Photographs: Mansi Thapliyal/Reuters Surajeet Dasgupta

According to Amadeus, global airlines made over $36.1 billion in revenues in 2012 from ancillary revenues, accounting for 5.4 per cent of their total revenues, up from 4.8 per cent two years ago, notes Surajeet Dasgupta

First, the reality check.

The excitement over Civil Aviation Minister Ajit Singh permitting scheduled airlines to unbundle certain services and charge passengers additional fees for them is overdone.

In fact, Singh's announcement does not represent a significant policy liberalisation as many would like it to be projected.

That's because most of the services that he listed are already 'unbundled' -- payment for in-flight meals, check-in baggage, sporting and musical equipment, using the lounge and so on.

. . .

All's fare in airline pricing

Image: New Delhi International Airport.Photographs: Rediff Archives

The only new item is a preferred seat fee. In effect, then, the government merely clarified and slightly expanded an earlier position.

Equally, Singh's assertion that the move will not increase effective passenger fares is illusory.

Consider, for instance, the fact that Air India and Jet Airways recently reduced their free luggage allowance on economy seats by five kg from 20 kg.

That means unsuspecting passengers who continue to carry 20 kg will find themselves paying a steep Rs 1,250 extra when they check-in.

On low-cost carrier IndiGo, a family of, say, three will have to pay Rs 400 more if it wants to sit together.

. . .

All's fare in airline pricing

Image: Bengaluru International Airport.Photographs: Rediff Archives

That's because aisle and window seats are now available for Rs 200 if they are pre-booked (you could try your luck via web check-in or at the counter and not pay the extra).

But going forward it is a fair bet that domestic passengers will find themselves paying more such add-on costs as margins plummet on the back of soaring competition (not least the impending debut of Asian low-cost champion AirAsia).

Unbundling gives airlines more flexibility in pricing fares, but also allows them to maximise revenues from passengers who want some of the a la carte frills.

This is standard global practice.

. . .

All's fare in airline pricing

Image: Passengers stand outside the Air India counter at the domestic airport in New Delhi.Photographs: Adnan Abidi/Reuters

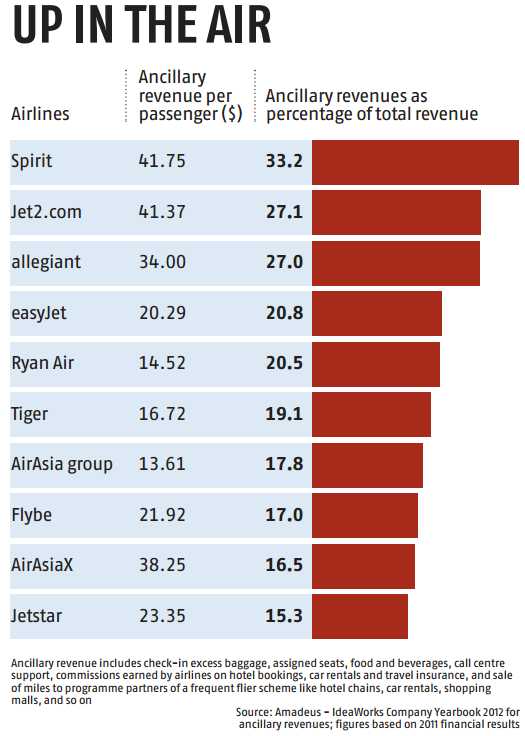

According to Amadeus, global airlines made over $36.1 billion in revenues in 2012 from ancillary revenues, accounting for 5.4 per cent of their total revenues, up from 4.8 per cent two years ago.

These additional revenues are core to the LCC model (see chart).

So, for instance, easyJet charges a staggering $25 for the checking-in at a counter. AirAsia has also mastered the art of unbundled fares.

It has no baggage allowance, and you pay anything between Rs 450 and Rs 730 for carrying baggage (upper limit: 40 kg) when travelling within Malaysia.

You also pay over Rs 200 for a wheelchair and about Rs 180 if you want to check-in at the airport counter.

. . .

All's fare in airline pricing

Photographs: Luke MacGregor/Reuters

Yet, Indian LCCs have so far been chary of charging for such ancillary services fearing a public backlash (in fact, Air Deccan had started with a baggage allowance of 15 kg but was forced to follow the industry norm under public pressure).

They also feared losing passengers to full-service carriers, because of the uniquely Indian phenomenon of the latter selectively dropping fares to LCC levels to stay airborne.

Thus, experts say, ancillary revenues account for not more than 0.5 per cent of Jet Airways' total revenues and slightly over three per cent for SpiceJet.

That pales into comparison against the big global airlines.

. . .

All's fare in airline pricing

Photographs: Graph, courtesy: Business Standard

But airlines are hoping that once the government liberalises the policy further (for example, allowing free seating, pay for check-in at counters), its share could go up to 10 per cent.

And if the Centre for Aviation, or CAPA is to be believed, these unbundled services could generate an additional $500 million in revenues for the aviation industry.

LCCs say the move can help them in many ways apart from a straight addition to the topline.

Currently, their break-even requires a high passenger load factor (PLF, a proxy for capacity utilisation) of 82 per cent -- that too, provided the average net yield from each passenger is around Rs 4,500 (minus sundry airport charges).

. . .

All's fare in airline pricing

Image: Ground staff guide a Jet Airways aircraft towards a gate on the tarmac at Bengaluru International Airport.Photographs: Rupak De Chowdhuri/Reuters

If they want to reduce fares, as a result of which net yield goes down to, say, Rs 4,000, PLFs must go up to 85 per cent, next to impossible in this competitive market.

In that situation, unbundling could provide a solution inasmuch as the Rs 500 difference could be made up from extra-baggage allowance, special seat reservations and so in.

In short, unbundling provides airlines with additional source of income even as it cuts the price of a seat, leaving a considerable amount of spending to passenger choice.

What LCCs do fear, however, is that unbundling could also be a potent and divisive weapon in the event of cut-throat competition.

"FSCs could drop fares to the same levels as LCCs or give the frills free to woo passengers.

. . .

All's fare in airline pricing

Photographs: Luke MacGregor/Reuters

"Why should anyone fly with us then? So we will have to do the same," said a top airline executive.

If, for instance, some airlines decide to dump fares at a basic price of Rs 1, and start a fare war, additional ancillary revenue will only reduce the huge losses LCCs will suffer, not mitigate it.

For passengers, however, unbundled fares could mark a fundamental change in the way they travel.

Though only 40 per cent of the flying passengers in the domestic skies have check-in baggage, they will now have to watch the number of bags they take on holiday (Indians typically travel with huge amounts of baggage) or arrive at the airport earlier to get their preferred choice of seats without paying extra.

And if the government allows free seating, which it had stopped earlier, they will also have to stand in queue quickly get their preferred seat.

If anything, the age of the LCC that behaved almost like a full-service carrier in India will be over soon.

article