| « Back to article | Print this article |

8 sectors double shareholders' wealth in 4 years

Last four years have been the worst of times for most countries across the world since the depression of the 1930s.

India, too, has suffered, but on a relative basis - it has done better, recording the second-best growth rate after China.

But, despite these tough times, select sectors have done remarkably well, helping Indian markets shine.

Click NEXT to read more...

8 sectors double shareholders' wealth in 4 years

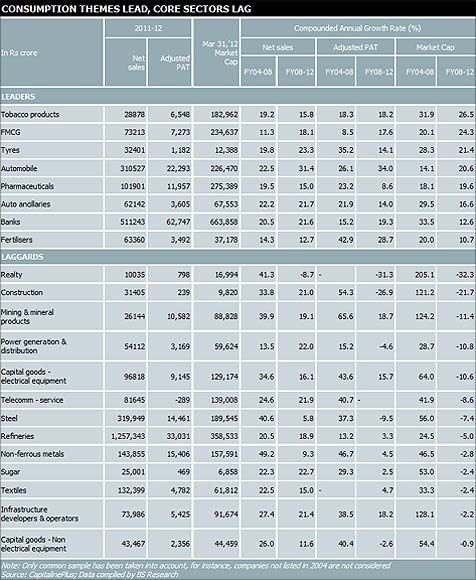

Automobiles, auto ancillaries, banks, fast-moving consumer goods (FMCG), pharmaceuticals, tobacco producers, tyre makers and fertiliser companies are the eight sectors that clearly stand out.

They have reported a compounded annual growth rate (CAGR) of 22.1 per cent and 19.5 per cent in sales and adjusted net profit during FY08-12.

A lot of their success is consequent to healthy demand in the domestic market.

Click NEXT to read more...

8 sectors double shareholders' wealth in 4 years

Their aggregate adjusted net profit had grown from Rs 29,991 crore in 2003-04 to Rs 57,694 crore in 2007-08. Those were the times when Indian and global economies were doing well.

However, even during the tough times that followed the global crisis of 2008, their aggregate profits continued to rise and stood at Rs 1.19 lakh crore for the year ended March 2012 (FY12).

Click NEXT to read more...

8 sectors double shareholders' wealth in 4 years

The markets have been quick to reward them. While their market capitalisation increased 148 per cent to Rs 8.84 lakh crore during FY04-08, compared to the Sensex's 194 per cent, it has nearly doubled to Rs 17 lakh crore between FY08 and FY12 against the Sensex's 6.3 per cent.

In contrast, the negative outliers are the core sectors like capital goods, power, metals, construction, textiles and refiners, which have fared poorly during the last four years, thanks to issues pertaining to economic slowdown, high debt, hurdles in environment clearance and input availability among others.

Click NEXT to read more...

8 sectors double shareholders' wealth in 4 years

New entrants, in terms of those which didn't have a significant presence like realty (high debt, subdued demand) and telecom (stiff competition, regulatory woes) have also lagged.

While their combined profits are up by just Rs 838 crore during FY08-12 (to Rs 99,574 crore in FY12), sales have grown at a CAGR of 15.5 per cent to Rs 22.96 lakh crore. Not surprisingly, their combined market cap is down 20 per cent.

Click NEXT to read more...

8 sectors double shareholders' wealth in 4 years

The outperformers

The auto sector has been a star performer, with its net profits clocking a CAGR of 34 per cent, fastest among the eight sectors.

New vehicle launches, cut in excise duties and low interest rates helped the industry.

However, with excise duties returning to normalised levels and interest rates ruling high, growth rates have again slowed in recent months, which experts believe is a temporary phase–they expect growth to revive in the long run.

Click NEXT to read more...

8 sectors double shareholders' wealth in 4 years

Among companies responsible for the sector's stellar show during FY08-12 are Tata Motors, Hero MotoCorp and Mahindra and Mahindra.

The auto sector's performance also had its influence on the auto ancillary sector, wherein Bosch Exide, Amara Raja and Fag Bearings did well both in terms of profits and shareholders' wealth creation.

Tyre companies also did well, but not as well as auto companies.

Click NEXT to read more...

8 sectors double shareholders' wealth in 4 years

With farm incomes rising, it has led to rising aspirations among Indians based in smaller towns and villages, which have helped FMCG companies deliver fast growth.

Their aggregate adjusted net profits has grown at a CAGR of 17.6 per cent, more than double the 8.5 per cent reported during FY04-08.

In fact, auto and FMCG companies are the only ones to have reported higher growth rates (both in sales and net profit) during FY08-12, compared to FY04-08.

Click NEXT to read more...

8 sectors double shareholders' wealth in 4 years

Not surprisingly, the gains for their shareholders have also been fantastic. It is the same case with tobacco companies, which include ITC, VST Inds and Godfrey Phillips.

Among the top scorers, the pharmaceuticals sector has also done well, but it could have been higher on the toppers chart. Subdued by Ranbaxy (due to US Food and Drug Administration-related issues) and Glenmark pulled down the performance.

However, both are expected to see a visible improvement in their performance –Ranbaxy's FDA issues are being sorted and Glenmark is seeing expansion in its niche product portfolio.

8 sectors double shareholders' wealth in 4 years

The positive outliers are Lupin, Cadila Healthcare, Torrent Pharma, Ipca, Dr Reddy's Lab and Sun Pharma, which have grown at a fast clip, as well as rewarded their shareholders well.

Lupin, which saw fast growth in its US and Japan operations, tops the chart wherein sales and profit grew at 26-28 per cent, while the market cap widened 58 per cent during FY08-12.

Among mid-caps, Cadila and Ipca did well by growing at a fast pace in the domestic market - Cadila also did equally well in the US. On the other hand, Dr Reddy's, while growing strongly in the US, also reported robust sales in Russia and other emerging markets. Sun has delivered a decent show.

Its performance could have been better, had it not faced problems with its acquisition of Israel-based Taro.

Click NEXT to read more...

8 sectors double shareholders' wealth in 4 years

Surprisingly, despite volatile times, India's banking sector clocked over 19 per cent CAGR in aggregate adjusted profits during FY08-12 and that, too, when the top two banks (State Bank of India and ICICI Bank) saw profit growth of 11-15 per cent. Other banks saw profits growing between 20-80 per cent.

This performance is commendable, given the trend in rising non-performing assets and restructured loans and the recent slowdown in growth rates, which has restricted their performance on the bourses.

Click NEXT to read more...

8 sectors double shareholders' wealth in 4 years

The underperformers

The big surprise is the refinery space. Here, while Reliance Industries Ltd (RIL) and Indian Oil Corp (IOC) have seen a rising trend in profits, RIL's dismal performance on the bourses (25 per cent fall in market cap) has pulled down the sector, which can be attributed to worries over fall in margins, excess cash lowering return ratios and declining gas output.

What's surprising is that even as oil marketing companies (Hindustan Petroleum Corp, Bharat Petroleum Corp) saw a decline in profit (in FY12 over FY08), their market value rose.

Click NEXT to read more...

8 sectors double shareholders' wealth in 4 years

Steel Authority of India's market value and profits have tanked by half, which is largely responsible for the sector's dismal show on the bourses.

Tata Steel, which has also seen its profits fall by over 50 per cent, has lost just 10 per cent in market value.

However, its performance would have been worse had the company not raised funds from promoters to lower its debt-equity ratio. The positive outlier is Jindal Steel and Power.

Click NEXT to read more...

8 sectors double shareholders' wealth in 4 years

Its profits rose 80 per cent in four years, leading to a 60 per cent rise in market capitalisation. So, has Bhushan Steel.

In capital goods, Havells, Siemens, Engineers India and Larsen and Toubro (L&T) have seen an improvement in profits. However, barring L&T (market cap down about 10 per cent), the other three have seen a surge in their market values.

On the other hand, Bharat Heavy Electricals Ltd (Bhel) (down 37 per cent in market value) and ABB (down 28 per cent) pulled down the sector's performance on the bourses.

Bhel, despite having reported rising profits, is down due to concerns over order inflow led by slowdown in the power sector.

Click NEXT to read more...

8 sectors double shareholders' wealth in 4 years

The deterioration in the profitability and concerns over growth in the core sectors are key reasons for the decline in shareholders' wealth.

In fact, these were the sectors that did exceptionally well during FY04-08.

But don't write them off so fast. Experts say when the Indian economic growth looks up (to above 8 per cent levels) on a sustainable basis, these sectors will rebound.