| « Back to article | Print this article |

Sales growth plunges to single-digit across sectors

India Inc's fastest growing sectors have finally succumbed to a single-minded focus on inflation and the economic slowdown in China, Europe and America.

Sales growth rates have plunged to a multi-quarter low for key sectors such as refineries, capital goods, cement, chemicals, construction, consumer durables, fertilisers, infrastructure, metals, power, realty, steel and telecom.

The rupee depreciation has benefited pharmaceutical and software services companies; cement and fast moving consumer goods companies have managed growth on the back of price increases.

Faltering domestic growth and weakening of the European and US economies brought the rupee to a new low in June.

The forex borrowing through foreign currency convertible bonds and external commercial borrowings paid heavily through this currency depreciation, with mark-to-market losses of Rs 13,000 crore (Rs 130 billion) accounting for 16 per cent of the pre-tax profit of 2,080 companies.

Click NEXT to read further. . .

Sales growth plunges to single-digit across sectors

Forex borrowings, hedging of exports and rupee depreciation have hurt sectors such as agro chemicals, automobile ancillaries, automobiles, oil marketing companies, refineries, metals, pharmaceuticals, power, steel and telecom.

The 2,080 companies that had declared their results for the quarter ended June recorded sales growth of 14.8 per cent, significantly down compared to the 25.6 per cent growth achieved by the same sample a year before.

The cost of raw materials as a percentage of sales remains high on a year-on-year basis, up 140 basis points to 58.5 per cent. Rupee depreciation led to higher interest outgo, up 40 per cent.

Net profit declined 34 per cent.

Click NEXT to read further. . .

Sales growth plunges to single-digit across sectors

The results are comparatively healthy, excluding oil marketing companies and refineries, with sales moving at a higher pace of 16.7 per cent and net profit growing at a respectable 7.5 per cent.

Automobiles, banks, pharmaceuticals and software companies were growth drivers in the first quarter.

On the domestic front, the slowdown was seen in capital goods, construction and power sectors, as capital expenditure plans were put on hold due to rise in the cost of borrowings.

OMCs suffered a net loss of Rs 40,500 crore (Rs 405 billion) in the first quarter, on account of forex loss of Rs 4,800 crore (Rs 48 billion) and the lag between sales of petroleum products below cost and receiving the subsidy.

Click NEXT to read further. . .

Sales growth plunges to single-digit across sectors

Indian Oil Corporation has been the worst performer, with net loss mounting sixfold to Rs 22,450 crore (Rs 224.5 billion), as the company reported a forex loss of Rs 3,187 crore (Rs 31.87 billion) and net under-recoveries at Rs 17,500 crore (Rs 175 billion).

The company did not receive any subsidy from the government and reported a negative gross refining margin of $4.8/bbl, led by inventory loss of $7.5/bbl.

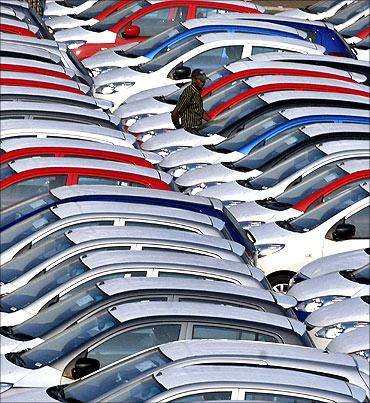

The automobile sector showed robust growth in sales, backed by Tata Motors, Maruti Suzuki and Mahindra & Mahindra.

However, sales growth could not be converted into strong growth in net profit on account of rise in the cost of production.

Click NEXT to read further. . .

Sales growth plunges to single-digit across sectors

Tata Motors' operating performance was better than expected, with higher margins in both the Jaguar and Land Rover and standalone businesses.

Tata gained from a favourable mix and lower forex losses in JLR, lower raw material cost and higher other income in the standalone business.

M&M reported sales growth of 39 per cent, supported to a great extent by a 25 per cent rise in realisations.

The growth in realisations was also in line with the price increases of two to three per cent taken in this quarter.

Raw materials to sales went up significantly by 430 basis points year-on-year, but other expenses to sales declined 70 bps.

Click NEXT to read further. . .

Sales growth plunges to single-digit across sectors

Banks have reported strong results, with a 16.2 per cent rise in total income (net interest income plus other income), backed by strong performance from leading private banks HDFC and ICICI.

Public sector banks reported slower growth in total income with sector leader State Bank and the second largest in the public sector, Punjab National Bank, reporting moderate growth.

Net profit rose a hefty 33 per cent, led by SBI, which has reported a 94 per rise in net profit.

There was strong profit growth from private banks, while midsize PSBs reported single-digit growth in net profit.

Click NEXT to read further. . .

Sales growth plunges to single-digit across sectors

The capital goods sector reported moderate growth in sales, indicating a slowing in capex plans and poor order flow for power and infrastructure companies.

Larsen & Toubro did well by reporting strong growth in revenue, but net profit was up a modest 16 per cent on account of a rise in cost of raw materials.

Bharat Heavy Electricals continues to reel under demand pressure, with only modest growth in sales and profit for the past several quarters.

Cement companies have maintained robustness on account of strong price realisations.

Click NEXT to read further. . .

Sales growth plunges to single-digit across sectors

Owing to the rise in cement prices across regions, sales revenue rose 19 per cent. Average realisations increased 10-15 per cent but a rise in freight and fuel costs offset these and impacted net profit, which grew 25.4 per cent.

Lack of investment by the government continues to hurt infrastructure and construction companies, with sales growth subdued.

The sales growth rate has plunged to single digit for small and medium sectors, such as consumer durables, edible oils, fertilisers, hotels, media and paper.