Vrishti Beniwal in New Delhi

Advance tax collections from corporate India in the first quarter this year (April-June) reported a meagre 4.9 per cent increase to Rs 32,882 crore (Rs 328.82 billion).

That marked a steep fall from 19 per cent growth to Rs 31,346 crore (Rs 313.46 billion) in the corresponding period last year.

The indication is companies may have paid less tax foreseeing a slowdown in earnings.

According to finance ministry data, collections from the top 100 companies showed an even sharper drop in growth.

. . .

Q1 advance tax figures signal corporate gloom

Image: India Gate in New Delhi.Photographs: B Mathur/Reuters

Their collections grew 5.33 per cent to Rs 17,893 crore (Rs 178.93 billion), compared with 34 per cent and 18 per cent growth in the previous two years, respectively.

The government has a 14 per cent corporation tax growth target for the financial year.

The slowdown in the growth of advance tax collections, an indicator of the financial health of companies, does not bode well for the economy.

Economic growth slowed to 6.5 per cent in 2011-12.

Advance tax is paid by companies in four instalments (in June, September, December and March) based on an assessment of their profits during the quarter.

. . .

Q1 advance tax figures signal corporate gloom

Image: Indian rupee notes in the shape of a kite.Photographs: Reuters

Industrial output growth was flat in April, at 0.01 per cent.

"The economy is not doing well.

"Companies are not investing. Naturally, growth will come down," said a ministry official.

The official added traditionally collections in the second quarter were better than the first. The first quarter usually accounts for about 15 per cent of the total advance tax payment in a year.

. . .

Q1 advance tax figures signal corporate gloom

Image: Indian fans cheer for their team during their Twenty20 World Cup cricket match.Photographs: Juda Ngwenya/Reuters

The second and third quarters account for 30 per cent each and in the last quarter companies typically pay the remaining 25 per cent.

ONGC, the highest taxpayer, showed an increase of about 27 per cent in its first instalment of advance tax payment of Rs 1,347 crore (Rs 13.47 billion), followed by the State Bank of India and Reliance Industries Ltd at Rs 1,170 crore (Rs 11.7 billion) and Rs 768 crore (Rs 7.68 billion), respectively.

Though RIL was the third highest taxpayer in April-June, it paid about 15 per cent less tax than last year.

. . .

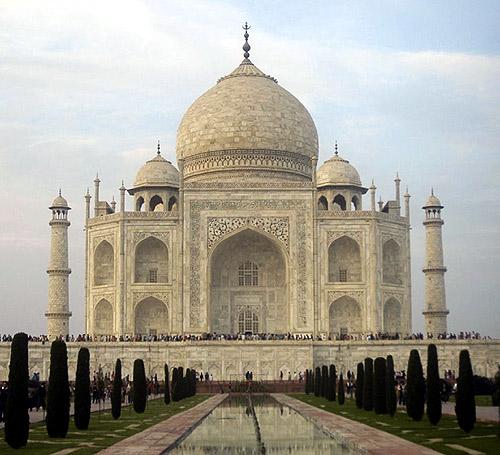

Q1 advance tax figures signal corporate gloom

Image: Tourists stand in front of the historic Taj Mahal in Agra.Photographs: Jayanta Dey/Reuters

Other companies that paid less tax compared to the corresponding period of last year included BHEL, SAIL, GAIL, L&T, OBC, Sesa Goa, Bharti Airtel, Hindalco Industries, Hindustan Aeronautics Ltd, Maruti Suzuki, Siemens, Grasim Industries, Torrent Power and Nokia.

On the other hand, companies such as HDFC Bank, Infosys Technologies, ICICI Bank, Citibank, Hindustan Lever, Wipro, Ultratech Cement, Kotak Mahindra Bank, IDFC, JPMorgan Chase Bank, HCL Technologies and DBS Bank posted a rise in advance tax payments.

The direct tax collection target for 2012-13 is Rs 5.7 lakh crore (Rs 5.7 trillion) -- an increase of about 25 per cent over the actual collections in the last financial year.

. . .

Q1 advance tax figures signal corporate gloom

Photographs: Danish Siddiqui/Reuters

Gross direct tax collections increased 3.62 per cent during April-May to Rs 52,232 crore (Rs 522.32 billion).

While the corporation tax collection showed a decline of 2.82 per cent to Rs 24,329 crore (Rs 243.29 billion), the collection of personal income tax was up by 10.02 per cent to Rs 27,884 crore (Rs 278.84 billion).

However, direct tax collections (net of refunds) showed an increase of 172.64 per cent to Rs 35,323 crore (Rs 353.23 billion) because of a nearly 55 per cent decline in refunds.

article