| « Back to article | Print this article |

Thorny road ahead for Raghuram Rajan

The new RBI governor takes office at a time when the economy may well be in a full-blown crisis.

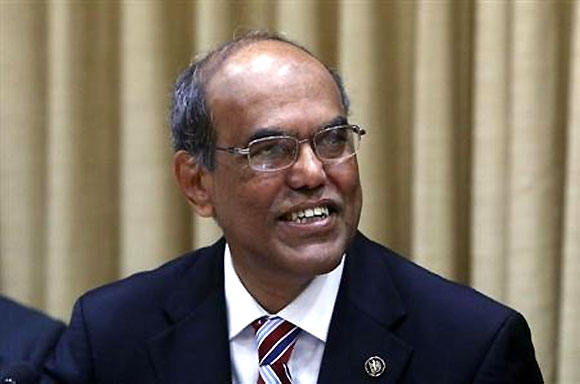

Five years ago, Duvvuri Subbarao’s appointment as governor of the Reserve Bank of India came amidst a gathering global storm.

Ten days after he took office, Lehman Brothers collapsed, triggering a period of turbulence that lasted several months.

The storm may have abated, but the environment that Dr Subbarao had to negotiate was continually buffeted by a succession of threats, both global and domestic.

His successor, Raghuram Rajan, whose appointment -- notwithstanding the usual last-minute intrigue -- was widely anticipated, takes office at a time when the economy may well be in a full-blown crisis, this time mainly the result of domestic factors.

Click NEXT to read further. . .

Thorny road ahead for Raghuram Rajan

His admirers will see this as a ‘cometh the hour, cometh the man’ situation, an opportunity to put his considerable skills and reputation to work in resolving the extremely difficult situation.

His detractors will argue that his relative lack of ground-level experience in policy making and navigating through the administrative and political rapids will make life difficult for him.

Regardless of who is right, he has to quickly come to grips with a number of obvious challenges, ranging from the immediate to the medium term.

Obviously, his immediate priority is to bring some stability to the sliding rupee and stem the panic that seems to be gripping financial markets.

Click NEXT to read further. . .

Thorny road ahead for Raghuram Rajan

Recent actions by the RBI do not appear to have achieved this objective, even as they have been perceived to exacerbate growth risks.

Dr Rajan is presumably fully aware of the futility of using essentially temporary measures to deal with structural pressures.

He must persuade the policy establishment that only a combination of measures to address the current account deficit and short-term interventions can work in this situation.

The economy is fast running out of time on this front and his insistence that these responses cannot wait for the elections to be done with will be of critical importance.

His next agenda item will be the rather sensitive issue of bank licences.

Click NEXT to read further. . .

Thorny road ahead for Raghuram Rajan

Dr Rajan has publicly voiced his scepticism about corporate houses being allowed to set up banks.

Will he have his way with this?

More realistically, given the virtual inevitability of this outcome in the current round, he will have to find a way to protect the system from the risks he has warned about by a significant revamping of the Reserve Bank of India’s supervisory framework and its implementation. Beyond that, his views on the proposals made by the blueprint for the new Indian Financial Code will be studied with great interest.

Dr Subbarao articulated his scepticism about many of the proposals both during the process and after the report was submitted.

Click NEXT to read further. . .

Thorny road ahead for Raghuram Rajan

In fact, several proposals closely follow the recommendations of the Committee on Financial Sector Reforms, which was chaired by Dr Rajan himself and submitted its report in 2007.

Does this mean that the significant amendments to the Reserve Bank of India Act, which the new code suggests, will now get the backing of the RBI governor?

Or, as has been seen to happen in the past, does ‘where you stand depends on where you sit’ kick in?

This is an extremely full plate of issues and Dr Rajan certainly deserves the full backing and support of all stakeholders as he sets about his task.