| « Back to article | Print this article |

Secret bank accounts: Germany, Mauritius agree to share info

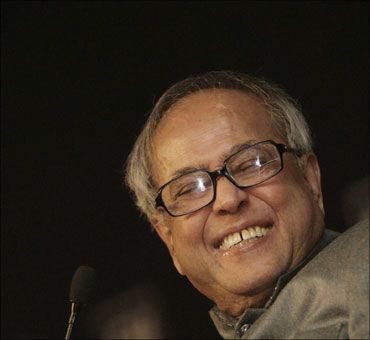

Germany and Mauritius have assured Indian Finance Minister Pranab Mukhejee that they would pass on information about Indian citizens holding secret bank accounts.

The assurance came at a bilateral meeting between Mukherjee and German Finance Minister Wolfgang Schaeuble on the sidelines of the meeting of the G-20 Finance Ministers and Central Bank Governors that concluded in Paris on Saturday.

Mukherjee appreciated the role of Germany in providing information about Indian citizens having secret bank accounts in the LGT bank of Liechtenstein.

Germany has earlier provided names of some Indians having secret accounts in the Liechtenstein Bank.

Mauritius has provided Indian authorities with banking information and other financial details on more than 90 cases of suspected tax evasion and financial malpractice over the past three years.

Asserting that it has put in place robust measures to help India track black money, the Mauritian Finance Ministry told PTI that the information sought by Indian authorities has been duly provided as per international norms.

While acknowledging that some unscrupulous persons might still beat the systems in place to check flows of black money, the Mauritian Finance Ministry said it has taken additional measures with respect to India.

"... With India, we have developed a mechanism to be in close consultation with the Indian authorities to deal with any issues that may arise. This includes the posting of an officer from the Central Board of Direct Taxes at the Indian High Commission in Mauritius," the ministry said.

Mauritius has often been suspected to be a facilitator of black money round-tripping or routing illicit wealth stashed abroad by Indians back into the country through their banking and financial institutions.

Click NEXT to read further. . .

Secret bank accounts: Germany, Mauritius agree to share info

"German Finance Minister . . . assured him (Mukherjee) that as and when they have such information, they will pass it on to the Indian government", said a statement.

Germany, it added, has also agreed to revise Double Taxation Avoidance Agreement and incorporate clauses to facilitate exchange of information between the law enforcement agencies of the two countries.

The negotiations to amend the DTAA will start soon, the statement said, adding Mukherjee has requested for early amendments to the tax treaty.

Click NEXT to read further. . .

Secret bank accounts: Germany, Mauritius agree to share info

Under the existing treaty, Germany cannot share information for non tax purposes.

German tax authorities, Mukherjee added, need to share information with India's Enforcement Directorate, a body that deals with offences relating to violation of foreign exchange laws.Raising similar issues with French Minister for Economy, Industry and Employment Christine Lagarde, Mukherjee said there was need to put pressure on tax havens to share information to prevent money laundering.

Mukherjee also recalled the commitment of the French Minister to share information on Indian monies in Swiss banks.

Click NEXT to read further. . .

Secret bank accounts: Germany, Mauritius agree to share info

The Indian minister asked his French counterpart to initiate early negotiations for amending the DTAA between the two countries.

Lagarde said the French team was working on the amendment proposed by India on the DTAA and the issue of providing information for tax purposes would be discussed shortly with Indian administration.

The two leaders also discussed a number of bilateral and multilateral issues and underlined the need for greater engagement between the two countries in the fields of energy, nuclear power, water treatment etc.

Click NEXT to read further. . .