| « Back to article | Print this article |

How the rising rupee is hurting Indian exporters

"It's very scary. I do not know what to do," says Rafique Ahmed, one of the largest Indian leather goods exporters, who has the likes of Walmart on his buyers list.

Ahmed, based in Chennai, speaks here of the ever-rising rupee.

For him, portfolio flows into India are now as important as recovery in Europe.

After all, foreign institutional investors have pumped in close to $20 billion (Rs 90,000 crore) this calendar year into the Indian equity markets and there are three more months to go before the end of 2010.

Compounding the problem for Ahmed and other exporters is the absence of hedging.

Though everyone expected the rupee to rise, it is the quantity of increase and the pace it is appreciating that has foxed them.

Besides, with not too many orders in the bag, hedging was not on the immediate horizon for several exporters.

Click NEXT to read further. . .

Surging rupee increases exporters' worry

Already, they are dealing with a situation where there is no substantial increase in orders, month-on-month.

"Though there are plenty of orders for the festival season, it is not increasing and is nowhere near the pre-crisis levels," says Sudhir Dhingra, chairman and managing director of Orient Craft, one of the large textile exporters.

'You'll have to cope'

Though the Federation of Indian Export Organisations, the exporters' lobby group, has already called for Reserve Bank of India intervention, officials in the commerce department are no longer talking in a tone that would remind you of yesteryears. "Exporters have to learn to live in a volatile currency scenario.

They have to hedge. There is no other option," Union commerce secretary Rahul Khullar said recently.

So far, RBI -- which follows a policy of intervening in the markets to check extreme volatility in the rupee -- has stayed away from buying dollars to stem the appreciation.

As a result, last week, the Indian currency hit a five-month high against the greenback following a surge in FII inflows.

Click NEXT to read further. . .

Surging rupee increases exporters' worry

It had appreciated by 4.3 per cent last month.

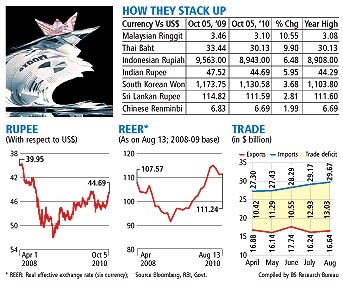

Compared to last August, in real terms the rupee has appreciated by 14.5 per cent against a basket of six currencies (see graph).

During the past 12 months, the rupee, which closed at 44.69 against the dollar, has appreciated by almost six per cent against the US currency.

A part of the reason for the absence of RBI intervention is the fear of adding to supply of the rupee in the system as a result of the purchase of dollars by the central bank.

A higher supply would not augur well for inflation, identified as the primary area of assault.

"In the short term, some appreciation in the rupee does not spell doom for anyone in the economy.

"Rather, it reduces the cost of imported goods.

The rupee has seen two-way movement and there is no point in the keeping the value down, especially when everyone around the globe is doing the same thing.

Click NEXT to read further. . .

Surging rupee increases exporters' worry

Short-term appreciation also improves the investment scenario. Having said that, this should not continue for long," says Ashima Goyal, professor at the Indira Gandhi Institute of Development Research.

HDFC Bank's chief economist, Abheek Barua, says the rising trend for the rupee is unlikely to see a reversal soon.

"The last phase had been a ferocious appreciation, which is temporary. The rupee would continue to appreciate for some more time due to the 3G (telecom spectrum) auction and other broadband auctions which will be ultimately funded by external commercial borrowings.

"That would act as a trigger. However, post that scenario, a gradual depreciation cannot be ruled out. Perhaps it's time the RBI intervenes little bit in the capital markets," he said.

"The RBI may have to resort to sterilisation of these funds in case they do get out of hand, though the present scenario of liquidity being scarce could defer this process," rating agency CARE said in a recent report.

Click NEXT to read further. . .

Surging rupee increases exporters' worry

Will it help?

But economists say even if the trend was reversed immediately, exports will not benefit significantly.

"If the recovery in the international markets is not good, then even a depreciating rupee would not help," says Goyal.

And, Barua added that exports from India and other developing countries are likely to slow down by the end of the financial year, mainly because of slow recovery in America and Europe.

While exporters might be complaining of losing competitiveness due to the currency, rival Asian currencies are also facing a similar problem, though the magnitude may vary.

"India is not the only country where appreciation of the currency is happening.

"The scenario is the same for all other developing Asian economies. Yes, the exchange rate does put pressure on the margins but this is not a single-directional aggressive movement of the rupee. There had also been two-way movements," says Sonal Varma, India economist at Nomura, the Japanese financial services firm.

Click NEXT to read further. . .

Surging rupee increases exporters' worry

"This sudden rise in the rupee, no doubt substantial, will not impact exports adversely. Nevertheless, certain sectors might face some difficulties, especially SMEs (small and medium enterprises). But we do expect a 10 per cent growth in exports compared to 2009-2010," says ING Vysya Bank's chief economist, Deepali Bhargava.

During the first five months of the current financial year, exports were estimated at $85.27 billion, compared to $66.32 bn a year earlier, indicating an increase of 28.6 per cent. Imports during the same period grew by 33.1 per cent to $141.9 bn from $106.6 bn last year.

For the moment, however, exporters are complaining. "The government talks about diversifying the markets. But it's not an easy task," says Orient Craft's Dhingra.