| « Back to article | Print this article |

RIL signals start of growth era

Production from its KG-D6 gas field is set to increase and the government is likely to revise gas prices.

When Reliance Industries Ltd (RIL) says that it will invest $5 billion in its domestic oil and gas discoveries over the next three to four years, it is not only setting a target for itself but is also assuaging investor concerns on falling gas output.

As a part of this exercise, it has drawn up a revised development plan to fix the KG-D6 geological snags.

Going forward, the next 12 months will be crucial for the biggest private sector player in the petroleum business.

For one, it will decide whether this investment is viable or #172 and if its downstream petroleum business that is not much talked about brings more value both on the refining and the retail side.

Since 2010, after the peak of 61.5 million standard cubic metre a day (mmscmd) was reached in March, production from the company's KG-D6 gas field has been falling and is as low as 15 mmscmd now.

Click NEXT to read more...

RIL signals start of growth era

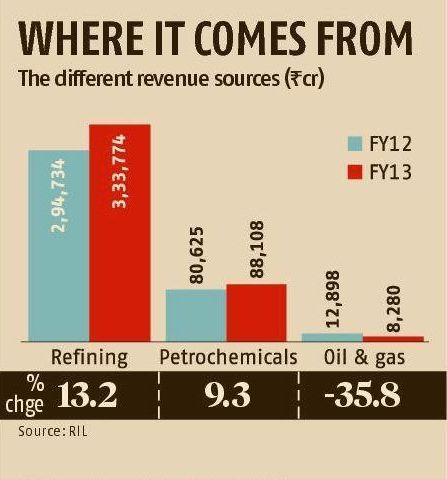

The net result was that oil and gas's contribution to RIL's revenue halved to 2 per cent in 2012-13 in a year's time.

Though contribution of the refining business to its revenue increased sharply to 55 per cent last year from 40 per cent in the previous year, its petrochemicals business fared poorly due to lower profit margin and volumes with its share shrinking from almost 23 per cent to 21 per cent.

Better margins in the refinery business helped the company boost its profitability by about 5 per cent to Rs 21,003 crore (Rs 210 billion), but the market is not cheering.

The scrip was well above Rs 1,000 in 2010, but since last month has been barely able to cross Rs 860.

"It is true that the stock price is not reflecting better gross refining margins and good results, since falling gas output remains a concern, but all concerns appear to be bottoming out," says KK Mittal, head, portfolio management service, Globe Capital.

Click NEXT to read more...

RIL signals start of growth era

Hinging on price

RIL is positive on exploration and production from the perspective of government approvals and policy direction. "It is confident in the (KG-D6) reservoir situation and its ability to implement planned projects," Goldman Sachs said in a recent report.

Though the company itself has no guidance on what the KG-D6 production will be like next year, what probably everyone is watching out for is the revision of gas price.

The government by its own decision has to review the capped price of $4.2 a million British thermal unit from April 2014 onwards.

"We just want market price under the production sharing contract," says an RIL executive who does not want to be named.

Though the company is not enthused by the recommendations of the Rangarajan Committee report that has suggested a complicated formula for pricing all domestic gas for five years instead of a market rate, natural gas price is set to go up even if it is not to the extent of what RIL wants.

Click NEXT to read more...

RIL signals start of growth era

There is also a strong possibility of production from the KG-D6 block increasing since by that time the drilling exercise for MJ1, a recent discovery, would be over. The extent of extractable reserves in the KG-D6 field would be known.

"The KG-D6 workover plans, new drilling plans and exploration would not only stop the decline in domestic gas production but also boost it," the Goldman Sachs report said.

Till last year, based on the production data, the company had admitted to a higher-than-estimated decline in pressure in the D1 and D3 wells of the block and consequently production had fallen.

"Volumes connected to existing wells are lower than envisaged. Gas outside the main channel is in small uneconomic volumes and not participating in production," the company had said in its annual report for 2011-12.

RIL's partner, BP, too had last year in February announced a write-off of $785 million in the net fair value of the "identifiable assets and liabilities" acquired in a $7.2-billion deal with RIL for a 30 per cent stake in 21 oil and gas blocks in India.

Click NEXT to read more...

RIL signals start of growth era

The value of BP's assets and liabilities arising out of its deal with RIL was $4.5 billion at the end of the December 2011 quarter, down from the estimated $5.28 billion in the previous quarter.

Besides falling production from KG-D6, it was the surrender of nine blocks that pulled down the value of the assets.

So, if the MJ1 discovery actually is worth commercial development and production, it could mean RIL can produce higher volumes at a higher price.

On the upstream oil and gas production side, RIL appears more upbeat about its shale gas assets in the US than probably its domestic blocks.

The company has invested $5.7 billion in its three joint ventures there. In fact, at 119 billion cubic feet, the gas production volumes from its US shale business are now more than half of its share of KG-D6 production.

Click NEXT to read more...

RIL signals start of growth era

"A recovery in Henry Hub prices to above $4 a million British thermal unit would mean that the breakeven price for Marcellus shale of about $4 mmbtu would be reached, which would likely help accelerate production," said the Goldman Sachs report.

New areas of growth

Among its downstream businesses, though refining was a source of concern for the company when its gross refining margin (GRM) dipped $6.8 a barrel in thequarter ended December 2011, this segment of its business has largely been out of trouble for some time.

Its GRM for the quarter ended March 2013 was a little over $10. Not surprisingly, the company has drawn up a $12-billion investment in refining and petrochemical business.

The other segment of its petroleum business that may see some action but is not talked about by the company is retailing.

At the peak of its petroleum retail business in 2005-06, RIL commanded a market share of about 15 per cent in diesel sales and 7.3 per cent in petrol with 1,433 outlets across the country; it now has just about 300 outlets operational since they could not compete with government companies who sold the fuels at subsidised rates.

Click NEXT to read more...

RIL signals start of growth era

Through phased decontrol of diesel, the fuel could be completely market priced in a year's time.

This will create an opportunity for the country's second biggest refiner that has 65-million-tonne capacity at Jamnagar in Gujarat whose mainstay has been diesel.

Domestic sales could not only add to its earnings but immune it to some extent from the uncertainty in the overseas market where it is currently selling most of its products.

The company did not respond to a detailed questionnaire but, at the current juncture, challenges for RIL are regulatory, primarily natural gas price revision, and approval of upstream investment plans; and the sword that hangs around its neck in the form of an ongoing statutory audit of the Comptroller and Auditor General of India on the KG-D6 block.

Mittal says till the time there is clarity from the government on these issues and from RIL itself on its investment plans, the company share price will continue to be volatile.

Nonetheless, from here on, the company's petroleum business may just start looking up.