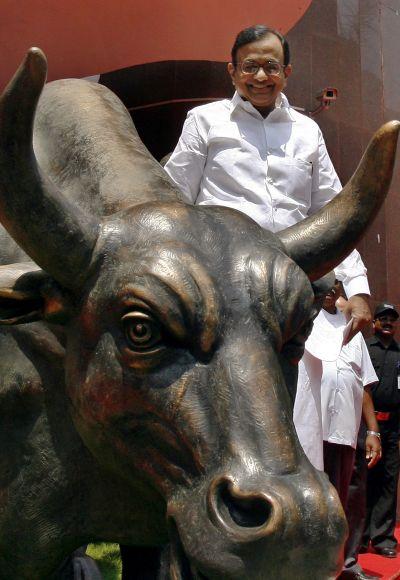

Photographs: Punit Paranjpe/Reuters Rajeev Malik

The recent performance of the Sensex is a reflection of global liquidity and shifts in global asset allocation than a dramatic improvement in the domestic real economy.

India is a country with multiple personalities within each of its social, political and economic layers.

Day-to-day decision-making and outcomes often appear to challenge logic, but never fail to confound, amaze or disappoint - sometimes all at one go.

Even on a good day, there seems to be crisis somewhere in the folds of this chaotic democracy. On a bad day, one often wonders how it functions, if at all.

In this country with multiple disconnects, the mother of all disconnects is the widening gap between the performance of the equity market and the real economy.

India's real GDP growth has been heading south but the benchmark equity index has been moving higher (and no, it is not just about financial markets being forward-looking).

...

Why Sensex is rising when economy is in doldrums

Photographs: Reuters

There is more to the drivers of share prices than GDP growth. Equity investors buy corporate earnings, not GDP growth. Earnings are also undoubtedly affected by the state of the real economy.

But, as the relative difference in the performance of equity markets in India and China (the latter's economic growth is much higher than former's) shows, higher real GDP growth doesn't necessarily indicate superior equity market performance.

At first blush it might appear surprising that the Sensex has been heading north since late 2011 despite the deceleration in India's real GDP growth.

More recently, it has even ignored the increased expectation of a delay in any investment-led economic revival. However, this dichotomy is in large part because of foreign liquidity inflows.

Inflows into the equity market have been from global rather than country-dedicated funds (domestic investors remain net sellers).

...

Why Sensex is rising when economy is in doldrums

Photographs: Jason Lee/Reuters

Thus, India has been relatively better off despite the local concerns, partly because it is less badly positioned than many other economies, especially the BRIC economies.

Indeed, the Sensex has outperformed other BRIC benchmark equity indices. The recent correction in commodity prices has a bigger positive impact on India than other BRIC countries.

In fact, the decline in commodity prices will be outright negative for Brazil and Russia. A common feedback from global investors is their favourable disposition towards the quality of Indian companies.

India's outperformance relative to China is more striking, despite the latter's much higher GDP growth and optically more attractive equity valuations.

India has more favourable structural drivers which could raise its trend growth rate, while China's structural drivers will pull its sustained growth towards lower levels. However, India is unlikely to have a smooth ride.

The key challenge will be its governments and governance, as politics remains a major impediment against quicker and greater unlocking of its growth potential.

...

Why Sensex is rising when economy is in doldrums

Image: Cars and trains move on Taksin bridge over Chao Phraya river in central Bangkok, Thailand.Photographs: Damir Sagolj/Reuters

In contrast to other BRIC indices, the Indian equity market has underperformed those of most countries in Southeast Asia. This is mainly because of the strength of the cyclical and structural positives that these economies enjoy.

Thailand and Indonesia show late-cycle stress of wider current account deficits but these are, unlike in India's case, because of strong economic growth.

Good macro and good equity markets don't have to be in sync all the time. What has worked in India's favour - and also considerably cushioned the macro strains - is the excess liquidity injections by central banks in key industrial economies.

In recent years, the Indian equity market has done well, even when the global economy is weak, because of easy global liquidity.

The government's corrective policy actions too have contributed to the improved investor sentiment. But the Sensex's north-bound march has been unaffected by the recent drying up of corrective economic measures, not to mention the near-absence of meaningful reforms in the real economy.

...

Why Sensex is rising when economy is in doldrums

Image: A currency trader works in front of a screen showing the value of the Indian Rupee against the US Dollar.Photographs: Vivek Prakash/Reuters

Unfortunately, the relative outperformance of the Indian equity market within the BRIC markets is not reflected in the rupee. It remains in the doghouse despite the government's efforts to attract more foreign capital and the recent correction in commodity prices.

More striking is the similar performance of the Brazilian real and the rupee, despite the opposite impact on each of lower commodity prices.

This underscores the impact - often ignored - of a stronger US dollar generally and the structural issues affecting the rupee specifically.

More worrying is that India appears to be ill-prepared for the anticipated reversal in a hitherto favourable global liquidity situation. This is of concern also because the triggers for that reversal are not in India's control.

Essentially, India has largely squandered the breathing room in the last couple of years provided by easy global liquidity to undertake path-breaking reforms.

Other Asian countries, which are more integrated with the global economy than India, do not show similar stress points despite facing the same global backdrop.

...

Why Sensex is rising when economy is in doldrums

Photographs: Vivek Prakash/Reuters

The bottom line is that the recent performance of the Sensex is a reflection more of global liquidity and shifts in global asset allocation than a dramatic improvement in the domestic real economy.

It in no way takes away credit from the recent constructive steps from the government, and the resulting elevated expectations of more action. But these measures are inadequate for a high sustained non-inflationary speed limit on growth.

India remains vulnerable to a shift towards a less favourable global liquidity environment.

Indian policymakers are still fire-fighting rather than undertaking structural changes in the real economy which would enhance economic resilience to global swings.

Some local positives are also often exaggerated to present a more attractive option to overseas investors.

The harsh reality is that India has been relatively better off to a large extent because others are much worse off. That should not be dismissed - but is hardly a vote in favour of the absolute strength of the India story.

...

Why Sensex is rising when economy is in doldrums

Photographs: Reuters

The critical issue in the coming months is not whether expectations of India's improving economic growth and some more monetary easing will keep foreign capital inflows robust, as is desperately needed.

The real question is whether India could be a casualty of the adverse impact of the reversal - even if it is gradual - in the global liquidity cycle, despite some improvement in economic growth.

Managing the transition as world growth recovers, the global liquidity wave recedes, the US dollar strengthens and US bond yields rise should be part of the Reserve Bank's thinking.

Its impact would be more than that of the widespread misguided focus only on wholesale price inflation. The anticipated transition will also trigger an unpleasant shock to the rupee.

In such a setting it is difficult to see how the RBI can deliver a series of rate cuts, an idea investors currently seem to be happily wedded to.

The writer is senior economist at CLSA, Singapore. These views are his own

article