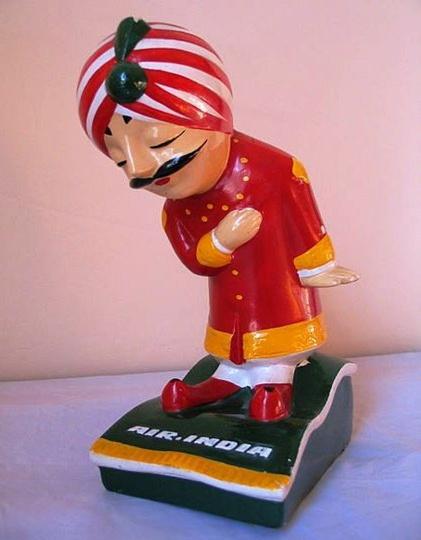

Photographs: Shakti/Wikimedia Commons Surajeet Das Gupta in New Delhi

While the latest airline to join the Star Alliance has met its target on occupancy for May, it remains woefully short on several other counts.

Amid all the gloomy news emanating from the offices of Air India, there were happy tidings earlier this month.

The airline reported a dramatic rise of 6 per cent over May 2013 in its passenger load factor (PLF) - a statistic that indicates the occupancy of the company's aircraft.

At 79.5 per cent, the figure bettered the PLF of rival Jet Airways (75.2 per cent) and came close to that of IndiGo (81.8 per cent). It also more than met the target of 78 per cent set in its turnaround plan.

This week, there was more good news. After years of negotiations, Air India signed up as the 26th member of Star Alliance, the world's largest league of airlines.

This will help the Indian company generate 3-5 per cent additional revenues, or around Rs 1,000 crore (Rs 10 billion), because the agreement enables its passengers to travel seamlessly across the globe.

However, scratch the surface and Air India is still mired in trouble.

…

Is Air India's turnaround still a dream?

Photographs: Reuters

Despite the government pumping in more than a third of the over Rs 30,000 crore (Rs 300 billion) it had promised as equity infusion, the turnaround expected in 2018 seems a distant dream.

Some of the targets for 2013-14 fell woefully short, and its net losses for the fiscal touched Rs 5,400 crore (Rs 54 billion) - way above the target of Rs 3,989 crore (Rs 39.89 billion) and higher than the previous year's loss of Rs 5,198 crore (Rs 51.98 billion).

It also missed both its operational profit and revenue targets by a long mile.

The Centre for Asia Pacific Aviation (CAPA) says that if things continue unchanged, Air India will lose at least $1 billion annually from 2016. Says CAPA's India head Kapil Kaul: "I don't see any chance of a turnaround based on its current performance. Something dramatic needs to be done."

…

Is Air India's turnaround still a dream?

Photographs: Reuters

The demands for privatising the airline may be becoming more strident, but who will buy a debt-ridden airline? On March 2014, its debt stood at over Rs 49,000 crore (Rs 490 billion).

Telcos like Reliance Communications and Bharti Airtel have similar debts, but they have a healthy cash flow, make profits and are reducing their debt by selling some of their assets and inducting new investors.

In contrast, Air India has only government largesse to look at. The carrier paid a whopping Rs 2,600 crore (Rs 26 billion) in 2013-14 merely to service working capital, another Rs 1,100 crore (Rs 11 billion) to service loans.

With accumulated losses of around Rs 38,000 crore (Rs 380 billion), it has no money to modernise its domestic fleet. This would cost over $10 billion over the next decade but is important since the rivals are inducting new aircraft into their fleets.

…

Is Air India's turnaround still a dream?

Photographs: Reuters

Competition grows

Air India does have substantial business class seats. Business class seats constitute 8-10 per cent of the total domestic capacity. This earns Air India 15-20 per cent of its revenues.

Its only competitor here is Jet Airways. But Air India will soon face competition from Tata-SIA, which has cleverly chosen to concentrate on six cities that account for 85 per cent of all business class revenues (for instance, on the Delhi-Mumbai sector, Tata-SIA will have nearly a third of all the frequencies directly or indirectly).

Another big challenge will come from low-cost carriers, like AirAsia which has already kicked off a price war on the routes it is flying (Bangalore-Goa and Bangalore-Chennai).

Air India has been forced to match prices to stay in business. On the Delhi-Bangalore route, for example, based on fares on makemytrip.com, Air India offered the cheapest tickets between July 1 and July 20.

…

Is Air India's turnaround still a dream?

Photographs: Reuters

An analyst points out that this is a way for the carrier to improve its PLF and adds that reducing the number of flights by over 63 every week, most of them on loss-making routes, has also helped the airline's occupancy level. But its operational costs are 50 per cent higher than that of the nimble low-cost fliers, so obviously margins are being squeezed.

In the international skies, the big challenge is the Emirates and Jet-Etihad combine. The government has allowed Abu Dhabi an additional 37,000 seats per week in phases, while Dubai has managed an additional capacity of 11,000 weekly seats.

Leveraging the liberal bilaterals, Etihad has already announced that it is tripling the number of seats and doubling weekly flights between Abu Dhabi and the two key cities of Mumbai and Delhi from seven to 14.

Emirates is cashing in on the additional Dubai seats by flying in the A-380. The larger aircraft will mean over 3,000 additional seats from Delhi, Mumbai and Hyderabad to Dubai.

Air India, which has not enhanced capacity in the face of competition, would fare worse if the government dilutes the current rule allowing domestic carriers to fly abroad only after five years of operation and only if they have at least 20 craft.

If this happens, then Air India will have to contend with Tata-SIA's global ambitions, especially in south-east Asia and Australia.

…

Is Air India's turnaround still a dream?

Image: AI DreamlinerPhotographs: Reuters

Banking on seamless travel

Can Air India face this challenge? Its international routes are increasingly being powered by the fuel-efficient Dreamliners. The airline's executives say that their strategy would be to fly direct to major cities, which Etihad or Emirates will find difficult to match as their onward services pass through their hubs.

Air India's direct flights include London, Rome, Sydney, Melbourne, Frankfurt, Paris and Milan. Yet despite being the only airliner flying directly to Australia, Air India is logging losses of around Rs 70 lakh a day on the India-Sydney route.

In all, it has lost Rs 80 crore (Rs 800 million) on the route so far. The airline grossly miscalculated the potential PLF at 80 per cent when the figure normally considered while fixing fare is 70 per cent.

…

Is Air India's turnaround still a dream?

Photographs: Reuters

Competing airlines don't think much of Air India. "Between Delhi and London you have the choice of flying directly on British Airways, Virgin and Jet Airways, which together offer you six services compared to two from Air India," says a senior executive of a leading foreign airline. "Emirates has five indirect flights, including to Gatwick. So it's already an overcrowded market."

Air India also has to close down or turn around its non-profitable routes. CAPA says the carrier does not make money on the three routes in the United States where West Asian airlines aggressively woo Indian passengers.

The company's board has already asked Air India to trim routes that don't make money, among them are 19 routes, six of them international, that do not even cover variable costs. These include lucrative routes like Delhi-Bangalore, Kolkata-Mumbai and Delhi-Sydney.

The new government has still not made up its mind on the national carrier's future. Experts have suggested that Air India needs to quickly monetise its real estate assets, currently stuck because of unavailability of land documents.

The money could be used to pay off the debt and to work out restructuring of its workforce though a voluntary retirement scheme.

In an interview to a newspaper, the new civil aviation minister, Ashok Gajapathi Raju, has merely said he would release the money that was promised by the government and hoped that the airline improved its performance. But the truth is the ministry and the government have to do more than just live on hope where Air India is concerned.

Sharmistha Mukherjee contributed to this report.

article