| « Back to article | Print this article |

The funny thing about foreign money

The Cabinet has agreed to the suggestion of the Department of Industrial Policy and Promotion or DIPP to allow companies like Walmart and Tesco to set up shop in the country.

These companies could earlier invest only in the cash-and-carry segment - they could sell to retailers but not to customers directly.

To ensure that small retailers aren't driven out of business, foreign retailers will be allowed to operate only in cities with a population of a million and above - there are 53 such cities in the country.

The move is driven by concern for the customer: foreign investment will kick in supply chain efficiencies and thus help reduce prices.

Companies like Walmart and Tesco have evolved strong processes over the years which will help products reach the customer faster, safer and cheaper.

Click NEXT to read more...

The funny thing about foreign money

Apart from that, these companies are huge aggregators and their core competence lies in bargaining really hard with their suppliers.

Many Indian exporters who supply to them know this only too well.

Another set of liberalisation measures is being contemplated by the government, in civil aviation. DIPP wants up to 26 per cent investment by foreign airlines in Indian carriers.

There is also the possibility that the government may allow Indian carriers to import jet fuel directly.

Thanks to high state levies, jet fuel is very expensive in India and is being cited as the sole reason for the staggering losses in the sector. The move is driven not by concern for the customer, but by the pain felt by the carriers.

Click NEXT to read more...

The funny thing about foreign money

The losses incurred by Kingfisher Airlines, and the downsizing of its operations, have proved the straw that broke the camel's back.

This is intriguing. As long as there was no pain, no need was felt to let in foreign airlines.

Foreign investment of up to 49 per cent is allowed under current rules, but foreign airlines cannot buy into an Indian carrier.

Many years ago, when Ratan Tata wanted to enter the market with Singapore Airlines, the move was scuttled on the grounds of national security.

Unfortunately, all discussion stops whenever the bogey of national security is raised.

Click NEXT to read more...

The funny thing about foreign money

Nobody has ever bothered to explain what kind of national security is involved here.

When foreign airports can buy into Indian airports, what security breach will be caused by foreign airlines? Shouldn't the customer's interest be paramount here too? And, of course, what about efficiencies?

It is clear by now that most Indian carriers are hugely inefficient, and some of them are even confused.

How does one airline, IndiGo, faced with similar high jet fuel costs, make money while all others bleed?

Incidentally, the civil aviation ministry had suggested 24 per cent investment by foreign airlines.

That was ridiculous. It would be difficult to find a better example of having the cake and eating it too.

Click NEXT to read more...

The funny thing about foreign money

If this proposal was to be accepted, Indian carriers would have got their money from abroad without being accountable to the new shareholder.

It is only with 26 per cent that the partner can influence the company's management in any possible way.

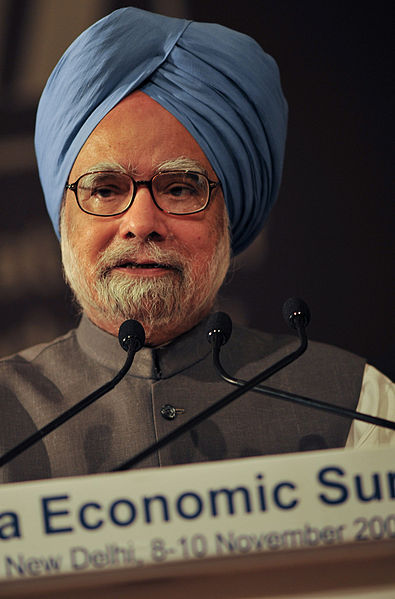

For the Manmohan Singh government, it is important not just to act fast but also to be seen as acting fast.

Even as it reels under more than one corruption scandal, its inactivity (certainly not masterly) has drawn the ire of businessmen as well as the common man.

The two moves in retail and civil aviation, it hopes, will reinstate its liberal credentials and lift the mood in business circles.

Click NEXT to read more...

The funny thing about foreign money

But the reform agenda has to be driven by the consumer's interests and not by lobby groups.

While at it, the government might as well review the foreign investment norms in the media.

At present, up to 26 per cent foreign investment is allowed in news media and up to 100 per cent is allowed in non-news media.

It is difficult to understand the reasons for the 26 per cent cap, other than the fact that the government wants to do nothing that will upset the country's media barons.

There has been much breast beating ever since Justice Markandey Katju, the head of the Press Council of India, talked about the quality of Indian journalism.

Click NEXT to read more...

The funny thing about foreign money

He may have had in mind the electronic media, which does not come under the purview of the Press Council of India, but the criticism is no less applicable to the print media.

Quality suffers because there are too many players in the market. Every editor is under pressure to do something that can make his publication or channel stand out.

In which other country of the world will you find at least five mainline business dailies?

In which other country will you find so many news channels on television? There are at least two dozen national channels; smaller towns have their own channels - the total number will be mindboggling.

Click NEXT to read more...

The funny thing about foreign money

The reason is that there are no entry barriers. Media ventures in the country are hugely underfunded.

So it takes little to set up a newspaper or start a news channel. If foreign media is allowed on its own, it will surely raise the bar in the sector.

It will do what Maruti Suzuki's entry did to the then car makers who had invested nothing in design and technology for decades together.

In the final analysis, it is the consumer who will benefit.