Photographs: Reuters.

In line with expectations, the RBI on Tuesday cut its short-term lending rate by 0.25 per cent to spur growth and revive investment but sounded a note of caution on further easing of rates on account of high food inflation and current account deficit.

"The foremost challenge for returning the economy to a high growth trajectory is to revive investment. A competitive interest rate is necessary for this but not sufficient," the Reserve Bank said in its mid-quarter review of the monetary policy.

Accordingly, its short term lending rate or the repo was reduced by 0.25 per cent to 7.5 per cent, making it the second consecutive cut in as many months.

The market was widely expecting a cut by 0.25 per cent due to the deteriorating growth which is estimated to touch a decade low of 5 per cent and a cooling in the core inflation to a 35 month low.

...

RBI cuts repo rate, loans may get cheaper

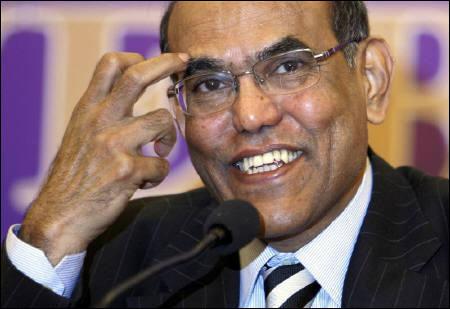

Image: RBI governor Subbarao.Photographs: Reuters.

He, however said "...even as the policy stance emphasizes addressing the growth risks, the headroom for further monetary easing remains quite limited."

Expecting the government to begin spending, it left the cash reserve ratio or the amount of deposits banks have to park with RBI, unchanged at 4 per cent.

The BSE Sensex, which started sliding after the policy announcement, fell sharply by almost 300 points after a coalition partner DMK pulled out of the UPA alliance.

The RBI, however stressed that a interest rate cut alone will not be helpful in order to achieve the objective of reviving investment and called for bridging supply constraints and staying course on fiscal consolidation.

On its guidance, the statement was cautious on further easing and pointed towards the rising current account deficit-which is widely expected to touch a record high at 5 per cent and the expectation of inflation staying range-bound due to fuel price revisions and rising MSPs for agri produce, as the inhibiting factors.

...

RBI cuts repo rate, loans may get cheaper

Photographs: Reuters.

"The government has a critical role to play in this regard by remaining committed to fiscal consolidation, easing the supply bottlenecks and improving governance surrounding project implementation," RBI said, acknowledging the "firm commitment" to fiscal consolidation made in the budget.

"Elevated food prices, including pressures stemming from MSP increase and the wedge between wholesale and retail inflation (which rose to 10.9 per cent in February) have adverse implications for inflation expectations," it said.

Commenting on RBI policy action, Planning Commission Deputy Chairman Montek Singh Ahluwalia said "this policy gives signal in the right direction."

...

RBI cuts repo rate, loans may get cheaper

Photographs: Reuters.

On the CAD, the RBI said the risk remains significant notwithstanding the likely improvement in fourth quarter and added, "financing of the CAD with stable flows remains a challenge".

On liquidity management, which was mentioned by Finance Minister P Chidambaram yesterday, the RBI said it will continue using all instruments including government bond buybacks to inject liquidity.

RBI retains the growth and inflation forecast at 5.5 per cent and 6.8 per cent respectively for the current fiscal.

...

article