| « Back to article | Print this article |

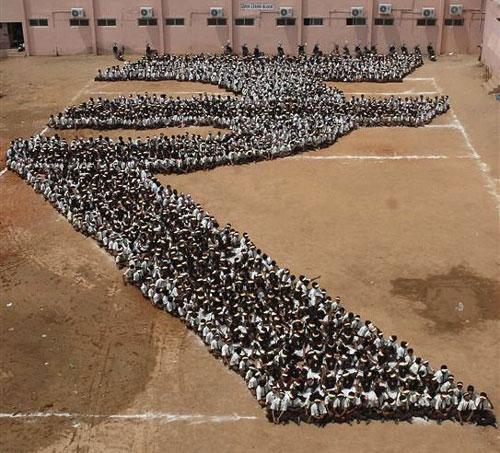

Rupee seen weakening as RBI continues to intervene

The rupee is seen weakening from current levels and government bond yields are seen falling in the near term.

The biggest trigger for the Street will now be the Budget where there will be clarity on the government’s fiscal deficit.

Click NEXT to read more..

Rupee seen weakening as RBI continues to intervene

The rupee ended at 59.39 to the dollar on Tuesday, compared with its previous close of 59.17.

During the day, it traded in the band of 59.09 to 59.43 to the dollar.

The yield on the 10-year benchmark bond ended at 8.60 per cent compared with its previous close of 8.66 per cent.

Click NEXT to read more...

Rupee seen weakening as RBI continues to intervene

Debendra Kumar Dash, associate vice-president (treasury), Development Credit Bank said, "Due to the cut in the SLR limit initially, bond yields rose. But later they fell because of the dovish stance by RBI in the monetary policy.

The yield on the 10-year bond may trade in the range of 8.65 to 8.50 per cent in the near term.

The bias is more towards yields falling. "

Click NEXT to read more....

Rupee seen weakening as RBI continues to intervene

The rupee is seen weakening by the Street, as according to currency dealers, inflows from foreign institutional investors (FIIs) have slowed a tad compared with April-May and nationalised banks continue to buy dollars on behalf of RBI to limit the gains in the rupee.

Click NEXT to read more...

Rupee seen weakening as RBI continues to intervene

Sandeep Gonsalves, forex consultant and dealer, Mecklai & Mecklai said, “The next resistance for the rupee comes at 59.90 and if this level is breached the rupee may touch 60 to a dollar again.

Importers continue to book their near-term exposure, nationalised banks keep mopping up dollars due to which the bias is towards weakening.”