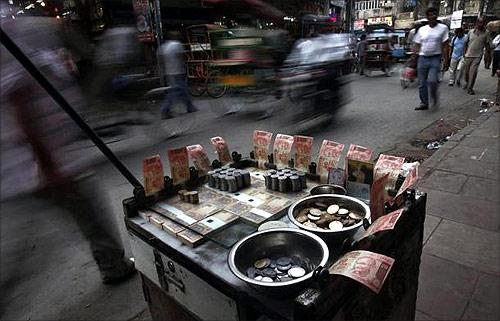

Photographs: Reuters

Falling for the second straight month, retail inflation declined sharply to 9.39 per cent in April due to easing of prices of vegetables, edible oil and protein-based items.

The Consumer Price Index based inflation stood at 10.39 per cent in March.

The prices in the vegetables basket eased to 5.43 per cent in April from 12.16 per cent in March.

Inflation in protein-based items -- egg, meat and fish -- stood at 13.60 per cent during the month.

In oils and fats segment, it was 7.52 per cent.

The overall food and beverages segment saw an inflation of 10.61 per cent in April as against 12.42 per cent in March.

. . .

Retail inflation drops to 9.39%

Photographs: Reuters

Among all the constituents that make the CPI, cereals recorded the highest inflation of 16.65 per cent in April, according to data released on Monday.

Besides, inflation in pulses stood at 10.91 per cent and in sugar it was 10.49 per cent on an annual basis.

The rate of price rise in clothing and footwear segment stood at 10.22 per cent during the month.

In urban areas, retail inflation declined to 9.73 per cent in April from 10.38 per cent in March.

The CPI for rural population fell to 9.16 per cent during the reported month from 10.33 per cent in March.

. . .

Retail inflation drops to 9.39%

Image: Workers fasten iron rods together at the construction site of a bridge on the outskirts of Jammu.Photographs: Mukesh Gupta/Reuters

The CPI stood at 10.91 per cent in February, 2013.

The data for wholesale price index-based inflation is expected on Tuesday.

The March WPI eased to a three-year low of 5.96 per cent, but was still higher than RBI's comfort level.

In order to accelerate economic growth, the Reserve Bank of India earlier this month cut key interest rates by 0.25 per cent.

"Although headline WPI inflation has eased by March, 2013 to come close to the Reserve Bank's tolerance threshold, it is important to note that food price pressures persist and supply constraints are endemic, which could lead to a generalisation of inflation. . .," the RBI had said.

article