| « Back to article | Print this article |

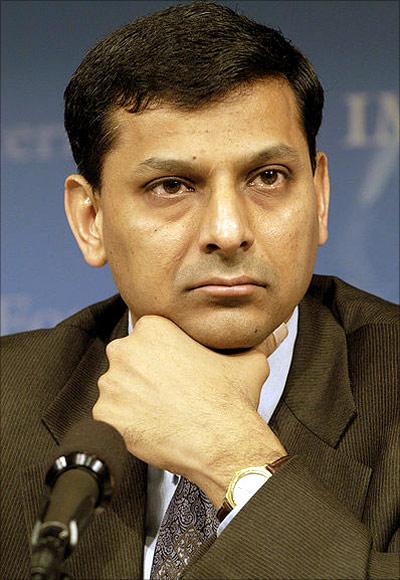

Raghuram Rajan will be the next RBI governor

India named Raghuram Rajan, a prominent former International Monetary Fund chief economist who in 2005 predicted the global financial crisis, to lead the Reserve Bank of India (RBI) as the country struggles to defend a rupee that hit a record low on Tuesday.

Rajan, 50, will take over from Duvvuri Subbarao, whose turbulent five-year tenure ends on Sept 4, amid a darkening outlook for Asia's third-largest economy.

In terms of monetary policy, Rajan is seen to be a pragmatist whose views on inflation are roughly in line with those of Subbarao, who fought an uphill battle against price pressures for much of his term in an economy plagued by supply-side bottlenecks.

"He has the intellectual pedigree and policy experience but my worry is people will think a smart guy coming in will fix all of India's problems," said Bhanu Baweja, head of emerging markets strategy at UBS in London.

Click NEXT to read more...

Raghuram Rajan will be the next RBI governor

"The problem in India is political consensus and execution. By itself the appointment doesn't change my view on the market, I am underweight the rupee and Indian equities," Baweja said.

In a March interview with Reuters, Rajan said he believed inflation of around 5 percent in a developing economy is "reasonable", putting him on the same page as Subbarao, who has set 5 percent as medium-term goal and 3 percent as a long-term target.

Rajan also favours formation of a monetary policy committee, as opposed to the current autocratic powers enjoyed by the governor, a set-up that would bring the RBI more in line with the practice at major central banks elsewhere.

Click NEXT to read more...

Raghuram Rajan will be the next RBI governor

"He is a highly credible, experienced economist. He has no central banking background so it will be a steep learning curve," said Robert Prior-Wandesforde, economist at Credit Suisse in Singapore.

"The jury is out on his monetary policy views. My assumption is he will be pragmatic. Hopefully he will be a safe pair of hands," he said.

Rajan was appointed to a three-year term. Subbarao was also initially appointed for three years, and his tenure was then extended by two years.

The rupee is down about 11 percent in 2013, making it the worst performer in Asia, and emergency steps by the RBI on July to drain liquidity and raise short-term interest rates have failed to halt its decline.

Click NEXT to read more...

Raghuram Rajan will be the next RBI governor

The currency fell to a record low of 61.80 to the dollar earlier on Wednesday. Meanwhile, economists have been cutting back their growth forecasts for an economy that expanded by just 5 percent in the last fiscal year, its weakest in a decade.

While Rajan had been considered the most likely candidate to be the next Reserve Bank of India governor when he returned to India last year to accept the top advisory post at the Finance Ministry in New Delhi, some in government had said his relative outsider status might count against him.

(Additional reporting by Rajesh Kumar Singh, Sujata Rao-Coverley, and Subhadip Sircar; Editing by John Chalmers)