

Ireland asserts tax jurisdiction only over companies that are managed and controlled in Ireland, but the United States bases tax residency on where a company is incorporated.

A second Irish subsidiary claiming not to be a tax resident anywhere is Apple Sales International which, from 2009 to 2012, had sales revenue totalling $74 billion, the Senate Panel said.

...

Apple used subsidiaries to dodge billions in taxes

Image: A customer poses next to an Apple logo.Photographs: Reuters

"The company appears to have paid taxes on only a tiny fraction of that income, resulting, for example, in an effective 2011 tax rate of only five hundreds of one per cent," it said.

"The third Irish subsidiary is Apple Operations Europe. In addition to creating non-tax resident affiliates, Apple Inc has utilised US tax loopholes to avoid US taxes on $44 billion in otherwise taxable offshore income over the past four years, or about $10 billion in tax avoidance per year," the Senate Panel said.

article