| « Back to article | Print this article |

RBI Guv conducts inflation poll, wins handsomely

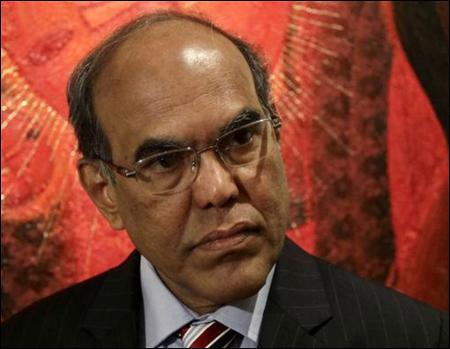

It's not often that Reserve Bank of India Governor D Subbarao personally conducts a poll on the central bank's stance on inflation. That's precisely what he did at a conference in Mumbai on Saturday.

Participating in a panel discussion, moderated by him, Subbarao suddenly turned to the audience and asked them to raise their hands on whether they wanted the RBI to give priority to growth. Only a few hands went up. The next poser was whether they supported the central bank's anti-inflationary stance. An overwhelming majority of the audience, comprising economists and researchers at the Indira Gandhi Institute of Development Research, voted in favour.

The majority votes came at a time when Subbarao had been holding the repo rate in the last four monetary policy reviews. RBI had cut the repo rate by 50 basis points in April to eight per cent. The landslide victory on the issue of inflation perhaps encouraged Subbarao to pose another question to the audience: Is India's capital account position comfortable? The audience voted in the affirmative.

In his observation, former RBI governor Y V Reddy said the country's inflation should be in sync with the global scenario. "In order to integrate the Indian economy with the global economy, the Indian inflation should not be out of alignment with the global inflation and there is a need to revisit the situation in the context of the new normal inflation and the new normal from global inflation perspective which will be definitely higher than the pre-crisis levels."

Subbarao agreed to it and said, "I am not saying that definitively we will change the inflation number, but we will certainly revisit our strategy in the light of what you have said."

According to Reddy, there is a lot of pressure due to inflation targeting and RBI can have a self imposed inflation target which could be reasonably flexible given the circumstances to peg the inflation.

However, another former governor also present at the discussion did not agree to this. "I do not think we should really alter the indicative number very much beyond what we have," said C Rangarajan. According to Rangarajan, the dominant objective of monetary policy is to control inflation and that is somewhat different from being an inflation targetter.

Reddy, however, said the current level of growth is certainly far lower than the potential output, and seven-eight per cent growth is possible.

There have been concerns by economists that the fiscal deficit of the current fiscal may breach the revised target of 5.3 per cent of the GDP. According to Rangarajan, if it exceeds six per cent then it is a cause of damage. "We are talking about an appropriate level of fiscal deficit at 6 per cent of the GDP, both at the Centre and the states taken together, and that is a level of fiscal deficit justified by our domestic savings rate and justifying by the demand from various other sectors. That is why if it exceeds this level, it causes a damage," he said.