| « Back to article | Print this article |

What is Vijay Mallya doing to keep Kingfisher alive?

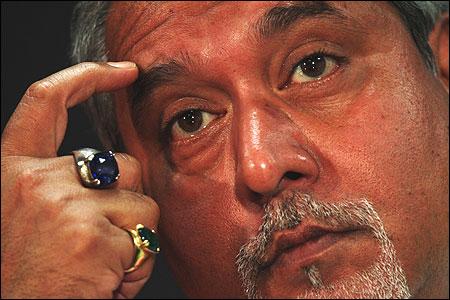

On Tuesday, Rajya Sabha met for all of 20 minutes. In the House was Vijay Mallya, dressed in all white: shoes, trousers, shirts.

He sat for the entire 20 minutes, going over the questions and other business listed for the day, and was seen using an inhaler.

One newspaper reported that Mallya managed a quick word with Prime Minister Manmohan Singh before the House started.

What he said to the prime minister could be anybody's guess.

Mallya's Kingfisher Airlines is in deep, deep trouble - losses have mounted, flights have been curtailed and a huge debt of Rs 7,500 crore or Rs 7.5 billion (average interest of 18 per cent) has piled up. It needs help.

Click on NEXT for more...

What is Vijay Mallya doing to keep Kingfisher alive?

The government's stated position is that it cannot tailor a bailout package for Kingfisher Airlines alone.

Another newspaper report mentioned that Mallya was made to wait for an hour in the last week of October before he could get 20 minutes with Civil Aviation Minister Vayalar Ravi.

This was followed by another hour-long wait for a 20-minute meeting with Secretary Nasim Zaidi.

And when bank representatives met Mallya's men in Bangalore recently, they were assertive in demanding information on the airline and gave no indication of what they intended to do.

Smartly, the banks had sent mid-level officers for the meeting to ensure that no commitment is extracted from them.

Click on NEXT for more...

What is Vijay Mallya doing to keep Kingfisher alive?

Still, Mallya seems to have made the right noises, which includes a press briefing in Mumbai to lay bare the financial woes of his airline.

Thus, a proposal has been mooted within the government to allow foreign airlines to buy up to 26 per cent in Indian airlines.

For well over a decade, the government never thought even once to open up the sector.

Even Ratan Tata, when he planned to set up a venture with Singapore Airlines in the 1990s, couldn't make the government change its view.

This time, it has responded to Mallya's agony calls. It may also allow airlines to import jet fuel directly from abroad (state levies have made jet fuel frightfully expensive, the reason why most carriers are in the red).

Click on NEXT for more...

What is Vijay Mallya doing to keep Kingfisher alive?

If the two proposals see the light of the day, it will bring some succor to Mallya: Kingfisher Airlines is valued at around Rs 1,200 crore (Rs 12 billion).

And while banks have started to act tough, the government has asked Life Insurance Corporation to consider a 10 per cent stake in Kingfisher Airlines; of course, the "final decision" will have to be taken by the state-owned insurer.

Mallya may be in a spot of bother, but it is too early to count him out.

"To write the epitaph of Kingfisher Airlines constantly is not fair," he said at a press meet in Mumbai last week.

At the Formula 1 Grand Prix at Greater Noida late last month, Mallya was in the Force India garage along with son, Sidhartha.

The garage had all the trappings of high glamour: F1 drivers, film stars, models et al. No one could have made out that one of Mallya's key businesses was bleeding heavily.

Click on NEXT for more...

What is Vijay Mallya doing to keep Kingfisher alive?

Kingfisher Airlines had restructured its debt last financial year.

Thirteen banks converted a part of their debt into equity, which gave them a stake of under 25 per cent.

At State Bank of India, which had the highest exposure, it was driven by the then chairman & managing director, O P Bhatt.

Officers in the state-owned bank say the pressure from non-performing assets had begun to build, and the bank also had to make a provision of Rs 8,000 crore (Rs 80 billion) for pension revision.

Any delay would have made Kingfisher Airlines also a non-performing asset and affected the bank's profits; thus the proposal was rushed through without adequate discussions.

Click on NEXT for more...

What is Vijay Mallya doing to keep Kingfisher alive?

An informal proposal to have a nominee of the lenders on the board of Kingfisher Airlines was made at that time, which would have given the lenders better access to information, some influence on company strategy and early signals of financial health.

But this was outside the agreement for debt recast and was never implemented.

Though infusion of fresh capital - through global depository receipts, for example route - was very much a part of the pact, this proposal too was not actively pursued.

Though global equity markets have been in turmoil for a while, bankers say insistence from the lenders could have made Mallya arrange the funds on priority.

Click on NEXT for more...

What is Vijay Mallya doing to keep Kingfisher alive?

Nobody knew how deep the rot ran till research firm Veritas, in its report titled Pie in the Sky, said that Kingfisher Airlines was a bankrupt organisation and its parent, United Breweries Holdings, was "on thin ice" because of the investment.

At the 95th annual general meeting of the shareholders of United Breweries Holdings, held almost three months ago in the Good Shepherd Convent auditorium in Bangalore, Mallya had dismissed the report and also the research firm.

The meeting ended with visible bonhomie; several shareholders queued up to get photographed with Mallya's son, Sidhartha.

Then Kingfisher Airlines' auditor, B K Ramadhyani & Co, in its report two months ago said the airline had not paid over Rs 400 crore (Rs 4 billion) in TDS to government.

Click on NEXT for more...

What is Vijay Mallya doing to keep Kingfisher alive?

But the employees knew all wasn't well a couple of months before that.

The first sign was when their salaries began to get delayed. "Earlier we used to get our salary by the 7th of each month, but now we have been receiving it after the 15th.

Twice in the last four months our transport facilities were stopped as the car rental company was not paid.

We were forced to travel to airport and back home in taxis," a Kingfisher Airlines crew member discloses.

Over a hundred pilots have quit and are serving out their notice period.

Travellers began to suspect the health of the airline when in-flight service was curtailed. Even headsets were not provided: those who wanted to listen to music were encouraged to use the headset of their mobile phone.

Click on NEXT for more...

What is Vijay Mallya doing to keep Kingfisher alive?

Some travel agents say the airline has not issued them TDS certificates for ticket sales.

"So far we have not heard about the airline defaulting on bonus payments but there is a concern amongst agents on this issue," says S Saldhana, treasurer, IATA Agents Association of India.

There is much at stake for some agents who last year have lent a few crore rupees in deposits to Kingfisher Airlines.

The airline pays monthly interest on these deposits. Any adverse news on Kingfisher Airlines is bound to give them a lot of heartache.

So last week, Travel Agents Association of India's president, Iqbal Mulla, met senior officers of the Directorate General of Civil Aviation to ensure that the agents' interests must be protected if the airline goes belly up.

Click on NEXT for more...

What is Vijay Mallya doing to keep Kingfisher alive?

Airlines send aircraft components to vendors in Europe or Singapore for tests, repairs and overhaul.

"Kingfisher Airlines' vendors cut off credit for repair and replacement of inventories.

Thus, its inventory of spares depleted and it had remove parts from one plane and fit it to another to keep the aircraft flying," a Kingfisher Airlines employee says.

Both Delhi and Mumbai airports had threatened to put the airline from credit to cash, but haven't done so yet.

Hindustan Petroleum Corporation snapped fuel supplies briefly twice this year.

Other business partners like catering companies and ground handlers too are said to be upset over delays in payments.

Click on NEXT for more...

What is Vijay Mallya doing to keep Kingfisher alive?

High-ranked executives in Kingfisher Airlines, United Breweries Holdings and United Spirits, including some board members, admit the situation is sticky, but have full faith in their leader, Mallya, to tide over the crisis. Mallya's core team includes UB Group president & CFO A K Ravi Nedungadi, Kingfisher Airlines CEO Sanjay Aggarwal, United Breweries Holdings managing director A Harish Bhat and Kingfisher Airlines CFO A Raghunathan. Aggarwal, widely acknowledged as the man who built SpiceJet and got Wilbur Ross to invest in the airline, joined a year ago when Mallya decided that the airline should be run by a full-time CEO.

Till then, Mallya was also the managing director of Kingfisher Airlines.

"We have always punched above our weight, leveraged debt and built businesses. If we didn't have the faith of the financial institutions, we would not have been India's largest brewer as well as a global major in spirits.

We have been borrowing heavily and have a good track record with debt management," a member of Mallya's A team says.

Click on NEXT for more...

What is Vijay Mallya doing to keep Kingfisher alive?

But the options are limited and time is running out.

According to Jasdeep Walia, an analyst with Kotak Institutional Equities, small capital infusion or incremental increase in working capital limits can sustain operations only for some more time.

"In our view, the company needs large capital infusion and a reduction in interest rates to be able to sustain operations."

Long-term private equity is certainly an option, though historically Mallya has flirted with it to eventually shy away.

"Mallya is a strong individual and he runs the business hands on. He understands the business, at least the alcohol beverages part, and he feels that private equity funds will drive a hard bargain for a stake in the companies he has built over the years," a Mallya associate says.

Click on NEXT for more...

What is Vijay Mallya doing to keep Kingfisher alive?

Mallya too has echoed this time and again. "They (private equity) always want a bargain and I will not sell my assets cheap," he had said recently.

One more view in the Mallya camp is that if a private equity fund does indeed take a position in the company, it will obviously have a say on the board, and Mallya is not the one who will easily change his decision on what such a director may suggest.

"There will be clash of opinion and it is another reason why the UB group has always kept away from these funds," the associate adds. Mallya in the past has had wide-ranging discussions with global funds such as Citigroup, TPG and Rothschild.

Mallya has banked on the stock markets to a large extent to run his businesses. At the moment, the markets don't seem to have an appetite for a public offer.

Click on NEXT for more...

What is Vijay Mallya doing to keep Kingfisher alive?

So, Mallya is understood to be working closely with his business associates to help him sail through in the short time to salvage Kingfisher Airlines.

"Over the past three decades, I have created wealth for a lot of people and I have friends who will stand by me," Mallya had said recently.

According to some senior executives of United Breweries Holdings, Mallya has already raised almost Rs 700 crore (Rs 7 billion) from these close associates and is hoping for further support.

Industry analysts indicate that these associates may range from bottlers and suppliers who have been his long-term partners.

And, of course, there could be white knights ready to bail Mallya out.

Click on NEXT for more...

What is Vijay Mallya doing to keep Kingfisher alive?

The names that have done the rounds in the last few days are Reliance Industries, the Sahara group, the Tata group and Malvinder Singh of Fortis Healthcare and Religare.

Mallya told an overseas newspaper last week that he was close to finalising equity infusion of $250 million (Rs 1,250 crore) from a wealthy individual. Either way, this is Mallya's toughest fight ever.

In the good old days, Mallya used to send every aircraft to do a round of the Tirupati Balaji temple first thing upon delivery. The prayers and ceremonies too could come in handy at this juncture.

With inputs from Abhijit Lele and Aneesh Phadnis