| « Back to article | Print this article |

Why panicking about Indian markets is pointless

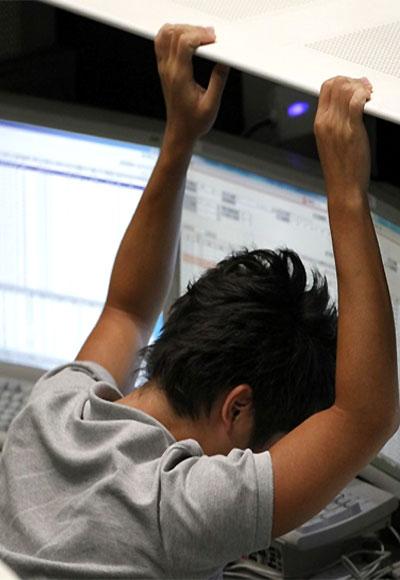

Regardless of what you’re told, this is not a 'home-grown crisis' -- it is a pan-emerging market problem, notes Mihir S Sharma

India is, even at the best of times, an inward-looking place.

There’s usually more than enough going on here for us to happily ignore what might be happening in the rest of the world.

Sometimes, however, that cheerful ignorance leads us into grave errors -- especially at the worst of times. Such as, for example, right now.

First: the facts.

The rupee is sliding, and it would be sliding faster if recent and ill-advised controls imposed by the Reserve Bank of India were withdrawn.

India is running a massive current account deficit, buying more from the world than it sells, caused by poor government policy -- excessive petrochemicals subsidies in particular.

Click NEXT to read further. . .

Why panicking about Indian markets is pointless

Merchandise exports can’t fill the gap because the government has been unable to remove the structural hurdles to investment in physical infrastructure.

Meanwhile, high inflation, a symptom of redistributive policy of one sort or another, has led the Reserve Bank of India to keep rates high -- raising interest costs, throttling demand and consequently killing growth.

These facts are used by many to argue that the ‘crisis’ we’re going through at the moment is basically home-grown.

Yes, not even professional critics of the United Progressive Alliance -- India’s only growth industry, with easy returns and no qualifications whatsoever for entry -- can deny that the reason for the recent sell-off in bond, equity and currency markets is that the United States Federal Reserve is on the point of withdrawing its massive quantitative easing programme, which had flooded India with money.

Click NEXT to read further. . .

Why panicking about Indian markets is pointless

But that’s just the match, we’re told; that the economy went up in flames demonstrates our uniquely poor performance.

Never in the appalling annals of political-economic punditry in India have so many people been so wrong simultaneously.

And the worst part is that this comprehensive error is born out of willing ignorance, and an inability to look beyond our shores for even a moment.

Truism: India’s uniquely troubled, and the United Progressive Alliance’s uniquely troublesome.

Facts: well, let’s look at our emerging market peers, for a moment, shall we?

Click NEXT to read further. . .

Why panicking about Indian markets is pointless

Indonesia: The only large economy growing faster than India. (I’ll get to China later.) But it has even higher fuel subsidies than India, with the consequent fiscal stress.

In addition, an agricultural policy that restricted imports has pushed food prices through the roof, causing nine per cent inflation.

Thus, it’s just seen a four-day, 12 per cent drop in its stock market, and the rupiah is at its lowest since the financial crisis hit.

Over in Indonesia, they’re blaming this on a government they call paralysed, led by someone they complain is pleasant, but indecisive and taciturn.

I was there recently, and felt comfortably at home: the news is all about corruption scandals in gas, in transport infrastructure, in government procurement -- fear of corruption, I was told, is causing an investment fall-off.

Click NEXT to read further. . .

Why panicking about Indian markets is pointless

Thailand: Has actually slipped into a genuine recession -- the economy has shrunk for two successive quarters.

It is struggling with high household debt that many fear is about to go bad; the current account has slipped into deficit, in spite of it being a major commodity exporter.

The government is blamed for populist fiscal policy, and for holding up infrastructure investment.

It’s spent only 60 per cent of its infrastructure budget for the past three years; and the courts have held up much of the rest for environmental reasons.

Meanwhile, the rice trade has effectively been nationalised, with the resultant subsidies draining the exchequer.

And, of course, the government is paralysed by fear of street protests.

Click NEXT to read further. . .

Why panicking about Indian markets is pointless

South Africa: Once the bright spot in that continent, now one of its slowest-growing economies.

Inflation is very high -- and the current account deficit is a startling six per cent of gross domestic , driven in part by a collapse in mining output as the country is riven by internal dissent led by trade unions.

The fiscal deficit has expanded massively, and now runs at five per cent of gross domestic product.

Foreigners own 35 per cent of its debt, compared to under 10 per cent in India. Unsurprisingly, the rand has lost 16 per cent of its value this year, and the stock market index is down 21 per cent since May.

Click NEXT to read further. . .

Why panicking about Indian markets is pointless

Brazil: Street protests responding to high inflation and a perception of endemic corruption caused Brasilia to flail around, unable to correct the once high-flying socialist government’s free fall.

The real’s down 15 per cent this year, worse than the rupee. Each sector is in trouble: there’s even a phrase for lack of competitiveness -- the custo Brasil or ‘Brazil cost’.

A familiar tone of sad desperation suffuses how Brazilians write about their economy -- every problem seems short-term, and every solution long-term.

Click NEXT to read further. . .

Why panicking about Indian markets is pointless

Turkey: Its central bank has just raised rates to deal with a Turkish lira that’s down 10 per cent this year.

Government bonds have hit yields of 10 per cent.

Meanwhile, inflation has run steadily at close to nine per cent for much of the recent past. The hot money-funded current account deficit is over six per cent of GDP and, incredibly, some predict it may continue to rise. Meanwhile, massive street protests -- oh, you get the drift.

Across the emerging world, the story’s similar.

In Vietnam, investment is paralysed thanks to bad debt at eight per cent of banks’ assets. In Malaysia, central government debt is higher than India’s and majority-owned by foreigners, and so the currency is sliding.

And, of course, there’s China: few really believe their figures any more.

Famously, according to WikiLeaks, the current premier, Li Keqiang, said he ignored official data and constructed his own using various indicators like electricity demand and rail freight.

Click NEXT to read further. . .

Why panicking about Indian markets is pointless

By the ‘Li Index’, China’s growth has slowed by 10 percentage points to below two per cent annualised. Oops.

The simple fact is that India’s problems have neither a unique cause nor unique consequences; they are representative of what’s facing emerging markets today.

The reason? The induced expansion of liquidity following the global crisis led to mis-investment, overvalued currencies and excessive imports.

Meanwhile, emerging economy middle classes, everywhere more empowered but still a minority, feel that democratic set-ups transfer too much money to other people.

And, tellingly, the only place besides China managing to invest in infrastructure is Malaysia, in spite of it being the most corrupt country in the world, according to recent surveys of businessmen.

Click NEXT to read further. . .

Why panicking about Indian markets is pointless

Tellingly because Kuala Lumpur’s press is largely subservient to the ruling elite.

Whatever growth strategy India and other economies now craft, thus, needs to take these facts into account: that people will protest more on the streets; that redistribution is now a fact of emerging economy life, as is the inflation that comes with it; that infrastructure investment will be impacted by environmental concerns increasingly dominating the public sphere.

I’m not saying that India doesn’t need its own solutions to common problems; nor is the United Progressive Alliance apparently capable of providing them.

But this epidemic of what The Economist recently called India’s ‘self-flagellation like that of the villain in The Da Vinci Code’ is completely pointless.

As Paul Krugman wrote this week about the rupee: “This doesn’t look like as big a deal as some headlines are suggesting. What am I missing?”

What you’re missing, Professor Krugman, is our criminal inability to think beyond blaming New Delhi.