After plunging to a new low of 56.38, the rupee on Thursday staged a smart recovery to close at 55.64 against the dollar to snap the three-day string of losses as Reserve Bank of India's intervention saw increased dollar selling by banks amid investors regaining appetite for Indian stocks.

At the Interbank Foreign Exchange (Forex) market, the domestic unit opened lower at 56.14 a dollar from its previous close of 56 and soon logged an all-time low of 56.38 on sustained dollar demand from oil importers.

Soon RBI stepped in helping rupee bounce back and settling for the day at 55.65, a rise of 35 paise or 0.62 per cent.

This marks a turnaround after rupee's 158-paise plunge in the last three sessions weighed down by the deterioration in the Balance of Payments (BoP), mainly trade gap amid muted capital inflows in view of the volatile Eurozone situation.

Forex dealers said the rally in stock markets after yesterday's petrol price hike generated hopes that further economic reforms will get a boost and foreign funds will start returning to India.

"Rupee recovered today due to some selling of dollars by public sector banks with addition of liquidity from the EEFC accounts. Also, hike in petrol price has lifted the sentiment, pushing up the equity market, which in turn has positive impact on the domestic currency," said N S Venkatesh, Head of Treasury, IDBI Bank.

Click on NEXT for more...

Re rebounds from life-time lows; back to 55-level

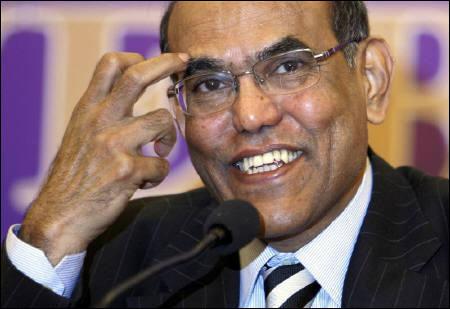

Meanwhile, RBI Governor D Subbarao at Mussoorie today said the central bank will do whatever is necessary to stabilise rupee. "Some structural changes are necessary for improvement in current account. Meanwhile, the RBI is monitoring the situation and we will do whatever is necessary, consistent with our policy," he added.

Forex experts said sentiments also favoured the rupee after the Euro regained after touching multi-month lows after European Union (EU) leaders reportedly decided to honour commitments to their bailout agreement with Greece.

The benchmark Sensex today bounced back by 274.20 points to close at 16,222.30. The dollar index was trading stable with a little bit upward bias against a basket of currencies.

According to Pramit Brahmbhatt, CEO, Alpari Financial Services (India), the rupee's rebound today was supported by a modest rebound in global currencies which have been weakening due to a rising dollar index on risk aversion.

Click on NEXT for more...

Re rebounds from life-time lows; back to 55-level

Experts said the rupee is likely to trade in the 55-55.30 range per dollar tomorrow while it may go back to 54-level in the next seven days.

"Going ahead, rupee is likely to appreciate and may recoup to Rs 54.70-Rs 54.80 in two-three sessions," said Hemant Doshi, Chief Currency Strategist, Geojit Comtrade.

"The rupee is facing a strong resistance at 56.25 levels, after the break out of this levels we can see rupee correcting up to 55.52 levels. The importers could look at the opportunity to cover their un-hedged exposures," said Abhishek Goenka, CEO, India Forex Advisors.

The rupee premium for the forward dollar today finished mixed on alternate bouts of buying and selling.

The benchmark six-month forward dollar premium payable in October eased to 153-155 paise from 155-157 paise previously while far-forward contracts maturing in April also settled up at 286-288 from 283-285 paise.

The RBI fixed the reference rate for the US dollar at 56.2870 and for euro at 70.8160.

The rupee also recovered against the pound sterling to end at 87.28 from 88.06 yesterday and also rebounded to 69.99 per euro against 70.87.

It too rose against the Japanese yen to 70.13 per 100 yen from last close of 70.55.

article