| « Back to article | Print this article |

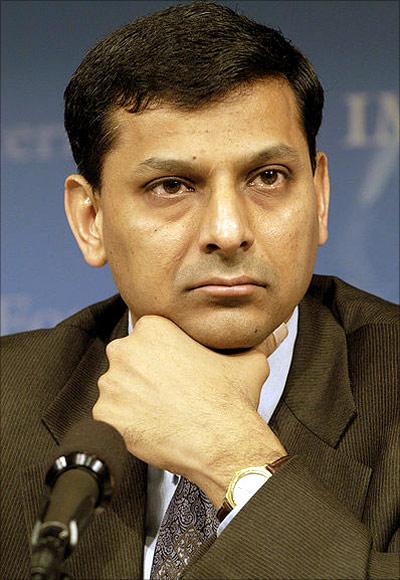

Rajan's mantra for stable and sustainable growth

“My remarks are motivated by the desire for a more stable international system, a system that works equally for rich and poor, large and small, and not the specifics of our situation,” said Raghuram G Rajan, Governor, Reserve Bank of India said at the Brookings Institution on April 10, 2014.

Here’s the speech he delivered at the Brookings Institution.

Good morning. As the world seems to be struggling back to its feet after the great financial crisis, I want to draw attention to an area we need to be concerned about: the conduct of monetary policy in this integrated world.

A good way to describe the current environment is one of extreme monetary easing through unconventional policies.

In a world where debt overhangs and the need for structural change constrain domestic demand, a sizeable portion of the effects of such policies spillover across borders, sometimes through a weaker exchange rate. More worryingly, it prompts a reaction.

Such competitive easing occurs both simultaneously and sequentially, as I will argue, and both advanced economies and emerging economies engage in it.

Aggregate world demand may be weaker and more distorted than it should be, and financial risks higher. To ensure stable and sustainable growth, the international rules of the game need to be revisited. Both advanced economies and emerging economies need to adapt, else I fear we are about to embark on the next leg of a wearisome cycle.

Central bankers are usually reluctant to air their concerns in public. But because the needed change has political elements to it, I take my cue from speeches by two central bankers whom I respect greatly, Ben Bernanke in his 2005 “Global Savings Glut” speech, and Jaime Caruana in his 2012 speech at Jackson Hole, both of whom have raised similar concerns to mine, although from different perspectives.

Before starting, I should disclose my interests in this era of transparency. For the last few months India has experienced large inflows of capital, not outflows, and is seen by the markets as an emerging economy that has made some of the necessary policy adjustments.

We are well buffered with substantial reserves, though no country can be de-coupled from the international system. My remarks are motivated by the desire for a more stable international system, a system that works equally for rich and poor, large and small, and not the specifics of our situation.

Click NEXT to read more...

Rajan's mantra for stable and sustainable growth

Unconventional Policy

I want to focus on unconventional monetary policies (UMP), by which I mean both policies that hold interest rates at near zero for long, as well as balance sheet policies such as quantitative easing or exchange intervention, that involve altering central bank balance sheets in order to affect certain market prices.

The key point that I will emphasize throughout this talk is that quantitative easing and sustained exchange intervention are in an economic equivalence class, though the channels they work through may be somewhat different. Our attitudes towards them should be conditioned by the size of their spillover effects rather than by any innate legitimacy of either form of intervention.

Let me also add there is a role for unconventional policies – when markets are broken or grossly dysfunctional, central bankers do have to think innovatively.

Fortunately for the world, much of what they did immediately after the fall of Lehman was exactly right, though they were making it up as they went in the face of extreme uncertainty.

They eased access to liquidity through innovative programs such as TALF, TAF, TARP, SMP, and LTRO. By lending long term without asking too many questions of the collateral they received, by buying assets beyond usual limits, and by focusing on repairing markets, they restored liquidity to a world financial system that would otherwise have been insolvent based on prevailing market asset prices. In this matter, central bankers are deservedly heroes.

The key question is what happens when these policies are prolonged long beyond repairing markets – and there the benefits are much less clear.

Let me list 4 concerns:

Is unconventional monetary policy the right tool once the immediate crisis is over?

Does it distort behavior and activity so as to stand in the way of recovery? Is accommodative monetary policy the way to fix a crisis that was partly caused by excessively lax policy?

Do such policies buy time or does the belief that the central bank is taking responsibility prevent other, more appropriate, policies from being implemented? Put differently, when central bankers say, however reluctantly, that they are the only game in town, do they become the only game in town?

Will exit from unconventional policies be easy?

What are the spillovers from such policies to other countries?

Since I have dwelt at length on the first two concerns in an earlier speech, let me focus on the last two.

Exit

The macroeconomic argument for prolonged unconventional policy in industrial countries is that it has low costs, provided inflation stays quiescent. Hence it is worth pursuing, even if the benefits are uncertain.

A number of economists have, however, raised concerns about financial sector risks that may build with prolonged use of unconventional policy.

Asset prices may not just revert to earlier levels on exit, but they may overshoot on the downside, and exit can cause significant collateral damage.

One reason is that leverage may increase both in the financial sector and amongst borrowers as policy stays accommodative.

One channel seems to be that a boost to asset liquidity leads lenders to believe that asset sales will backstop loan recovery, leading them to increase loan to value ratios. When liquidity tightens, though, too many lenders rely on asset sales, causing asset prices and loan recovery to plummet.

Because lenders do not account for the effects of their lending on the “fire sale” price, and subsequently on lending by others, they may have an excessive incentive to build leverage.8 These effects are exacerbated if, over time, lenders become reliant on asset sales for recovery, rather than on upfront project evaluation and due diligence.

Another possible channel is that banks themselves become more levered, or equivalently, acquire more illiquid balance sheets, if the central bank signals it will intervene in a sustained way when times are tough because unemployment is high.

Leverage need not be the sole reason why exit may be volatile after prolonged unconventional policy. Investment managers may fear underperforming relative to others. This means they will hold a risky asset only if it promises a risk premium (over safe assets) that makes them confident they will not underperform holding it.

A lower path of expected returns on the safe asset makes it easier for the risky asset to meet the required risk premium, and indeed draws more investment managers to buy it – the more credible the forward guidance on “low for long”, the more the risk taking.

However, as investment managers crowd into the risky asset, the risky asset is more finely priced so that the likelihood of possible fire sales increases if the interest rate environment turns. Every manager dumps the risky asset at that point in order to avoid being the last one holding it.

Leverage and investor crowding may therefore exacerbate the consequences of exit. When monetary policy is ultra-accommodative, prudential regulation, either of the macro or micro kind, is probably not a sufficient defence.

In part, this is because, as Fed Governor Stein so succinctly put it, monetary policy “gets into every crack”, including the unregulated part of the financial system. In part, ultra accommodative monetary policy creates enormously powerful incentive distortions whose consequences are typically understood only after the fact. The consequences of exit, however, are not just felt domestically, they could be experienced internationally.

Click NEXT to read more...

Rajan's mantra for stable and sustainable growth

Spillovers

Perhaps most vulnerable to the increased risk-taking in this integrated world are countries across the border.

When monetary policy in large countries is extremely and unconventionally accommodative, capital flows into recipient countries tend to increase local leverage; this is not just due to the direct effect of cross-border banking flows but also the indirect effect, as the appreciating exchange rate and rising asset prices, especially of real estate, make it seem that borrowers have more equity than they really have.

Exchange rate flexibility in recipient countries in these circumstances sometimes exacerbates booms rather than equilibrates. Indeed, in the recent episode of emerging market volatility after the Fed started discussing taper in May 2013, countries that allowed the real exchange rate to appreciate the most during the prior period of quantitative easing suffered the greatest adverse impact to financial conditions.

Countries that undertake textbook policies of financial sector liberalization are not immune to the inflows – indeed, their deeper markets may draw more flows in, and these liquid markets may be where selling takes place when conditions in advanced economies turn.

Macro-prudential measures have little traction against the deluge of inflows – Spain had a housing boom despite its countercyclical provisioning. Recipient countries should adjust, of course, but credit and flows mask the magnitude and timing of needed adjustment.

For instance, higher collections from property taxes on new houses, sales taxes on new sales, capital gains taxes on financial asset sales, and income taxes on a more prosperous financial sector may suggest a country’s fiscal house is in order, even while low risk premia on sovereign debt add to the sense of calm. At the same time, an appreciating nominal exchange rate may also keep down inflation.

The difficulty of distinguishing the cyclical from the structural is exacerbated in some emerging markets where policy commitment is weaker, and the willingness to succumb to the siren calls of populist policy greater.

But it would be a mistake to think that pro-cyclical policy in the face of capital inflows is primarily a disease of the poor; Even rich recipient countries with strong institutions, such as Ireland and Spain, have not been immune to capital-flow-induced fragility.

Ideally, recipient countries would wish for stable capital inflows, and not flows pushed in by unconventional policy. Once unconventional policies are in place, however, they do recognize the problems stemming from prolonged easy money, and thus the need for source countries to exit.

But when source countries move to exit unconventional policies, some recipient countries are leveraged, imbalanced, and vulnerable to capital outflows. Given that investment managers anticipate the consequences of the future policy path, even a measured pace of exit may cause severe market turbulence and collateral damage.

Indeed, the more transparent and well-communicated the exit is, the more certain the foreign investment managers may be of changed conditions, and the more rapid their exit from risky positions.

Recipient countries are not being irrational when they protest both the initiation of unconventional policy as well as an exit whose pace is driven solely by conditions in the source country.

Having become more vulnerable because of leverage and crowding, recipient countries may call for an exit whose pace and timing is responsive, at least in part, to conditions they face.

Click NEXT to read more...

Rajan's mantra for stable and sustainable growth

The Case for International Monetary Policy Coordination

Hence, my call is for more coordination in monetary policy because I think it would be an immense improvement over the current international non-system. International monetary policy coordination, of course, is unpopular among central bankers, and I therefore have to say why I reiterate the call and what I mean by it.

I do not mean that central bankers sit around a table and make policy collectively, nor do I mean that they call each other regularly and coordinate actions.

In its strong form, I propose that large country central banks, both in advanced countries and emerging markets, internalize more of the spillovers from their policies in their mandate, and are forced by new conventions on the “rules of the game” to avoid unconventional policies with large adverse spillovers and questionable domestic benefits.

Given the difficulties of operationalising the strong form, I suggest that, at the very least, central banks reinterpret their domestic mandate to take into account other country reactions over time (and not just the immediate feedback effects), and thus become more sensitive to spillovers.

This weak “coordination” could be supplemented with a re-examination of global safety nets.

Click NEXT to read more...

Rajan's mantra for stable and sustainable growth

The gains from coordination

Economists generally converged on the view that the gains to policy coordination were small provided each country optimized its own policies keeping in mind the policies of others.

The “Nash equilibrium” was not that far from the global optimum, hence the “own house in order” doctrine was dominant in the international monetary field. National macroeconomic stability was seen as sufficient for international macroeconomic stability. The domestic and international aspects were essentially regarded as two sides of the same coin.

Two factors have led to a rethinking of the doctrine. First, domestic constraints including political imperatives of bringing unemployment down and the economic constraint of the zero lower bound may lead monetary policy to be set at levels different from the unconstrained domestic optimal.

Dysfunctional domestic politics could also contribute in moving monetary policy further from the unconstrained optimal. In other words, the central bank, responding to a variety of political pressures and weaknesses, may stray away from even the constrained optimal – towards third best policies rather than second best policies.

Second, cross-border capital flows can lead to a more dramatic transmission of policies, driven by agency (and other) considerations that do not necessarily relate to economic conditions in the recipient countries.

One argument along these lines is that if some large country adopts unconventional and highly accommodative sub optimal policies, other countries may follow suit to avoid exchange rate appreciation in a world with weak demand.

As a result, the policy equilibrium may establish at rates that are too low compared to that warranted by the global optimal. Another argument is that when the sending country is at the zero lower bound, and the receiving country responds to capital inflows with aggressive reserve accumulation, both may be better off with more moderate policies.

Indeed, it may well be that coordination may allow policy makers political room to move away from sub optimal policies. If political paralysis and consequent fiscal tightening forces a source country to a sub-optimal reliance on monetary stimulus, policy coordination that allows for expanded demand elsewhere could allow the source country to cut back on its dependence on monetary stimulus.

Click NEXT to read more...

Rajan's mantra for stable and sustainable growth

Domestic Optimal is close to the Global Optimal

Despite these arguments, official statements by multilateral institutions such as the IMF continue to endorse unconventional monetary policies while downplaying the adverse spillover effects to other countries.

Indeed, in an excellent analysis of the obstacles to international policy coordination, the IMF’s own Jonathan Ostry and Atish Ghosh argue that “impartial” international policy assessments by multilateral entities could be suspected of bias.

“…if there were a systematic tendency of the assessor to identify a change in policy (tighter fiscal policy; looser monetary policy; structural reform) as always yielding welfare gains at the national and global levels. This would breed suspicion because the base case should be that countries do not fail to exploit available welfare gains…it is implausible that welfare gains at the national and global levels should always be positively correlated…”

By downplaying the adverse effects of cross-border monetary transmission of unconventional policies, we are overlooking the elephant in the post-crisis room. I see two dangers here. One is that any remaining rules of the game are breaking down.

Our collective endorsement of unconventional monetary policies essentially says it is ok to distort asset prices if there are other domestic constraints to reviving growth, such as the zero-lower bound. But net spillovers, rather than fancy acronyms, should determine internationally acceptable policy.

Otherwise, countries could legitimately practice what they might call quantitative external easing or QEE, whereby they intervene to keep their exchange rate down and build huge reserves. The reason we frowned on QEE in the past is because we believed the adverse spillover effects for the rest of the world were significant.

If we are unwilling, however, to evaluate all policies based on their spillover effects, there is no legitimate way multilateral institutions can declare that QEE contravenes the rules of the game. Indeed, some advanced economy central bankers have privately expressed their worry to me that QE “works” primarily by altering exchange rates, which makes it different from QEE only in degree rather than in kind.

The second danger is a mismanaged exit will prompt fresh distortionary behaviour. Even as source country central banks go to great pains to communicate how their removal of accommodation will be contingent on domestic activity, they have been silent on how they will respond to foreign turmoil.

Market participants conclude that recipient countries, especially those that do not belong to large reserve currency blocks, are on their own, and crowd devastatingly through the exit.

Indeed, the lesson some emerging markets will take away from the recent episode of turmoil is (i) don’t expand domestic demand and run large deficits (ii) maintain a competitive exchange rate (iii) build large reserves, because when trouble comes, you are on your own. In a world with deficient aggregate demand, is this the message the international community wants to send?

For this is not the first episode in which capital has been pushed first in one direction and then in another, each time with devastating effect. In the early 1990s, rates were held low in the United States, and capital flowed to emerging markets.

The wave of emerging market crises starting with Mexico in 1994 and ending with Argentina in 2001, sweeping through East Asia and Russia in between, was partially caused by a reversal of these flows as interest rates rose in industrial countries.

The subsequent reserve build up in emerging markets, including China, contributed to weak global demand and excess spending by some industrial countries, culminating in the global financial crisis of 2007-09. Once again, though, post-crisis unconventional monetary policy has pushed capital to emerging markets, with the associated build up in fragility. Are we setting the stage for a resumption of the “global savings glut” as emerging markets build reserves once again?

Two obvious remedies suggest themselves; Less extreme monetary policies on all sides with some thought given to adverse spillover effects when setting policy, and better global safety nets to mitigate the need for countries to self-insure through reserve buffers.

Click NEXT to read more...

Rajan's mantra for stable and sustainable growth

More Moderate Policy

Even though we live in a world where monetary transmission is global, policy focus is local. Central banks mount a number of defences as to why they should not take full account of spillovers.

One way to demonstrate the weaknesses in the usual arguments that are put forward to defend the status quo is to see how they would sound if they were used to defend QEE, that is, sustained intervention in the exchange market to keep the exchange rate competitive.

Defense 1: We are a developing country and we are mandated to support growth. Institutional constraints in enhancing productivity, and our vulnerability to sudden stops, means that a competitive exchange rate, and thus QEE, is essential to fulfilling our mandate.22

Defense 2: Would the world not be better off if we grew strongly? QEE is essential to our growth.

Defense 3: We take into account feedback effects to our economy from the rest of the world while setting policy. Therefore, we are not oblivious to the consequences of QEE on other countries.

Defense 4: Monetary policy with a domestic focus is already very complicated and hard to communicate. It would be impossibly complex if we were additionally burdened with having to think about the effects of QEE on other countries.

There are many problems with these defenses that those who have complained about currency manipulation will recognize. Currency manipulation may help growth in the short run (even this is debatable), but creates long-run distortions that hurts the manipulating country.

There are more sensible policies to foster growth. And even if a central bank has a purely domestic mandate, the country’s international responsibilities do not allow it to arbitrarily impose costs on the rest of the world. The net spillover effects need to be estimated, and it cannot be taken for granted that the positive spillovers from the initiating country’s growth (say through greater trade) more than offset the adverse spillovers to other countries.

Feedback effects to the source country represent only a small part of the spillover effects experienced by the world, and a central bank will be far from implementing the globally optimal policy if it is solely domestically-oriented, even if it takes these feedback effects into account.

Countries are required to pay attention to the effects of their policies on others, no matter how much the added complication, because we all have international responsibilities.

Of course, the reader will recognize that each one of these arguments has been made defending unconventional monetary policy. Yet multilateral institutions treat sustained currency intervention with great opprobrium while giving unconventional monetary policy a clean chit.

Should the cleanliness of the chit not depend on the size of the net spillovers and the competitive response it engenders? Without estimating them carefully, how can we tell?

Click NEXT to read more...

Rajan's mantra for stable and sustainable growth

Operationalising Coordination: Some Suggestions

We need to break away from this cycle of unconventional policies and competitive monetary easing. Already, the events of recent months have set the stage for renewed reserve accumulation by the emerging markets.

And this time, it will be harder for advanced economies to complain if they downplay their own spillover effects while they are pushing for recovery.

An Independent Assessor

In an ideal world, unconventional monetary policies such as QE or QEE should be vetted by an independent assessor for their spillover effects.

The assessment procedure is easy to visualize; Perhaps following a complaint by an impacted country (as in the WTO), the independent assessor could analyse the effects of such policies and come to a judgment on whether they follow the rules of the game.

Policies where the benefits are largely domestic, while the costs fall largely abroad, would be especially carefully scrutinized. And if the assessor deems the policy reduces global welfare, international pressure should be applied to stop such policies.

The problems with such an idealistic process are easy to see. Where is such an impartial assessor to be found? The staff at multilateral institutions is excellent, and well capable of independent judgment. But political pressure subsequent to the initial assessment operates unevenly.

Initial assessments typically remain unaltered when a small country complains (no country likes independent assessments), but are often toned down when a large economy protests. There are many exceptions to this, but more work is needed to build trust in the impartiality of assessments of multilateral institutions.

Even if multilateral organizations become immune to power politics, they are not immune to cognitive capture. Their staff has been persuaded by the same models and frameworks as the staff of industrial country central banks – models where monetary policy is an extremely powerful tool to elevate activity, and exchange rate flexibility does wonders in insulating countries from the most debilitating spillovers.

“Decoupling” is always possible in such models, even though the evidence is that the models typically underestimate the extent of “coupling”. Indeed, many of these models do not have realistic models of credit, or of monetary transmission in an economy with debt overhang, which reduces their value considerably. Progress is being made but it will take time.

And, of course, even if a truly independent assessment came to the conclusion that certain policies were in violation, how would such a judgment be enforced?

The reality is that the rules of the game were framed in a different era to deter competitive devaluations and currency manipulation. They have not been updated for today’s world of more varied competitive easing. But it is unclear that even if they were updated, they could be assessed and enforced in the current environment.

Click NEXT to read more...

Rajan's mantra for stable and sustainable growth

A More Modest Proposal

Perhaps then, it would be better to settle for a more modest proposal. Central banks should assess spillover effects from their own actions, not just in terms of immediate feedback, but also in terms of medium term feedback as other countries alter their policies.

In other words, the source country should not just worry about the immediate flows of capital to other countries from its policies, but the longer run reaction such as sustained exchange intervention that this would bring about. This would allow central banks to pay more attention to spillovers even while staying within their domestic mandate.

For example, this would mean that while exiting from unconventional policies, central banks would pay attention to conditions in emerging markets also while deciding the timing of moves, while keeping the overall direction of moves tied to domestic conditions.

Their policy statements should acknowledge such concerns. To be concrete in a specific case, the Fed postponing tapering in September 2013 allowed emerging economies more time to adjust after the initial warning in May 2013. Whatever the underlying rationale for postponement, it helped tapering start smoothly in December 2013, without disrupting markets.

In contrast, with volatility hitting emerging markets after the Argentinian problems in January 2014, the Fed policy statement in January 2014, with no mention of concern about the emerging market situation, and with no indication Fed policy would be sensitive to conditions in those markets in the future, sent the probably unintended message that those markets were on their own.

Speeches by Regional Fed Presidents emphasizing the Fed’s domestic mandate did not help. Since then, Fed communication has been more nuanced, though the real challenge in communication lies ahead when policy rates have to move up

Click NEXT to read more...

Rajan's mantra for stable and sustainable growth

International Safety Nets

Emerging economies have to work to reduce vulnerabilities in their economies, to get to the point where, like Australia, they can allow exchange rate flexibility to do much of the adjustment for them to capital inflows. But the needed institutions take time to develop.

In the meantime, the difficulty for emerging markets in absorbing large amounts of capital quickly and in a stable way should be seen as a constraint, much like the zero lower bound, rather than something that can be altered quickly. Even while resisting the temptation of absorbing flows, they will look to safety nets.

So another way to prevent a repeat of substantial reserve accumulation is to build stronger international safety nets.

As the financial crisis suggested, this is not just an emerging economy concern. In a world where international liquidity can dry up quickly, the world needs bilateral, regional, and multilateral arrangements for liquidity.

Multilateral arrangements are tried and tested, and are available more widely, and without some of the possible political pressures that could arise from bilateral and regional arrangements.

Indeed swap arrangements can be channelled through multilateral institutions like the IMF instead of being conducted on a bilateral basis, so that the multilateral institution bears any (small) credit risk, and the source central bank does not have to justify the arrangements to its political authorities.

Perhaps equally valuable would be a liquidity line from the IMF, where countries are pre-qualified by the IMF and told (perhaps privately) how much of a line they would qualify for under current policy – with access limits revised every Article IV and any curtailment becoming effective 6 months later.

Access to the line would get activated by the IMF Board in a situation of generalized liquidity shortage (as, for example, when policy tightening in source countries after an extended period of low rates causes investment managers to become risk averse).

The IMF has suggested such arrangements in a discussion paper, and they should be explored because they allow countries access to liquidity without the stigma of approaching the Fund, and without the conditionality that accompanies most Fund arrangements.

Clearly, the Fund’s resources will be safe only if the situation is one of genuine temporary illiquidity rather than one where countries need significant reforms to regain market access. Equally clearly, access will vary across countries, and prolonged use after the liquidity emergency is declared over will necessitate an IMF program.

Nevertheless, the twin proposals of the Global Stability Mechanism and Short-term Liquidity Line that the IMF Board has examined in the past deserve close examination for they come closest to genuinely helping offset reserve build-up.

Finally, it would be a useful exercise for the Fund, in a period of growing vulnerability to capital flow reversals, to identify those countries that do not have own, bilateral, regional, or multilateral liquidity arrangements to fall back on, and to work to improve their access to some safety net.

The role of honest ex-ante marriage broker may be one that could prove to be immensely important when the interest rate environment changes.

Conclusion

The current non-system in international monetary policy is, in my view, a source of substantial risk, both to sustainable growth as well as to the financial sector.

It is not an industrial country problem, nor an emerging market problem, it is a problem of collective action. We are being pushed towards competitive monetary easing.

If I use terminology reminiscent of the Depression era non-system, it is because I fear that in a world with weak aggregate demand, we may be engaged in a futile competition for a greater share of it.

In the process, unlike Depression-era policies, we are also creating financial sector and cross-border risks that exhibit themselves when unconventional policies come to an end.

There is no use saying that everyone should have anticipated the consequences. As the former BIS General Manager Andrew Crockett put it, “financial intermediaries are better at assessing relative risks at a point in time, than projecting the evolution of risk over the financial cycle.”

A first step to prescribing the right medicine is to recognize the cause of the sickness. Extreme monetary easing, in my view, is more cause than medicine. The sooner we recognize that, the more sustainable world growth we will have.