| « Back to article | Print this article |

Of social enterprise & how banks create a food crisis

Last week's Sankalp Forum in Mumbai yet again celebrated social entrepreneurs and offered a platform for addressing their concerns. But while such activities gather momentum many dark questions about the role of capital tend to remain in the shadows.

Even a brief glance at the finalists in the Sankalp awards is enough to cheer all those who long to see more inclusive growth.

And yet such enterprises cannot fulfill their promise if larger trends continue to make life harder for the poor and the middle-classes.

The April 27th issue of Foreign Policy, the New York-based journal, carried an article which documents how instruments created by Wall Street are largely responsible for food inflation across the world.

How Goldman Sachs Created the Food Crisis by Frederick Kaufman concludes that food derivative markets have reached such supranational proportions that they are beyond the reach of sovereign law.

Click NEXT to read on . . .

Of social enterprise & how banks create a food crisis

Even more significantly, no solutions are visible on the horizon. Thus the future looks grim as 'the index funds continue to prosper, the bankers pocket the profits, and the world's poor teeter on the brink of starvation.'

At the other end of the spectrum, hugging the ground, are enterprises like StarAgri, KNIDS Green, E-Healthpoint Services and others.

StarAgri, a five-year-old company, aims to provide sustainable solutions for the crop marketing problems of Indian farmers.

Operating out of Jaipur the company enables farmers to be more efficient and profitable by providing integrated post-harvest management solutions -- such as warehousing, risk management, retailing.

KNIDS Green aims to provide direct links between vegetable farmers and street vendors. At the one end of its chain are resource poor vegetable growers and farm labourers. At the other end are urban vendors. The company creates mechanisms that benefit both ends.

Click NEXT to read on . . .

Of social enterprise & how banks create a food crisis

E-Healthpoint Services provides families in rural villages with clean drinking water, medicines, comprehensive diagnostic tools and advanced tele-medical services.

Waterlife aims to provide high quality safe drinking water at affordable prices to those who are currently not able to access this basic need of life.

Native Konbac Bamboo Products is reviving the use of bamboo for luxury furniture.

FINO works among 28 million people -- 25 per cent of India's Below Poverty Line (BPL) population. It enables financial inclusion by facilitating linkage between banks, microfinance institutions, government entities, insurance companies and un-served people through a nationwide network of 'bandhus' (agents) who go to the door step of BPL households.

Sankalp, where many of these enterprises were honoured, is an annual event organised by Intellecap, a consultancy firm in the sphere of social enterprises.

Click NEXT to read on . . .

Of social enterprise & how banks create a food crisis

Panel discussions at Sankalp tend to be focused on the functional challenges facing such enterprises -- such as the shortage of impact investors and the interface between social enterprise and government.

The underlying assumption is that innovative business models can draw global capital into meeting needs of the population below poverty line or hovering on its edge.

The non-profit model of NGOs is largely dismissed as being incapable of up-scaling to meet the needs of hundreds of millions.

While greed tends to be denounced by many speakers there is little or no challenge to the power of capital.

For instance, in the closing panel discussion at Sankalp a young woman in the audience asked former RBI Deputy Governor Usha Thorat to respond to Grameen Bank founder Mohammed Yunus' suggestion that capital can and should support enterprise on a no-profit no-loss basis. Thorat disagreed. Capital has to make a return.

Click NEXT to read on . . .

Of social enterprise & how banks create a food crisis

Indeed that is the assumption on which the global economy currently runs. And yet the logic of this assumption leads directly to a scenario that is now leading to food inflation that is unrelated to actual supply and demand.

Yes, there has been some increase in demand for food in some parts of the world and oil prices have played some role in price rise.

But these factors are over-shadowed by the impact of certain kinds of trading in basic commodities by those who never actually take delivery of the goods.

"Today, bankers and traders sit at the top of the food chain -- the carnivores of the system, devouring everyone and everything below," writes Kaufman.

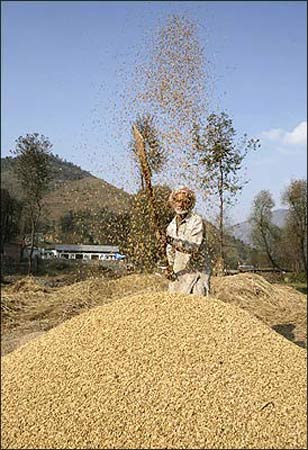

"Near the bottom toils the farmer. For him, the rising price of grain should have been a windfall, but speculation has also created spikes in everything the farmer must buy to grow his grain -- from seed to fertilizer to diesel fuel. At the very bottom lies the consumer."

At present analysis like this tends to remain in a separate domain from the realm where there is an upbeat excitement about the power of social enterprises to change millions of lives for the better.

That excitement is not without some basis. But for it to fulfill its promise the votaries of social enterprise will have to also reckon with the fundamental distortions being created by how the power of global capital flows.