Photographs: Reuters. Surajeet Das Gupta in New Delhi

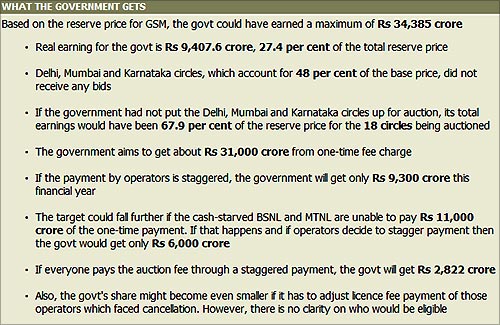

The recently concluded sale of 1,800-MHz spectrum through auction to telecom service operators, or telcos, has been declared a damp squib for two reasons: One, only five telcos participated in the auction; and two, the bids added up to Rs 9,407 crore (Rs 94.07 billion), which was less than a third of the Rs 30,000 crore (Rs 300 billion) the government had thought it would collect.

The numbers look even more appalling when analysed in some detail. The government has been able to sell less than 20 per cent of the Rs 48,000 crore of spectrum (GSM and CDMA combined) it had put up for bids.

The CDMA auction failed totally because there were no takers. Even if you ignore that failure, the numbers don't look attractive: In the 1,800-MHz band, the government has been able to get only 27 per cent of the base price.

...

Has the 2G spectrum auction really been a failure?

Photographs: Reuters.

Telcos blame the government for misreading the market and keeping the base price too high for anyone to be interested.

Yet, scratch the surface and the story begins to look different. If the overall revenues that the government has been able to garner were poor and interest in the auction from operators looked lacklustre, it was because of just three telecom circles where there were no bidders – Delhi, Mumbai and Karnataka – of the 22 the country is divided into.

(Rajasthan didn't see any bidding, too, but that could be a different story.) That happened because the base prices of these circles were unusually high. The reason for that is simple: The base price for the current round of auction was benchmarked on the prices discovered during the auction of spectrum for third-generation, or 3G, services in 2010.

...

Has the 2G spectrum auction really been a failure?

Photographs: Reuters.

Competition for these circles in that auction was stiff because telcos rightly assumed that data traffic would be heavy here.

That is why the base price became very high in these three hot circles in the latest auction.

The three circles together constituted as much as 48 per cent of the total base price of Rs 14,000 crore (Rs 140 billion) for pan-Indian spectrum of 5 MHz. Since these circles went unbid, the entire auction looked like a disaster.

If these three circles are kept aside, the total earnings of the government do not look so bad: The collections are 67.9 per cent of the total base price - not really a failure.

...

Has the 2G spectrum auction really been a failure?

Photographs: Reuters.

So far as fewer bidders are concerned, especially when compared to 2008, when there was a literal stampede for spectrum, it is worth noting that this time around, five telcos were in the fray, even though the spectrum was almost ten times more expensive than in 2008.

And that it hasn't got the government what it had hoped for doesn't mean the initiative has flopped.

"There is no requirement anywhere that all the spectrum available needs to be sold at whatever price. Spectrum is valuable and it can be auctioned again with the same base price and operators must get used to paying a premium, " says a former office-bearer of the Telecom Regulatory Authority of India.

...

Has the 2G spectrum auction really been a failure?

Telcos, battling low tariffs (phone calls in India are among the cheapest in the world), shrinking profits and massive debts, have naturally argued that the base price in these three circles was out of sync with the demand or the situation on the ground.

Rajan Mathews, the director-general of the Cellular Operators' Association of India, or COAI, the lobby group, says: "There is a need to recalibrate the price in these circles which was kept so high compared to their revenue potential that no one saw any value in even bidding for those." Operators argue, for instance, that the base price for Tamil Nadu was kept at Rs 306.09 crore, while it accounts for 8.75 per cent share of the overall telecom revenue.

...

Has the 2G spectrum auction really been a failure?

Image: Vodafone Zoozoo.At the same time, Delhi, with 8.41 per cent of the revenue, was priced higher at Rs 694 crore, and Mumbai, with 7.1 per cent of the revenue, had a base price of Rs 678 crore.

Picking and choosing

Operators have bid smartly in the auction: They have gone for many circles that have been reasonably priced and account for a healthy share of the country's telecom revenue. One case is that of Vodafone, which has picked up additional spectrum in as many as 14 circles.

A senior executive of the company says: "We have bid and won additional spectrum in circles where the base price has been reasonable and where the market is growing, for which we would require more spectrum".

So, while Vodafone has won spectrum in circles which constitute 44.67 per cent of the total telecom revenue, the value of these circles is only 22.85 per cent of the total base price (for pan-Indian spectrum). This makes these circles an attractive target.

....

Has the 2G spectrum auction really been a failure?

Interestingly, the top-five circles in terms of the number of blocks sold (seven to 11) - Bihar, UP (west), UP (east), Gujarat and West Bengal - are also attractive in terms of the price- value equation.

While together they contribute over 24 per cent of the total telecom revenue, their share of the base price is nearly half, at 13.6 per cent.

Telenor has cleverly decided not to bid for the expensive Mumbai circle, apart from Kolkata and West Bengal, even though it currently has subscribers in these circles.

That is because if it had done so, it would have had to pay a staggering 51.96 per cent of the total base price to get into circles which have 50.06 per cent of the overall telecom revenue.

...

Has the 2G spectrum auction really been a failure?

That would have been unwise. What Telenor has done instead is to bid for circles which constitute 37.17 per cent of the telecom revenue, but whose share in the total base price is 28.5 per cent.

Idea Cellular just stuck to the circles which it had lost due to the Supreme Court order cancelling all licences handed out in 2008 (under the first-come, first-served policy) when Andimuthu Raja was the telecom minister.

Videocon was cashing in on the fact that its outgo in the auction would be neutralised by the Rs 1,658 crore that will get adjusted under the auction policy. The government has agreed to adjust the money that the operators paid for the cancelled licences.

...

Has the 2G spectrum auction really been a failure?

Image: Pranab Mukherjee.Photographs: Reuters.

Videocon has forked out Rs 2,221 crore in the latest auction, which effectively means all it has to give the government is Rs 733 crore upfront and the rest in instalments spread over 10 years.

However, Venugopal Dhoot, the chairman of the Videocon group, says his company has to pay nothing now as this would be set off against the licence fee it had paid earlier .

High estimates

The other question is whether the government has misread the market by expecting too much money from the telecom sector.

The reality is that when Pranab Mukherjee, then finance minister, now President, had announced in this year's Union Budget that the government would raise Rs 40,000 crore (the target was later lowered to Rs 30,000 crore) from spectrum auction, he, as well as the government, was perhaps unaware that three things could happen: One, the deferred payment scheme, whereby bidders need to pay only a third of the money upfront; two, state-owned BSNL and MTNL making it clear that they do not have any money to pay Rs 11,000 crore as one-time fee to the government for excess spectrum; and three, after the Supreme Court verdict, it would have to provide credit for companies that lost spectrum.

...

Has the 2G spectrum auction really been a failure?

Photographs: Reuters.

If there was no instalment scheme, the cash from the auction and the one-time fee (to be paid by operators who have spectrum beyond 4.4 MHz in GSM and 2.5 MHz in CDMA) would have been enough for the government to meet its original target of Rs 40,000 crore (Rs 400 billion).

That includes Rs 31,000 crore (Rs 310 billion) from one-time fee as cleared by the government. The numbers, however, have changed dramatically because of the three new elements that have come into the picture.

However, despite the new challenges, most experts assume that bidders will go for a staggered payment scheme rather than paying upfront, even though it means paying annual interest of 9.75 per cent for 10 years.

...

Has the 2G spectrum auction really been a failure?

But, the reality could be different and many might find it easier to raise funds overseas at a much cheaper rate and pay upfront. Vodafone, for instance, has publicly opposed the staggered payment scheme. If that happens, the revenue numbers could change in favour of the government.

There is some talk that those who lost their licences after the Supreme Court verdict will get credit for their sunk investment only if there are no criminal cases against them in court. Though such companies insist there is no such rule, COAI's Mathews says: "It's a tricky issue whether those who have charges would get the benefit or not."

What is, however, clear is now for the government to take the next steps – what to do with the partial spectrum blocks in many circles that have not been sold and, more importantly, what to do with the three key circles where no one has bid. Can it reduce the base price without the move being challenged in a court of law? Over to the government.

(With contribution from Sounak Mitra)

article