| « Back to article | Print this article |

How Chanda Kochchar changed the fortunes of ICICI Bank

As she begins her second term as MD & CEO, Chanda Kochhar wants the bank to grow more than the industry not by taking on more risk but by building a strong base of customers and shunning the pell-mell marketing of credit card and personal loans to newcomers, says Shyamal Majumdar.

As the days at work got longer after she became the managing director & CEO of ICICI Bank exactly five years ago, Chanda Kochhar had to make substantial changes in her once must-do routine.

But she has refused to give up two things: one, visiting the bank’s branches almost unannounced; and two, her monthly informal meetings with about 20 employees picked on a random basis.

These two things help her stay glued to the ground, Kochhar says. For example, at one of her visits to a bank branch, Kochhar learnt why the “May I help you” desk at a branch should be manned by one of the most experienced employees instead of the junior-most staff as that is the customer’s first contact with the bank.

Click NEXT to read more...

How Chanda Kochchar changed the fortunes of ICICI Bank

Her monthly meetings with employees have nothing to do with performance reviews. These are free-flowing conversations on work environment in the branches, how customers are feeling, gender issues, transfer policies, etc.

“Over time, people have learnt that they can speak to me; no one outside the room knows who spoke,” Kochhar says. She adds data can only tell you about things you are doing already but it can’t tell you about things you’re not doing.

Attention to details such as these and relentless focus on execution are what have helped Kochhar, 52, achieve a radical reversal in the bank’s strategy by toning down the earlier exuberance (30-40 per cent annual growth in credit portfolio with consumer loans making up two-thirds of its total book before she took over) and muscular image (bank employees forgot that they had to be humble and listen to customers).

Click NEXT to read more…

How Chanda Kochchar changed the fortunes of ICICI Bank

In the first phase of her stewardship, ICICI Bank became a cautious entity which didn’t sit on its ego. So risk was out and profitability was in, even if it meant reduction in the balance sheet size.

Kochhar says as a conscious effort, the bank has evolved and has brought about change with continuity: “What we have still continued is some of the strengths of dynamism, speed and so on but what we have changed or added is a lot more sensitivity to our stakeholders. And that includes dealing with employees in a more sensitive and humane way.”

Click NEXT to read more…

How Chanda Kochchar changed the fortunes of ICICI Bank

The road ahead

That’s the story of the last five years. As she began her second five-year term this month, Kochhar is now talking about growth again.

“We are not just back to growth; we are now actually in a position to grow 2-4 per cent higher than the industry without diluting profitability or picking up wrong credit risks,” Kochhar says.

Her strategy is to expand not by taking on more risk, but by building a base of loyal customers and shunning the pell-mell marketing of credit card and personal loans to newcomers that so endangered the bank just five years ago.

Click NEXT to read more…

How Chanda Kochchar changed the fortunes of ICICI Bank

So going forward, the three fulcrums of her strategy will be growth, profitability and risk management.

In other words, it will be disciplined expansion that has added a fifth “C” (credit growth) to the bank’s well-known 4C strategy (CASA or current and savings account deposits which are inexpensive, credit quality, cost and capital conservation).

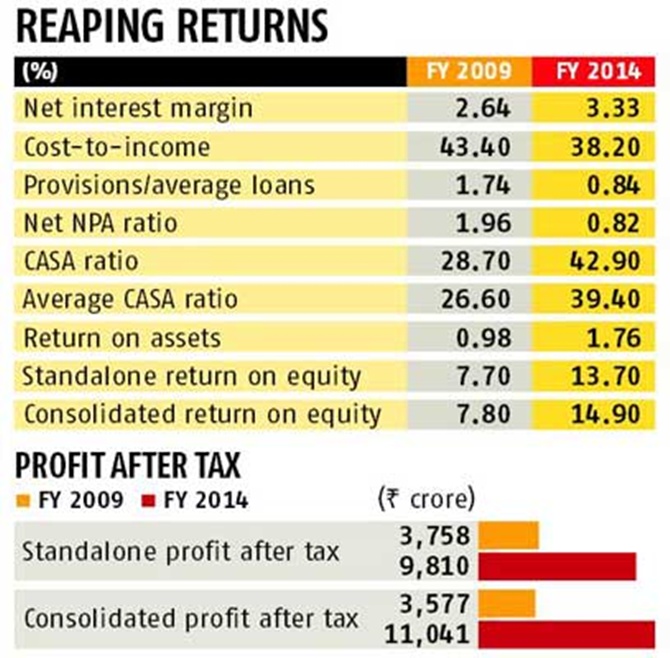

The growth, she says, will be diversified across retail, housing, car loans, new projects, working capital loans, and so on. Kochhar knows she is on a sound footing when she talks about higher growth than the industry (see Reaping returns).

Click NEXT to read more…

How Chanda Kochchar changed the fortunes of ICICI Bank

The CEO says she has no problems if people refer to her as a boring banker because of the bank’s obsession with caution, as the so-called boring part of any banking business gives the core operating revenues.

“The extra cream and cherries will depend on how the environment moves. In the banking business, you have to take risks, but the risk should be understood, quantified and priced in. It is risk management and not risk avoidance,” Kochhar says.

The move has paid off well in the current business environment as even though non-performing assets, or NPAs, and restructured assets have gone up requiring higher provisions, the bank has been able to increase its net interest margins, giving it the ability to absorb the extra risk.

Click NEXT to read more…

How Chanda Kochchar changed the fortunes of ICICI Bank

Keeping things as they are

The country’s second largest private bank will also retain its current business mix of 35 per cent retail, 25 per cent international and 40 per cent corporate, at least till the time investment activity picks up again.

In fact, there will be some marginal tweaking in favour of retail, considering that this portfolio will grow faster than the other two in the near future. But Kochhar expects things to change once the new government settles down and initially targets the low-hanging fruit that can contribute to growth.

Though the bank is firing on all cylinders on its retail engine, analysts say HDFC Bank has gone much ahead of her bank which was once the leader in retail banking. Kochhar, however, rejects the notion that ICICI Bank has vacated any position to anybody.

Click NEXT to read more…

How Chanda Kochchar changed the fortunes of ICICI Bank

“When we took the retail business to 60 per cent of our book, the country was passing through a phase where there was hardly any capital investment and most of the growth was getting driven by consumerism. There was less activity on our basic business of project finance and more activity on consumer finance. So the additional business was mainly retail. Our focus is more on secured retail business like housing and car loans. While we will do some unsecured loans — credit cards and personal loans, we will do it primarily with existing customers,” she says.

Technology is another focus area. And tab banking, which is a huge success, is just one part of it.

The bank has opened 101 touch banking branches where customers can do almost everything 24x7: whether it’s internet banking or cash deposit.

He can even do a video conference with a call centre agent as if it’s an officer in a branch sitting in front of him and solving his queries. For opening loan accounts, the bank has established technology linkages with the taxation department and with the Credit Information Bureau so that everything can be monitored online.

Click NEXT to read more…

How Chanda Kochchar changed the fortunes of ICICI Bank

Risk vs profitability

Kochhar has three big priorities: one, maintaining the right balance between growth, profitability and risk management, making sure the bank grows profitably while having its risk appetite right; two, relentless focus on cost efficiencies so that net interest margins remain strong; and three, continuous monitoring of the portfolio as the economic environment has changed substantially in the last two years and is likely to change again in the not-so-distant future.

No one could have any quarrel with that strategy as Kochhar has walked the talk for the past five years - with brilliant results.

Click NEXT to read more…

How Chanda Kochchar changed the fortunes of ICICI Bank

When she took over as MD & CEO five years ago, the bank recorded a net profit of just Rs 744 crore (Rs 7.44 billion), and gross NPAs as a percentage of loans were 4.32 per cent. That is a distant memory now.

Kochhar, who lost her father when she was just 13, has often attributed her tenacity and willpower to her mother who graduated from a housewife to a determined career woman after moving from Jaipur to Mumbai with her three children.

ICICI Bank’s success shows determination is truly in the genes.