| « Back to article | Print this article |

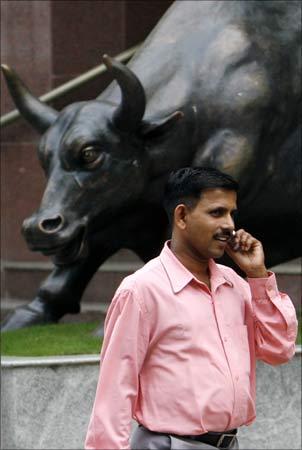

Sensex may hit 19,500 this year: Experts

Driven by the election outcome, the benchmark index Sensex could catapult to 19,500 level this year, provided the government pushes through the reform agenda, analysts said.

Market experts believe that the reforms expected to be carried out by the new government may keep the market sentiment upbeat and propel the index to regain the levels, it had seen in 2007, in the months ahead.

"Our upside target for the Sensex is 19,500 this year which the index may climb if the government surprises us with a phenomenal budget," Morgan Stanley managing director Ridham Desai said in an investor summit arranged by television channel CNBC TV 18.

Text: PTI

Sensex may hit 19,500 this year: Experts

However, more probability for the index is to remain in mid-15,000 levels or about 10 per cent higher than current levels, he said.

The financial sector reforms which are there before the government include raising FDI cap from present level of 26 per cent from 49 per cent through amendment in Insurance Act, pension reform and banking sector reforms.

Echoing similar view Reliance Capital Asset Management equities head Madhusudan Kela, 19,500 levels were possible this year but would depend if the government aggressively carries out the expected reforms.

Sensex may hit 19,500 this year: Experts

Meanwhile, if the global market turn downwards and the government fails terribly to keep up public expectations, the index may see a level of 8,500 on the downside, Desai added.

Further, if the S&P 500 index falls below the 666 points level then the domestic stock indices may give in to pressure and plunge into negative territory, analysts said.

Sensex may hit 19,500 this year: Experts

The benchmark index Sensex has climbed around 40 per cent to 13,800 levels, so far, this financial year.

Besides, foreign institutional investors have also turned bullish on Indian equity markets and have made net investments to the tune of Rs 14,586 crore (around $3 billion) in May so far.

Sensex may hit 19,500 this year: Experts

According to Ramesh Damani, member BSE, financial sector reforms as well as disinvestment should take place as it will be good for the sector and the economy as a whole.

The coming Budget should give some signal as far as reforms are concerned, Damani said.

Last year, the government tabled the Insurance Reforms Bill in the Rajya Sabha aimed at increasing the cap on foreign investment in private companies in the sector from 26 per cent to 49 per cent.