| « Back to article | Print this article |

How Raghuram Rajan has performed so far

He has already succeeded in restoring calm in the foreign exchange market.

Raghuram Rajan has walked the talk so far. On his first day in office, he had said he would not work for votes or Facebook Likes.

The mid-quarter review of monetary policy on September 20 showed he would not hesitate to take tough decisions, he had hiked the repo rate.

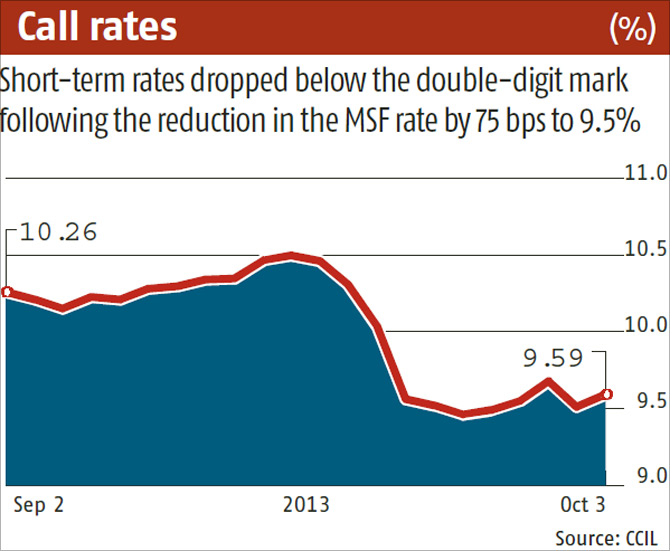

The move stumped market participants. At the same time, he reduced the marginal standing facility (MSF) rate - that is operative rate now - to signal his willingness to restore normalcy in the money market.

Rajan, who completed a month as the governor of Reserve Bank of India on Friday has already succeeded in restoring calm in the foreign exchange market.

Business Standard takes a look at how things have changed for the better in the last one month.

Click on NEXT for more...

How Raghuram Rajan has performed so far

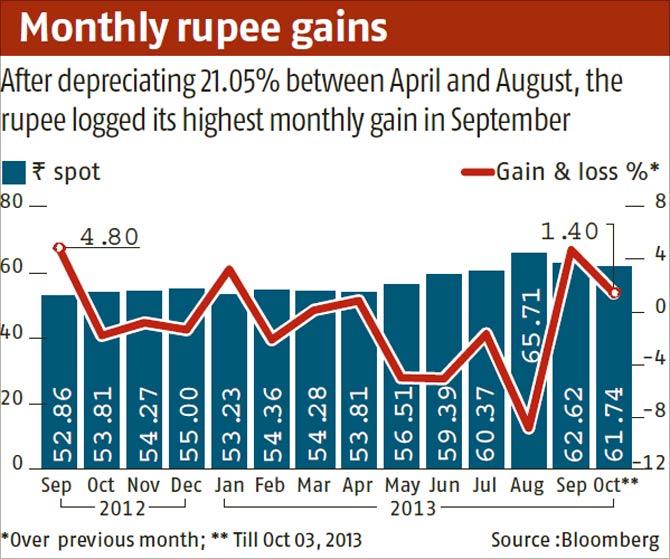

Rupee gains

The rupee logged its highest monthly gain in September.

Click NEXT to read more...

How Raghuram Rajan has performed so far

Call rates

Short-term rates dropped below the double-digit mark.

Click NEXT to read more...

How Raghuram Rajan has performed so far

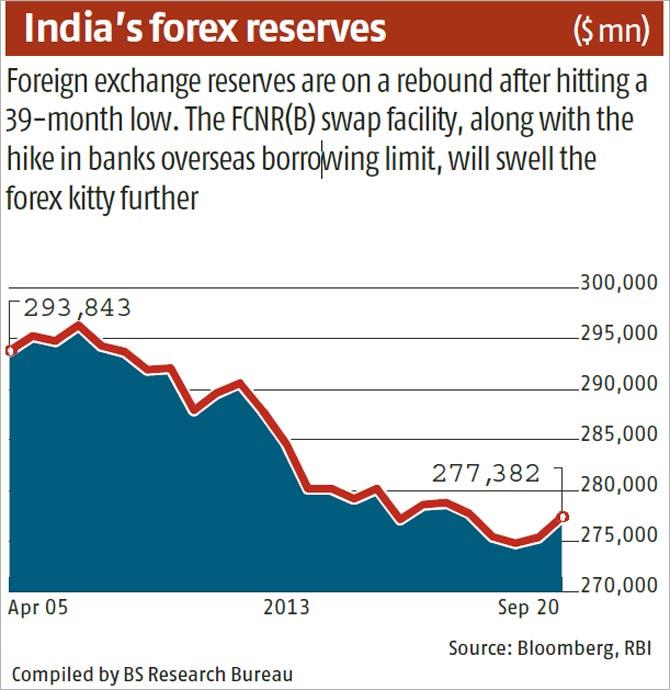

Forex reserves

India's forex reserves have rebound after hitting a 39-month low.

Click NEXT to read more...

How Raghuram Rajan has performed so far

Inflation

Hike in repo rate to 7.5 per cent to anchor inflation expectation.