| « Back to article | Print this article |

Question of change or continuity hovers over RBI

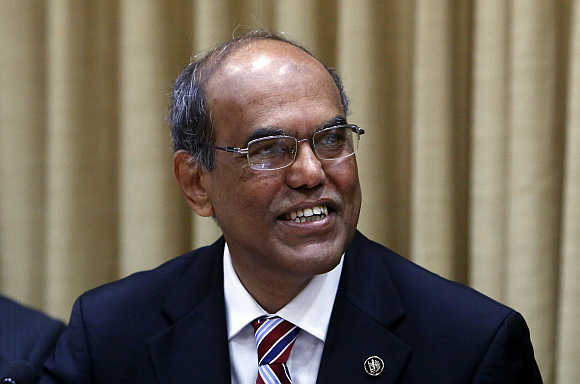

The identity of India's next central bank chief remains a matter of speculation even as Reserve Bank of India Governor Duvvuri Subbarao scrambles to support an embattled rupee with less than seven weeks to go before he is due to leave office.

An extension of Subbarao's tenure, once unlikely, has become a possibility as the rupee reels from a selldown of emerging markets that has hit India especially hard because of its high current account deficit.

Click NEXT to read more...

Question of change or continuity hovers over RBI

Other leading candidates are Raghuram Rajan, India's chief economic advisor, who made his name by predicting the global financial crisis; and Economic Affairs Secretary Arvind Mayaram, a career civil servant and key lieutenant to Finance Minister P Chidambaram.

Saumitra Chaudhuri, 59, a member of Prime Minister Manmohan Singh's influential Planning Commission, has also been cited by government sources and media as a contender.

Click NEXT to read more...

Question of change or continuity hovers over RBI

Speaking in Moscow on Saturday, Subbarao told Reuters that he had not so far been asked to stay on. "No offer has been made so far, so there is no question of accepting so far. It is a hypothetical question. As I said before, I must move on," Subbarao said on the sidelines of a meeting of the world's financial leaders.

Whoever gets the nod inherits an economy growing at its slowest in a decade, and saddled with a record high current account deficit which has raised fears that the balance of payments could worsen. Down nearly 10 per cent against the dollar since the start of May, the rupee recently hit a record low.

Click NEXT to read more...

Question of change or continuity hovers over RBI

To make matters worse, Prime Minister Singh's weak coalition is heading for elections due by May next year, making it harder to push through unpopular reforms that could take some pressure off the current account by attracting more foreign investment.

Left fighting a rearguard action to slow the rupee's slide, the RBI took a risk last week by tightening liquidity and raising short-term rates, a strategy that compromises efforts to put some momentum back into growth.

"Now, the major decision-making variable for them is current account deficit and external sector risks," said Rupa Rege Nitsure, chief economist at Bank of Baroda in Mumbai, who put the odds of a Subbarao extension at better than 50 per cent.

Click NEXT to read more...

Question of change or continuity hovers over RBI

As things stand, Subbarao is due to lead his last quarterly review of monetary policy on July 30, with speculation mounting that he may be forced to squeeze liquidity harder, possibly by raising banks' cash reserve requirements. A hike in policy interest rates, unthinkable a week ago, is now seen by some economists as an outside possibility.

Rajan, a former International Monetary Fund chief economist and University of Chicago professor who returned to India last year to become the lead advisor in the finance ministry, had long been viewed as the favourite, but ministry insiders say he has competition.

Click NEXT to read more...

Question of change or continuity hovers over RBI

The front-runner has not always gotten the RBI post, and the powerful Indian civil service, of which Mayaram is a member, tends to push for one of its own. Subbarao and his predecessor, YV Reddy, were also part of the Indian Administrative Service.

The decision will ultimately be made by the prime minister in consultation with Chidambaram. If the choice is to stay the course with Subbarao, 63, it may be for a short term, possibly to tide the government through the elections, one economist said. Subbarao was initially given a three-year term that was extended to five. Chaudhuri, Mayaram, Rajan, and Subbarao declined to comment.

Click NEXT to read more...

Question of change or continuity hovers over RBI

The next RBI governor will oversee the process of issuing bank licences to Indian corporate houses, a policy driven by the finance ministry that has been less enthusiastically embraced at the central bank in Mumbai.

A candidate's view on issuing bank licences may no longer be the litmus test it would have been in a more stable economic environment, but it remains a consideration. "Since there are differences between the government and Subbarao on the issue of new banking licenses, this factor may go against him," said one finance ministry official, declining to be identified given the sensitivity of the matter.

Click NEXT to read more...

Question of change or continuity hovers over RBI

Rajan, 50, would bring global stature and a dash of glamour to the RBI. His status as an 'outsider' - he has spent much of his career in the United States - could count against him, as could the possibility that he might be too independent for New Delhi's liking.

His views on inflation management are seen to be roughly in line with those of Subbarao, who has been unexpectedly hawkish.

Click NEXT to read more...

Question of change or continuity hovers over RBI

By comparison, a veteran New Delhi insider such as Mayaram, 57, would be perceived to be more likely to yield to government pressure to ease monetary policy in favour of growth. However, the same was said of Subbarao, who has hardly been a pushover.

Given Rajan's credentials, he could be seen as someone who can meet the broad policy challenges raised by turmoil in the rupee, concern over the balance of payments, and weakening economic growth. The same factors increase the chance that Subbarao's term is extended.

© Copyright 2025 Reuters Limited. All rights reserved. Republication or redistribution of Reuters content, including by framing or similar means, is expressly prohibited without the prior written consent of Reuters. Reuters shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.