Photographs: Vivek Prakash/Reuters Aniruddha Joshi

The Indian economy is going through a bad phase.

Markets are sinking and rupee too has hit a new low.

Though the government is trying its best to retain investors' confidence, they are being jittery.

Every Indian is now awaiting some drastic steps by the finance ministry that will lend stability to the economy.

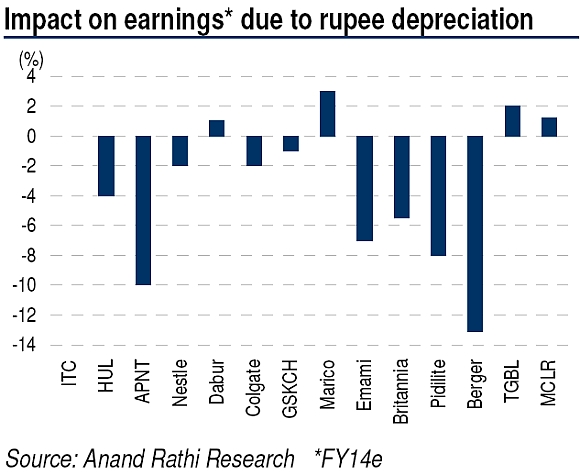

At this juncture, a Anand Rathi Institutional Research report said that rupee depreciation will cut earnings 3-4 pe cent in FY14.

Click NEXT to know more about that report. . .

How rupee depreciation will hit consumer companies

Photographs: Courtesy, Anand Rathi

Rupee depreciation to cut earnings 3-4% in FY14. Major raw materials for consumer companies -- light liquid paraffin, linear alkyl benzene, wax and packaging material -- are crude-oil linked and imported.

Other major imported raw materials are palm and other edible oils.

Packaging material is the biggest imported raw material and makes up ~9 per cent of sales of consumer companies.

The ~10 per cent rupee depreciation in the past two months

is expected to raise raw material costs for all the companies after a one- or two-quarter lag and may squeeze FY14 earnings 3-4 per cent.

No consumer company has foreign debt except Nestle India (foreign debt of Rs10.5 billion).

. . .

How rupee depreciation will hit consumer companies

Photographs: Courtesy, Anand Rathi

Raising prices may prove difficult. In 9MFY13, consumer companies raised prices aggressively (6-10 per cent).

Though no major price hikes were seen in 4QFY13, consumer companies will be compelled to raise prices 2-3 per cent to pass on higher raw material prices.

As inflation is also expected to move up 100bps merely due to rupee depreciation, hiking prices may prove difficult.

Higher transportation costs may impact distribution expansion. Transport costs make up 2per cent of net sales and may move up further.

However, transport costs incurred by distributors and wholesalers will also climb, and cut their earnings 300-400bps.

The higher transport costs could make selling in rural areas non-profitable, resulting in slower distribution expansion.

. . .

How rupee depreciation will hit consumer companies

Photographs: Courtesy, Anand Rathi

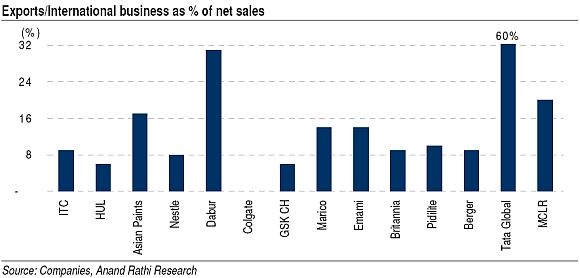

Export revenues may constitute a natural hedge. Some companies such as Dabur, Marico, HUL, Asian Paints and Pidilite have exports.

Their international business accounts for 10-20per cent of their net sales. We believe this may constitute a natural hedge against the depreciating rupee.

Our take. We believe that the rupee depreciation would have the maximum

impact on paint companies and Pidilite, and some impact on personal care companies such as HUL and Emami.

However, we continue to be upbeat concerning food companies, and see little impact on their earnings.

Anand Rathi Shares and Stock Brokers Limited (hereinafter “ARSSBL”) is a full service brokerage and equities research firm and the views expressed therein are solely of ARSSBL and not of the companies which have been covered in the Research Report. This report is intended for the sole use of the Recipient and is to be circulated only within India and to no countries outside India.

The views expressed in this Research Report accurately reflect the personal views of the analyst(s) about the subject securities or issuers and no part of the compensation of the research analyst(s) was, is, or will be directly or indirectly related to the specific recommendations or views expressed by the research analyst(s) in this report.

article