Surabhi Roy in Mumbai

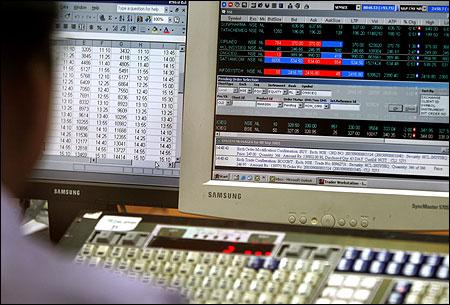

Benchmark share indices ended over 2% down on Monday, amid weak European cues, on concerns that high crude oil prices would fuel inflation further delaying the lowering of key rates by the central bank.

The fall was led by index heavyweights and rate sensitive shares.

The 30-share Sensex ended at 17,446 down 478 points or 2.7% and the 50-share Nifty ended at 5,281 down by 148 points or 2.3%.

The Sensex and the Nifty reached an intra-day low of 17,382 levels and 5,268 mark, respectively.

On November 21, 2011, the Sensex ended at 15,946 down 427 points whereas the Nifty closed at 4,778 down 127 points.

Bloodbath on the bourses! Sensex down 478 points

On the global front, the Nikkei closed lower by 13 points at 9,633 levels, Hang Seng was down 223 points at 21,183.

However, Shanghai and Taiwan ended marginally higher. European markets are trading weak with CAC-40, DAX and FTSE-100 declining by almost 1% each.

Back home, BSE Realty and Metal indices plunged by almost 5% followed by sectors like Capital Goods, Auto, Power, Banks, Consumer Durable and Oil & Gas, all declining between 2-4%.

Apart from FMCG, all the major BSE sectoral indices ended in red zone.

Index heavyweight Reliance Industries (RIL) plunged nearly 5%.

Bloodbath on the bourses! Sensex down 478 points

According to media reports, BP PLC (BP) and RIL will jointly submit a proposal to the government containing plans to develop the D6 block, including satellite fields, in the east coast Krishna-Godavari basin.

BSE Metal index plunged over 5%, its sharpest fall in past 21 months, on concerns that weak Chinese consumption data and rising oil prices which touched 10-month highs last week might dampen industrial growth.

Tata Stell was the top Sensex loser, down 7%.

Other Metal stocks like Jindal Steel, Hindalco and Cola India fell between 3-5%. Sesa Goa slipped more than 10%.

Vedanta Resources, the holding company of Sesa Goa and Sterlite Industries, has decided to merge the two companies.

Bloodbath on the bourses! Sensex down 478 points

Meanwhile, Deutsche Bank has downgraded Sesa Goa to hold from buy after the restructuring announcement and also cut target price to Rs 249 from Rs 270.

Banking shares like ICICI Bank, HDFC Bank and SBI plunged between 2-5% on profit taking.

HDFC extended Friday's losses and down by nearly 2% after Citigroup Inc which holds around 145 million shares, or a 9.9% stake, in the company sold its entire stake at an average market price of Rs 670 per share via block deals last week.

Capital Goods majors L&T and BHEL declined between 4-5%. BHEL dropped 4% on reports that Tamil Nadu Chief Minister J Jayalalithaa on Friday scrapped the 1,600 megawatt power joint venture and announced that the government would fully fund the project itself.

Bloodbath on the bourses! Sensex down 478 points

From the realty pack, DLF crashed by 5%.

Auto stocks like Hero MotoCorp slipped by nearly 7%. Maruti Suzuki, Bajaj Auto, M&M and Tata Motors fell between 2-5%.

IT stocks like Wipro and Infosys were down between 2-3%.

However, from the FMCG pack ITC gained by over 1%.

The broader indices extended the losses and ended weak with BSE Midcap and Smallcap indices declining by over 3%.

The market breadth in BSE remained dismal with 2,210 shares declining and 649 shares advancing.

article