Photographs: Reuters

Markets made a marginal recovery in late noon deals even as heavyweights witnessed selling pressure. The Sensex finally ended down 365 points or 2% at 16,502.

The BSE benchmark had touched a low of 16,393 on negative cues from global peers in intraday deals. Nifty shed 113 points at 4,946.

A dismal index of industrial production data dampened investor sentiments further.Data showed that industrial growth has fallen to a meagre 3.3 per cent in July this year on account of poor performance mainly by capital goods, manufacturing and mining sectors, reflecting sluggishness in the economy.

Growth in the factory output, as measured in terms of the Index of Industrial Production, had stood at 9.9% in July last year.

"Going forward, we believe the pickup in consumer goods output growth is unlikely to persist, as intermediate goods output continues to weaken.

"Other indicators, such as loan growth for consumer durables, also suggest that demand for durable goods is likely to weaken in the coming months," said Nomura India in a research report.

. . .

Markets languish in late-noon trades

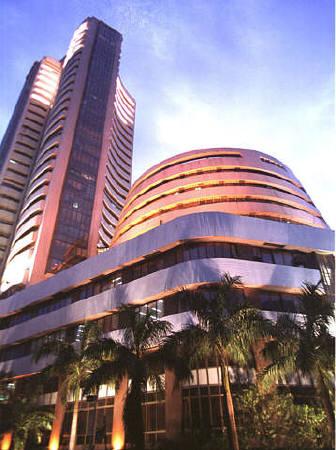

Image: The Bombay Stock Exchange.Most markets across the globe dipped on fears that the Greek government may default on its debts.

Worries about France's rating being cut by Moody's also played spoilsport. Greece on Sunday slapped a new tax on real estate to plug a 2011 budget hole, please international lenders and secure a key new loan tranche as concerns mounted in Europe over its euro zone membership. In Asia, Hang Seng dropped 4.2% to 19,031.

Nikkei and Straits Times shed around 2.5% each. In Europe too markts touched 26-month lows.

CAC tanked over 3%, followed by DAX and FTSE which were down 1-2% each.

Back home, markets would be looking at the RBI's monetary policy review on Friday and the corporate advance tax payments on Thursday.

Analysts believe that the Reserve Bank of India would be hiking rates once again as inflation pressures continue to remain strong.

An increase would be the 12th in the current cycle and would take the repo rate, the central bank's key lending rate, to 8.25%, where most economists see it staying until at least the end of the fiscal in March.

All the sectoral indices ended in the red with the BSE metal index skidding 3.6% to 11,862. Consumer durables, IT, banking and realty indices also dropped over 3% each.

. . .

Markets languish in late-noon trades

Image: A trader reacts.Photographs: Reuters

Among individual stocks, ICICI Bank, Reliance and Infosys contributed 140 points to the Sensex's fall.

Metal stocks were the big losers in the Sensex pack. Hindalco tumbled 5.2% to Rs 142. Jindal Steel and Tata Steel slipped 4-5% each. Wipro, SBI and Jaiprakash Associates were some of the other key losers.

Tata Motors dropped 4% to Rs 146 after its Group CEO and managing director Carl-Peter Forster quit due to "unavoidable personal reasons".

Meanwhile, FMCG heavyweight -- Hindustan Unilever, jumped 3.8% to Rs 346. Cipla and Sun Pharma from the healthcare pack, also bucked trends and were up over 1% each in trades.

. . .

Global tremors, IIP nos drag markets

Among other stocks, Pipavav Defence & Offshore Engineering Company, better known as Pipavav Shipyard, soared 11% to Rs 91 upon announcement of a joint venture with Mazgaon Dock for defence orders such as building warships for the Indian Navy.

This is the first time post independence that a private sector company has been selected by a company controlled by the Ministry of Defence to build warships together, which will result in speeding up the delivery of warships to the Indian Navy.

In other news, the Securities and Exchange Board of India has approved an initial public offering by Multi Commodity Exchange, the country's biggest commodity exchange.

MCX will sell 6.43 million shares constituting a 12.6% stake in the company through the IPO, its chairman had said in March.

The BSE market breadth remained extremely negative with 1,909 shares on the declining side and 877 on the advancing side.

About 2,907 shares were traded in total.

article