| « Back to article | Print this article |

Sebi consent order on RIL may be delayed

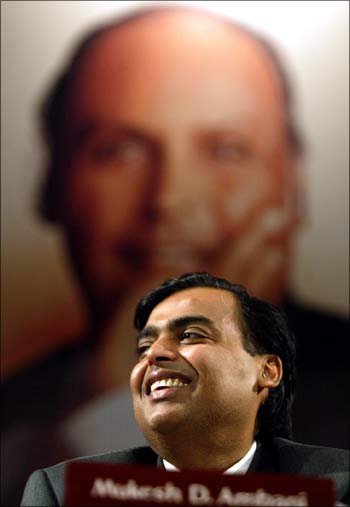

The much-awaited Securities and Exchange Board of India consent order on the Mukesh Ambani-led Reliance Industries Ltd is expected to be delayed.

"It is going to take a lot of time," a senior Sebi official told Business Standard.

However, the official said this did not mean Sebi had opted for a go-slow approach in delivering consent orders in other enforcement cases.

"The pace of action in the enforcement, surveillance and investigative cases has improved in the last few weeks and will further pick up."

Click NEXT to read further. . .

Sebi consent order on RIL may be delayed

The RIL order is critical as the estimated penalty amount of Rs 1,500 crore (Rs 15 billion) could be the highest ever levied by Sebi.

Industry insiders say the penalty could be three times the gain made by the company.

Sebi had issued a show cause notice to RIL last February, as the parties could not agree on the consent terms for insider trading.

However, RIL later reapplied to Sebi, requesting it to go for a consent process. Sebi's consent order norms allow companies to approach it again for consent in some cases, even if the first attempt was unsuccessful.

Click NEXT to read further. . .

Sebi consent order on RIL may be delayed

The case was regarding the sale of shares of Reliance Petrochemicals held by RIL.

The company had hedged their sale position in the derivative segment.

During the process, it had made a huge profit, of over Rs 500 crore (Rs 5 billion) four years ago.

While the company had shown the profit in its balance sheet and paid the relevant tax, Sebi said RIL was aware of the likely gain from derivatives trade in the name of hedging.

RIL had first sold the shares in derivatives and then, while selling the shares in the open market, covered the derivatives position, which resulted in profit.

It argued before Sebi it had hedged its sale position to ensure the market price did not crash when it offloaded its holding.

Click NEXT to read further. . .

Sebi consent order on RIL may be delayed

An RIL spokesperson declined to comment on the issue.

The regulator had passed a Rs 50-crore (Rs 500-million) consent order on two Anil Ambani-led companies Reliance Infrastructure and Reliance Natural Resources in January this year.

Sebi had started the consent order mechanism in 2007 for settling cases with wrongdoers in the equity market to avoid long-drawn litigations.

The system was based on the plea bargaining procedures popular in the US market. Consent orders can be passed at any stage where a probable cause for violation was found.

Click NEXT to read further. . .

Sebi consent order on RIL may be delayed

It gives the opportunity to intermediaries to pay a fine and avoid a legal battle.

Sebi's new chairman U K Sinha had expressed his disapproval of the 'arbitrary' way in which some serious cases were being settled by the regulator.

Under such orders, those charged with specific violations were let off by paying a settlement charge, without admitting or denying guilt.

This helped Sebi rake in close to Rs 200 crore (Rs 2 billion) in just over four years.

Even some of the serious market manipulation cases and those related to the Initial Public Offer scam were let off under consent terms.