| « Back to article | Print this article |

Property mart: Budget brought cheer but difficult times to stay

The sops offered by the government and the Reserve Bank of India to the housing sector have brought cheer to the property market, but real estate does not seem to be out of the woods.

The budget for 2014-15 had a number of proposals to boost the real estate sector: 'pass through' status for real estate investment trusts, relaxation of foreign direct investment norms, increased income tax exemption on housing loans and Rs 4,000 crore (Rs 40 billion) to the National Housing Bank for cheap houses.

Within five days of the budget, the RBI reclassified housing loans below Rs 50 lakh (Rs 5 million) as priority sector lending, which will make them less expensive.

Please click NEXT to read further. . .

The image is used for representational purpose only

Property mart: Budget brought cheer but difficult times to stay

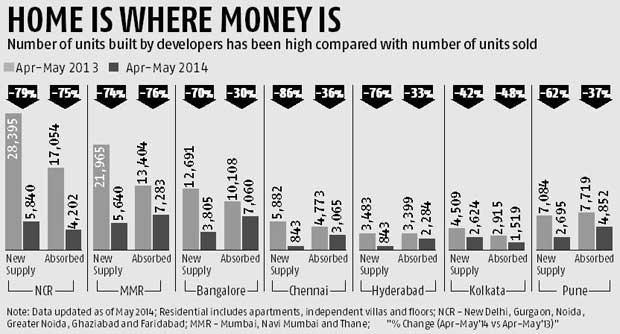

According to realty research firm PropEquity, absorption of houses and flats in two of the country’s largest housing markets -- the National Capital Region and the Mumbai Metropolitan Region -- has fallen by 75 per cent and 46 per cent, respectively, in April and May this year from the same period in 2013.

Property consultants and stock analysts said the situation was not expected to improve soon.

“With the new government and budget proposals, sentiment has improved.

"Changes in policy and an expected uptick in the economy and jobs could increase demand for real estate in the next 12-16 months,” said Shishir Baijal, chairman and managing director at Knight Frank, a real estate consultant.

Please click NEXT to read further. . .

The image is used for representational purpose only

Property mart: Budget brought cheer but difficult times to stay

“But it all hinges on interest rates coming down and economic growth picking up,” Baijal said.

Nischal Maheshwari, head of research at Edelweiss Securities, said it would take at least a year for the sector to resolve its issues.

Even Developers agree that revival is some time away.

“The ground situation continues to be challenging and demanding.

"It will take a few more quarters for the ground situation to improve,” DLF, the country’s largest developer said in the latest analyst presentation.

According to a Mumbai-based stock analyst who did not wish to be named, barring easier FDI the budget did not have much for the real estate sector.

“There was a policy announcement on Reits, but a lot needs to be done for the sector,” he added.

Please click NEXT to read further. . .

The image is used for representational purpose only

Property mart: Budget brought cheer but difficult times to stay

Edelweiss’ Maheshwari said real estate companies with large volumes and reasonably healthy balance sheets such as Prestige, Sobha Developers, Phoenix Mills, Godrej Properties and Oberoi Realty would benefit.

“Things will not change much for developers with stressed balance sheets,” he added.

At end of March 2014, the country’s top listed developers were sitting on Rs 39,772 crore (Rs 397.72 billion) of debts, which was 17 per cent lower than in the previous financial year.

“Developers have to go through cycles.

"As and when things pick up, liquidity will improve and they can resolve the issues they are facing,” Baijal said.

According to the analyst quoted above, developers in Bengaluru, Pune and Chennai that are selling houses worth Rs 50 lakh (Rs 5 million) are already doing well.

Developers in Mumbai and the NCR would take four to five quarters to come out of the liquidity squeeze, he said.

“Good developers are already getting better rates from banks,” he added.

Please click NEXT to read further. . .

The image is used for representational purpose only

Property mart: Budget brought cheer but difficult times to stay

Vikas Oberoi, chairman and managing director of Oberoi Realty, said since the government had come out with many policy changes, the onus was on the developers to cut debt, execute projects and sell their properties.

"The government has created a platform, developers have to perform now," Oberoi said.

Though BSE Realty Index has risen 59% in the last six months, outperforming broader BSE Sensex which grew 28%, analysts say it was mostly due to the fact that the real estate stocks ran on improvement in sentiments and because they were the highest among beaten down indices among the sectoral indices.

The image is used for representational purpose only