| « Back to article | Print this article |

Emerging markets mania was a costly mistake: Goldman exec

Investors who wrongly called time on US economic supremacy during the financial crisis are set to pay a hefty price for betting too much on the developing world, according to a top Goldman Sachs strategist.

The US investment bank helped inspire a twenty-fold surge in financial investment in China, India, Russia and Brazil over the past decade, its chief economist popularising the term BRICs in a 2001 research paper.

Sharmin Mossavar-Rahmani, in charge of shaping the portfolios of the bank's rich private clients, has been arguing against that trend for four years, however, trying to persuade investors and colleagues they were safer sticking with the developed world.

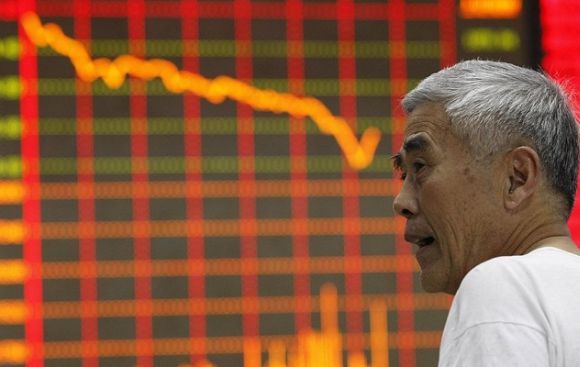

The past six months has substantially vindicated that view. China's boom is finally wobbling under the weight of economic imbalances including an undervalued currency, and emerging stock markets are down 13 per cent compared to an 11 per cent rise in the US S&P 500 index over the same period.

Click NEXT to read more…

Emerging markets mania was a costly mistake: Goldman exec

"Many investors and market commentators have been too euphoric about China over the last decade and this euphoria is finally abating. Many just followed the herd into emerging markets and over-allocated to many of the key countries," she says.

"It is easier to be part of the herd even if one is wrong, than stay apart from the herd and be right in the long run."

The net gains for US stock markets may just be a taste of the reassertion of western dominance that may emerge in the next few years, Mossavar-Rahmani argues.

Structural advantages like abundant mineral wealth, positive demographics and, most importantly, inclusive, well-run political and economic institutions make the United States the best bet going forward, she says.

"(Emerging market) investors are taking on so many risks compared with the U.S. where the risk is largely cyclical rather than structural," she says.

Click NEXT to read more…

Emerging markets mania was a costly mistake: Goldman exec

Many of the cyclical issues affecting the US such as high levels of debt, are also on their way to being resolved.

"One thing that normally puts investors off from increasing their US holdings is the long term debt profile, but we think the magnitude of the work done to address this has been underappreciated by investors," she says.

West is Best

The idea that authoritarian countries are less effective than open economies like the US at incentivising entrepreneurship and innovation is long accepted in academia.

Daron Acemoglu and James Robinson laid out the case for doubting the emerging power of China and others in a book 'Why Nations Fail' last year, arguing poor institutions that entrench inequality will hamper a country's path to prosperity.

But this view was largely put aside by professional investors who allowed themselves to be swept up in a "mania" about the rewards up for grabs in emerging markets, especially China.

Click NEXT to read more…

Emerging markets mania was a costly mistake: Goldman exec

The widely held position, enhanced by the crisis of 2007-8, was that the developed world was entering a long decline and the best prospects for investors would be found in emerging markets, particularly in Asia.

That prompted a boom in emerging market themed equity funds, which in Europe multiplied from 13 in 2002 to 67 in 2012 according to Lipper, a Thomson Reuters company that tracks the funds industry.

Lipper data also shows the balance of money flowing into emerging market themed equity funds globally, including those focused on the BRICs, soared from 2.42 billion euros in 2008 to 51.23 billion euros in 2012.

In contrast, equity funds overall lost 21.5 billion euros in 2012.

Unrest

China's efforts to rebalance its economy from an export dependent to consumer-led model is likely to bring slower growth, more market volatility and greater potential for social unrest - a worrying trinity of red flags for foreign investors who have poured cash into China in recent years.

Click NEXT to read more…

Emerging markets mania was a costly mistake: Goldman exec

Meanwhile, mass protests are causing political crisis in Brazil and investors are fretting about ponderous, economically stifling bureaucracy in India. South Africa, sometimes called a fifth BRIC, is also struggling with a tide of labour unrest and infrastructure and social problems.

Data from fund tracker EPFR Global shows investors pulled out a record $10 billion from emerging markets debt and equity funds in the week to June 28.

Mossavar-Rahmani argues investors should not base decisions so heavily on which countries post the most impressive economic growth numbers, a temptation to which she says many succumbed when overallocating money to China.

Even when countries enjoy rapid economic growth, the increases in GDP do not equate to similar jumps in investment returns, she says, citing a study published in 2005 by the London Business School.

"If you rank the world's economies from fastest to slowest in terms of growth, the fastest-growing quintile actually generate the lowest investment return while the slowest third deliver the highest," she said.

© Copyright 2025 Reuters Limited. All rights reserved. Republication or redistribution of Reuters content, including by framing or similar means, is expressly prohibited without the prior written consent of Reuters. Reuters shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.