| « Back to article | Print this article |

Why Mukesh Ambani acquired Network18

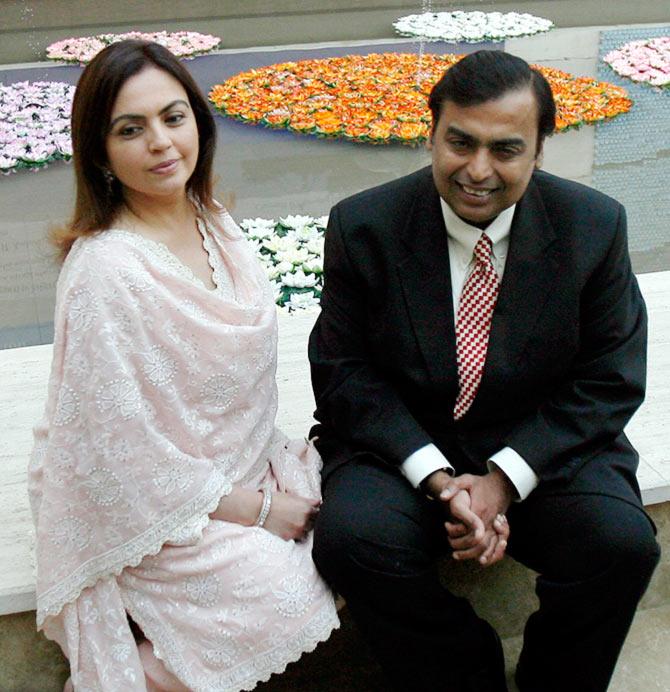

Recently, when Reliance Industries (RIL) sent out a press statement announcing the takeover of Network18 - one of the biggest media houses in the country - for Rs 4,000 crore (Rs 40 billion), it did not come as a surprise to many.

In 2012, when Mukesh Ambani, chairman, RIL bailed out Raghav Bahl, founder and chairman of Network18 Group, media industry was abuzz that soon, he (Ambani) will buy controlling stake in the media company.

This turned out to be true, as gradually Ambani started making small investments in the media firm.

Click NEXT to read more...

Why Mukesh Ambani acquired Network18

In 2013, when Network18 hired consulting firm Ernst and Young to suggest ways to control costs, media barons did not mince words to say that since Ambani was indirectly controlling the media house, he wanted a lean structure in the company.

In the restructuring process, over 300 employees were handed over pink slips.

After the deal was finally announced, Bahl wrote a farewell letter to Network18 employees and also wished them luck. He even assured them that the company was going 'into fantastic hands' and was all praise for Ambani, who is also his good friend.

After the deal was finally announced, Bahl wrote a farewell letter to Network18 employees and also wished them luck. He even assured them that the company was going 'into fantastic hands' and was all praise for Ambani, who is also his good friend.

Mr Ambani is a visionary and undoubtedly the media firm will soar into the “cloud” under his leadership, Bahl wrote in his letter.

Click NEXT to read more...

Why Mukesh Ambani acquired Network18

Though, RIL had not given any reason for acquiring Network18, industry watchers have been active in analysing the takeover.

Telcos and even media houses have been saying that since Ambani’s Reliance Jio Infocomm will roll out 4G services soon, he will get huge access to Network18’s broadcast, digital and e-commerce content.

This is partly true, but there are bigger reasons which prompted the richest man in India to acquire Bahl’s company.

RIL had in its press statement said, "The acquisition will differentiate Reliance’s 4G business by providing a unique amalgamation at the intersection of telecom, web and digital commerce via a suite of premier digital properties.”

But, it will have to confront broader questions on the acquisition from its shareholders at the company's annual general meeting next month.

Click NEXT to read more...

Why Mukesh Ambani acquired Network18

Kush Katakia, owner, Beanstalk Advisory said, “Ambani was always interested in buying a media company. Network18 acquisition will give him easy and cheaper access to content on premier properties like CNBC-TV18, CNN-IBN, Firstpost.com and CNBC Awaaz.”

By owning one of the biggest media companies, he will become more powerful, Katakia said.

He further added, globally a trend has emerged where more and more telcos are buying media firms to get cheaper access to content.

One such instance can be of US telco firm AT & T buying Direct TV.

Click NEXT to read more...

Why Mukesh Ambani acquired Network18

Renowned investment advisor, PN Vijay said, “RIL is sitting on a huge cash pile. The Network18 deal will not strain company balance sheet.”

RIL has cash and cash equivalents of Rs 88,190 crore (Rs 881.90 billion) as on March 31, 2014 in the form of bank deposits, mutual funds and government securities/bonds.

The acquisition will not give Ambani immediate synergy benefits in 4G space because currently, Jio Infocomm is into back end operations. In later stages, he will reap benefits, added Vijay.

However, expressing concern over the acquisition, Vijay said, “In some countries business houses are not allowed to pick up controlling stake in a media company as they may get a powerful tool to influence news.”

Click NEXT to read more...

Why Mukesh Ambani acquired Network18

The Network18 deal assumes significance because a powerful company like RIL has acquired a popular media brand which has around 17 news and entertainment channels in various languages and a sizeable presence in digital and e-commerce space.

There is one more theory which is doing rounds in the market:

The government has not interfered in the deal till now, but there is a possibility that the deal might come under scanner as news about RIL Group companies may be skewed in the interest of many businesses that Ambani owns. These companies are -- Reliance Industries, Reliance Retail, Reliance Textiles and Jio Infocomm.

There are also talks that this development may encourage other corporates to come forward to acquire cash-strapped media firms.

Some observers expect competition to beef up in broadcasting and digital space with Ambani going aggressive over growth in the media industry,

Click NEXT to read more...

Why Mukesh Ambani acquired Network18

If industry watchers are to be believed, RIL has already hired media veterans to run the show at Network18.

Alok Agrawal, former director, Zee News has updated his LinkedIn profile informing about his appointment in RIL’s media company, but he did not mention his new designation.

Rohit Bansal, ex managing editor at India TV may take up a key position at Network18 and BV Rao who has earlier worked as group editor at Sahara may become News and Communications director at Network18.