Photographs: Adnan Abidi/Reuters Katya B Naidu in Mumbai

The government’s recent decision to allow up to 100 per cent foreign direct investment in telecom is expected to provide some elbow room to telcos like Bharti Airtel to raise equity and reduce their debt burden.

Almost four years after savage tariff cuts, the telecom sector is slowly limping back to normalcy.

The cuts were triggered by the new telecom licences handed out by Andimuthu Raja, then telecom minister, in 2008. The newcomers, in the absence of any other strategy, offered rock-bottom tariffs.

As the market was close to saturation, their objective was to wean away customers from the existing operators. The incumbents, left with no option, too had to drop tariffs.

Everyone bled. Profit margins got squeezed, some even had to book losses and telecom stocks went into a free fall. But the first signs have now begun to emerge that the industry is coming out of the binding squeeze.

…

India's telecom sector begins to emerge out of gloom

Image: A salesman explains the features of a blackberry phone to a customer inside a showroom in Mumbai.Photographs: Adnan Abidi/Reuters

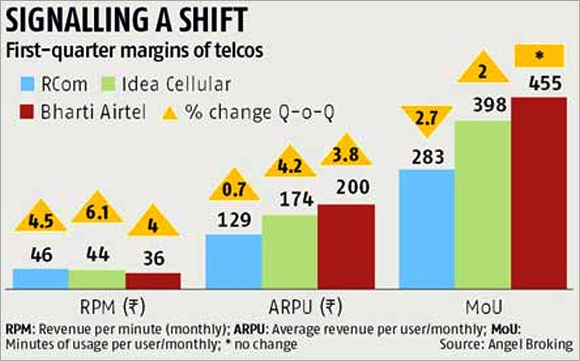

In the quarter that ended on June 30, Bharti Airtel, Idea Cellular and Reliance Communications have shown improvements in their profit margins and in key parameters like revenue per minute, average revenue per user (ARPU), and even minutes of usage. (See chart.)

“Pricing power has returned to the pan-India operators,” says Gurdeep Singh, chief executive of the wireless business of Anil Ambani-controlled Reliance Communications. The company, like all others, has shifted its focus from adding subscribers blindly or holding back churning subscriber. “The focus is now on paid and profitable minutes,” Singh says.

Fewer players

The market eased a bit early last year when the Supreme Court ordered all the 122 telecom licences issued during Raja’s tenure to be cancelled over allegations of impropriety in their allotment.

Since then, many of the new players have exited the market. Telcos like Sistema Shyam and Uninor, which came back, chose to buy back spectrum in fewer circles than they owned earlier.

…

India's telecom sector begins to emerge out of gloom

Image: An electrician speaks on his mobile phone in Mumbai.Photographs: Sima Dubey/Reuters

The intensity of the competition in the sector may have reduced last year, but it has taken another year for operators to cut away free minutes and promotional offers.

For a year-and-a-half now, operators have been raising tariffs as well as revising free offers, which they have chosen to call “tariff rationalisation”. The impact of this showed this quarter as revenue per minutes increased.

“We had gone through a bad trough but are coming out of it now. There are still more players in the industry than required in a healthy sector. But, we will see better times going forward for sure,” Akshay Moondra, chief financial officer of Kumarmangalam Birla-promoted Idea Cellular, says.

Most telcos say that with six or more operators in each circle, the market is still a little overcrowded. The right number, according to most, is not more than four or five operators per circle. (The country is divided into 22 telecom circles.)

…

India's telecom sector begins to emerge out of gloom

Image: A trader talks on his phone.Photographs: Reuters

Idea Cellular has seen its profits almost double, rising 97 per cent to Rs 462.7 crore in the June-ended quarter from the year-ago quarter.

Interest worries and forex losses impacted Sunil Mittal-promoted Bharti Airtel’s profit which was down 9.6 per cent to Rs 689 crore for the quarter. But its minutes of usage grew 2.1 per cent and ARPU grew 3.6 per cent.

“Key performance indicators of core cellular business surprised us, and consensus positively implies that larger telcos like Bharti Airtel and Idea Cellular are benefiting at a faster than expected pace from declining competitive intensity. We expect Bharti Airtel (along with Idea Cellular) to continue to gain momentum in their core business,” says a recent research report by Goldman Sachs.

Singh of Reliance Communications says that the benefits of tariff increases will show up in a big way in the third-quarter (October to December 2013) results, though they were visible in a small measure during the first quarter as well.

…

India's telecom sector begins to emerge out of gloom

Photographs: Reuters

The company is trying to move customers to headline tariffs, which have been raised. This process is expected to be completed in eight months. In the first quarter, Reliance Communications’ profits were down by 33 per cent to Rs 108 crore, due to an increase in financing costs.

“It is good that sanity has come back to the market. The situation that prevailed during the tariff war was detrimental to everybody’s interest and was putting a huge strain on the finances and profitability of the sector,” says Hemant Joshi, leader of telecommunications at Deloitte Haskins & Sells.

It is not just the environment that is helping the operators. Two quarters back, most of them went in for cost optimisation and worked on their efficiencies, which has also helped their margins.

“With better cost efficiencies, we saved (money) on a quarter-on-quarter basis. With churn going down, so did our subscriber acquisition costs,” says Himanshu Kapania, the managing director of Idea Cellular. Reliance Communications saw 9,000 employees moving out of its rolls as a result of its cost-management exercise and network outsourcing deals.

…

India's telecom sector begins to emerge out of gloom

Photographs: Reuters

Selling data

In spite of the rise in tariffs, and the expectation that they could rise further in the days to come, they are not going to reach the pre-tariff-war levels, say experts.

Telcos are perhaps aware that tariffs cannot be pushed beyond a certain limit; so they have begun to aggressively push their data plans, especially 3G plans, in the last couple of quarters.

Idea Cellular claims that its data ARPU is Rs 54 per month for the 30.9 million subscribers who use that service, up from Rs 47 a year back. The ARPU for its 3G subscribers is twice as much at Rs 110 per month, and this grew by Rs 20 in the last one year.

Bharti Airtel’s data ARPU increased 15 per cent to Rs 63 per month between the last two quarters. “The subscribers for 3G are expected to double in the next two months; data will grow exponentially in the next couple of years,” predicts Joshi. Not to be left behind, Reliance Communications is pushing its 3G data plan aggressively in the market. Of course, it has dropped 3G prices to 2G levels.

…

India's telecom sector begins to emerge out of gloom

Photographs: Reuters

In spite of the positive signals, analysts and experts hold back from saying that telecom is all set to become the sunshine sector it once was. It will take policy clarity from the government, they say.

“The key lies in clarity in policies like mergers and acquisitions, spectrum re-farming and spectrum charges,” says Joshi. Added to that, the sector is also high on debt. Most of the big companies like Bharti Airtel and Reliance Communications have huge debt on their books.

Bharti Airtel has a debt of Rs 59,270 crore (Rs 592.70 billion), which it had incurred after acquiring Zain’s telecom assets in Africa in 2010.

“While operational performance in the first quarter was better than our expectations, regulatory issues still persist. Apart from this, higher debt, interest costs and forex risks pose a risk to earnings,” says Ankita Somani, research analyst at Angel Broking, in a report which reviews Bharti’s quarterly performance. Reliance Communications’ net debt of Rs 38,000 crore has been a huge concern for the market as well as sector analysts.

“The company’s net-debt-EBITDA ratio remains high at 5.7 times. Debt reduction efforts have not materialised in a significant way so far. Rupee depreciation is a further headwind for debt and cash flow,” says Harit Shah of Nirmal Bang Securities in a recent report.

However, the government’s recent decision to allow up to 100 per cent foreign direct investment in telecom is expected to provide some elbow room to telcos like Bharti Airtel to raise equity and reduce their debt burden.

article