| « Back to article | Print this article |

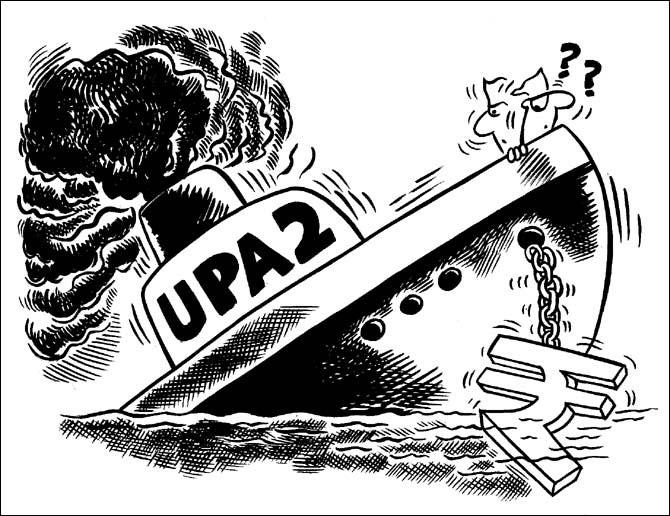

The rupee alone can't resurrect India's manufacturing exports

The true upside in exports will only emerge when the competitiveness of an industry improves to a fundamental and sustainable level, and if we place our bets as a country in the right sectors and countries, feel Arun Bruce & Anirban Mukherjee.

As a nation, we possess a refined ability to see the silver lining despite the gloom. Collectively, as we battle inflation, a falling rupee, weakening domestic demand, and a sluggish policy environment, we hope of a bright long term, including hope of an export boom.

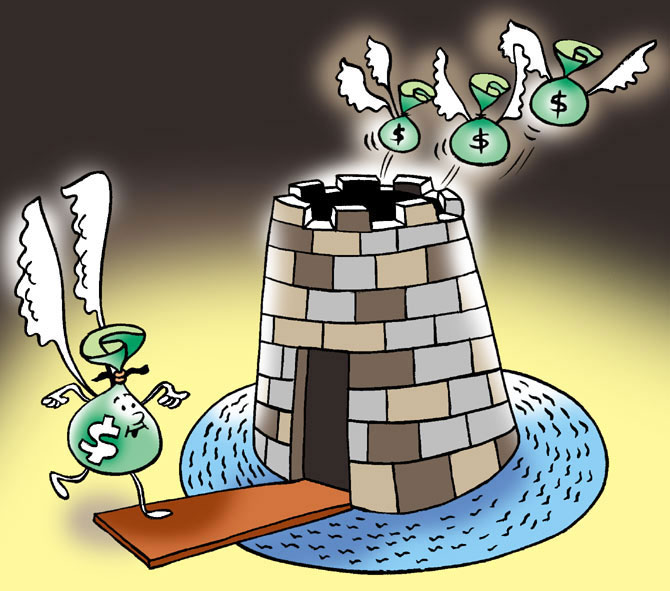

As the currency has depreciated by over 15 per cent since April (it had lost more than 25 per cent a few weeks ago before bouncing back), voices abound on the kind of export boom this could trigger.

Sadly, this prophecy is not entirely true — at least definitely not for manufactured products.

First, 70 per cent to 90 per cent of the cost base of manufactured products is “exchange rate neutral”, thanks to the tightly linked world we live in.

Most manufactured products (for instance, auto components, appliances) have a commodity cost base of between 70 per cent and 90 per cent — and most commodities are priced at parity to equivalent international options.

Copper is available in the domestic market only at London Metal Exchange prices (which are dollar denominated).

Domestic steel manufacturers price their steel on par with steel imports — and are currently in the process of raising prices — thereby nullifying any advantage a weak rupee may provide. Domestic plastics and chemicals are also constantly priced on par with equivalent international imports.

Click on NEXT for more...

The rupee alone can't resurrect India's manufacturing exports

Any big benefit that is currently being perceived is transient, and largely due to inputs purchased at a lower dollar (say, when the rupee was 54), and demand fulfilled when the dollar is stronger (say, when the rupee was 58 to 60).

A large part of the third-quarter surge in export order books that many companies are experiencing is precisely due to this factor.

Second, even an advantage in the remaining 20 per cent to 30 per cent of the cost base is lower than what a mere currency rate difference would suggest, because of our dependence on oil imports that tends to impact logistics cost of allied materials and cost of living (and hence domestic inflation) over a period of time.

The net advantage that remains for the exporter can still be substantial, but not large enough to boost exports considerably.

The true upside in exports will only emerge when the competitiveness of an industry improves to a fundamental and sustainable level. Take the US for example. The country has been experiencing what you would call an export boom. Consider this: the very country who’s currency has strengthened against the rupee, has been and is experiencing a boom.

A close look will reveal that US manufacturing competitiveness has steadily increased over the last decade in comparison with key peers. The US’ productivity-adjusted labour cost is now 15 per cent to 40 per cent lower than that of several advanced economies (Japan, Germany, the UK, Italy) and its labour laws are considered far more flexible than several advanced economies (No 3 in index developed by the Fraser Institute that measures labour regulations, vis-à-vis No 112 position occupied by Germany).

Energy prices are also more favourable in the US. Natural gas is 40 per cent of the price prevailing in Japan/US, industrial electricity is 50 per cent to 70 per cent cheaper than Italy/Japan/France. How is that for a sustainable source of advantage?

And the advantage is showing. While the share of global exports by Western Europe and Japan decreased between 2005 and 2010, US exports have held steady at 11 per cent and grown at an overall rate of 8 per ent a year (despite the slowdown in 2008/09).

Click on NEXT for more...

The rupee alone can't resurrect India's manufacturing exports

How does India perform on fundamental manufacturing competitiveness? India has one of the lowest costs of labour and “on paper” a competitive price of power.

In reality though, labour productivity is very low and power is unavailable for up to two shifts a day in many industrial clusters — forcing them to use inefficient diesel generator sets — that nullify any factor cost advantage. India’s road and port infrastructure are still far from ideal.

Our port turnaround times are upwards of 80 hours — roughly five times that of Sri Lanka. The average truck speed in India is 35 to 40 km per hour roughly half of that in China.

To drive exports, we need to fix competitiveness in manufacturing. We will need to build many more efficient clusters — either by resurrecting “dying” special economic zones or by ensuring land acquisition for National Investment and Manufacturing Zones.

We will need to increase power generation capacity, at the rate of 25 Gw per year. We will need to proceed aggressively with port infrastructure enhancement, and accelerate the projects on the anvil. We will need to actively focus on workforce skilling and automation. We will also need to place our bets as a country in the right sectors and countries. For example, Africa is a growing consumer with fast growing imports — what is our strategy as a country to address this demand?

None of these measures are really new, but then our challenge has always been our ability to execute well. The day we fix that, we needn’t be exuberant anymore about a weakening currency. Until then, cheers to a weak rupee. <hr>

Arun Bruce is partner and director, BCG. Anirban Mukherjee is Project leader, BCG

The views expressed are personal