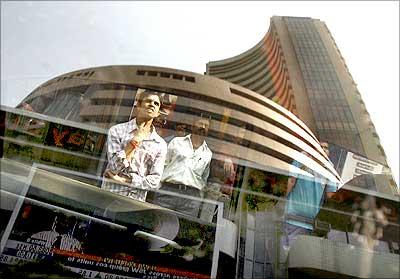

Photographs: Arko Datta/Reuters

The power of the financial markets should be daunting but many people are not deterred.

I have friends in Monaco who are amateur currency traders. They don't have the same experience, resources, or the skill, of George Soros.

Nor do they follow a disciplined approach to trading. It's completely crazy that they think they can win. Why do people underestimate the difficulty of making money in the financial markets? I believe there are two main reasons.

The first, which I will discuss here, is the 'experts' in the media...

(Excerpt from Taming the Lion: 100 Secret Strategies for Investing by Richard Farleigh. Published by Vision Books.)

Safe investment? Beware of experts!

Image: Indian stock brokers watch the key Sensex share index graph at a brokerage firm in Mumbai.Photographs: Punit Paranjpe/Reuters

Beware of 'experts'

The experts in the media promote the idea that markets are easier than they really are. A guy on TV or in the newspaper says that the price is going to do this and do that, and it sounds easy.

The market can be beaten. The message is that the market's behaviour can be forecasted. It's a persistent and seductive message, and people think, 'Ah, I can have a go at that, I can make money out of that'.

You can't blame the average person for following what they read in the newspaper and what they're being told on TV.

However, many so-called experts are just commentators or analysts who often don't have any track record and who often, to my ear, don't even make much sense.

Follow my advice and listen critically, rather than just accept what you're hearing or reading. You may be surprised to find that they're not really experts.

Safe investment? Beware of experts!

Image: Traders work on the floor of the New York Stock Exchange.Photographs: Lucas Jackson/Reuters

Most professionals are not outguessing the market

You may heed my early warnings that the markets are difficult and that the media underplays the difficulties, but you may also wonder about all the money made by the people working on Wall Street or in the City of London. Surely they know something about markets that you don't?

Let me put you straight on this. The truth is that very few are successfully backing their views on markets. Most of them wouldn't have a clue what the market was going to do. They make money in other ways, such as commission and management fees, in other words by getting a cut on the money you invest!

It's not that people working in finance don't know anything - they are usually very good, very smart people. I respect a lot of them and many are my friends - but the fact is they're making money out of sales, client relationships and by doing transactions, i.e. facilitating the whole process.Safe investment? Beware of experts!

Image: An index manager at the Vienna Stock Exchange.Photographs: Heinz-Peter Bader/Reuters

Equally, don't be too impressed with your stockbroker just because they sound confident and know a lot of stories and figures.

More information does not necessarily make the market more predictable. The extra information is probably useless as the price has already adjusted for it - it has been 'priced in'.

It's about as useful as playing roulette and knowing whether the roulette wheel was made in Taiwan or Korea.

The critical test is: does the broker make a living out of picking stocks? Probably not. They are sitting in their seat because they're getting the fees you pay them to buy and sell on your behalf.

It's very easy for someone to have a view when it's with someone else's money.

Safe investment? Beware of experts!

Image: A bronze sculpture of a bull is seen on the premises of the Bombay Stock Exchange.Photographs: Arko Datta/Reuters

They're not actually making money out of successfully predicting what's going to go up and down. There are, therefore, not a reason for you to take up punting cotton futures in your spare time.

Listen and read very critically

If you are trading or investing, the media probably plays a large role in forming your views, but it always surprises me how often they present faulty logic. So it is vital to learn to be critical of what you read and hear.

Try to spot mistakes such as those in the following real examples.

"Experts say the market is overvalued."

This is a subject I have already touched on. 'Experts' is the most overused word in finance. I see it all the time and wonder who these experts are! The only expert who interests me is someone with a proven track record of predicting the market.

Safe investment? Beware of experts!

Image: A man watches a large screen displaying India's benchmark share index on the facade of the Bombay Stock Exchange.Photographs: Punit Paranjpe/Reuters

As we have seen, most professionals are not capable of outguessing the market, and those that do are not normally very interested in telling the media about their thoughts.

What's more, you can normally find an expert somewhere to support any view at all. Perhaps the journalist has a heavy workload and just rang a friend at a bank, arranged to meet for a drink, asked about the market, and relayed this as 'experts say the market is overvalued'.

"The money market predicts rates will rise from 3.5 per cent today to 5 per cent by late next year...The good news is that such predictions are probably wrong... Many analysts see rates reaching no higher than 4.5 per cent in 18 months."

These 'analysts' are a bit like the experts. I would have more faith in the market's view. Those analysts are free to put their money where their mouth is and bet against the market if they want, but I've rarely met any with enough skill or conviction.

Safe investment? Beware of experts!

Image: A broker speaks on the phone during a trading session at the Indonesia Stock Exchange.Photographs: Enny Nuraheni/Reuters

"With the euro at $1.25 a sustainable range is $1.22 to $1.28. Upside risks pre- dominate though a short term drop to $1.15 is not out of the question."

This is a bet each way. The easiest forecast to make is something like: if the price doesn't rise, it will fall, or perhaps even stay the same. It's useless.

"The pound will rally to $2.10 before weakening to $1.50 next year."

This is what I call a 'zig-zag' forecast. Not content to just predict the next price move, the guy thinks he can predict the next two moves. He thinks he has the price on a string. A very untrustworthy type of forecast.

"The markets were overheated so a correction was expected."

Hindsight. With comments like these I always wonder who expected the correction. Did they sell at the right time?

Safe investment? Beware of experts!

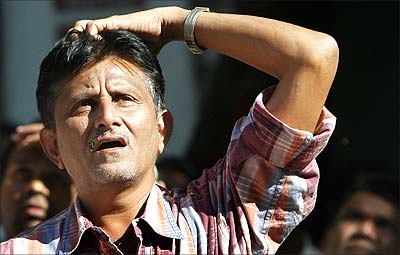

Image: A happy investor reacts as he speaks on the phone.Photographs: Reuters

"The market's gone too far."

Often these comments appear after a big move, but as you will see, I am a firm believer that the market often surprises everyone with how far it can go.

"The market's going to 20,000!"

Or to the moon. Beware of the crazy forecaster looking for a publicity stunt. Yes, it does happen. The wildest forecast gets the most press, and fifteen minutes of fame for the forecaster.

So keep a critical mind when you read or hear market comments. Ask yourself these questions:

- Does the commentator have any track record?

- Are they considering all of the factors?

- If they are pointing to influences which have been present for some time, why should they start moving the market now?

- Are they relying on hindsight?

- Are they hedging their bets?

Safe investment? Beware of experts!

Image: Traders talk on their phones at the Frankfurt Stock Exchange.Photographs: Alex Grimm/Reuters

I would have more respect if a commentator was asked something and actually said 'I don't know'. He could then continue 'because of the following...'

Then you know you're going to get a balanced answer. It's brave to say 'I don't know', especially if you're in a meeting with traders or at a board meeting talking strategy, and everybody wants to hear your opinion. I try to be disciplined enough to admit that it is just too difficult sometimes to have a view.

Learn from the market, instead

If the papers and so-called experts are unreliable, how do you ever learn about markets? The answer is that you should start by trying to understand what's happened in the past. I cannot stress this too strongly.

A common mistake of all levels of investors is not doing enough homework. Most of my own time on markets has been investigating how prices have behaved in the past. You cannot hope to predict if you do not understand.

Safe investment? Beware of experts!

Image: An Indian broker monitors stock prices during trading hours at a brokerage firm in Mumbai.Photographs: Punit Paranjpe/Reuters

I am not suggesting an enormous amount of research. The effort should be in thinking about how prices have reacted to big picture influences in the past few market cycles. This does not require extensive number crunching or time in the library.

When you are looking back at price moves you can also perform a useful training exercise. Try to imagine how you would have played the market in the past at different times based on the news which was available.

How would you have performed? Would you have picked the big moves? Make the market your teacher, and then listen to what it is telling you.

(Excerpt from Taming the Lion: 100 Secret Strategies for Investing by Richard Farleigh. Published by Vision Books.)

article