| « Back to article | Print this article |

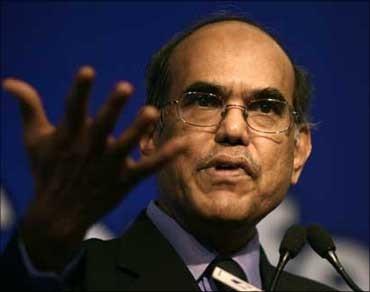

Probability of global recession low: RBI governor

The probability of a global recession is low, even though the United States is growing slowly and Europe is experiencing negative growth, Reserve Bank of India Governor D Subbarao said on Friday.

"The probability of a global recession, I think, is low," he said at a Confederation of Indian Industry event here, adding that even though India's growth rate is falling, this cannot be termed as recessionary.

"The US is not growing remarkably, but slowly. Europe is experiencing negative growth and Japan is also recovering," he added.

On the challenges currently facing the country, he said the RBI's job is to strike the right balance between growth and price sensitivity.

"I am sensitive to 80 per cent of the people of the country who are affected by price rise. We will have to balance the concerns of the corporate leaders crying against interest rate hikes and the poor."

Click NEXT to read on . . .

Probability of global recession low: RBI governor

Subbarao said it is a legitimate concern that inflation did not come down appreciably despite hikes in the interest rate 13 times since March, 2010, but maintained that the rate of price rise would have been even higher had monetary tightening steps not been taken.

"It is a valid criticism. Had the RBI not acted, inflation rate now would have been 12 per cent or 13 per cent and not 9.7 per cent at the moment," he said.

On capital account convertibility of the rupee, he said it would not take place unless there was fiscal stability, more developed financial markets, stable growth and steady inflation.

Subbarao said the RBI's endeavour is to manage volatility of the exchange rate. "We do not target a specific band and urged the corporates to take resort to hedging as a protection against volatility," he said.

"Hedging is a good practice," he added.

Click NEXT to read on . . .

Probability of global recession low: RBI governor

The RBI governor noted that when the rupee depreciated sharply in 2008, it was offset by a sharp decline in oil prices.

"But in 2011, the depreciation of the rupee is not accompanied by a fall in oil prices. Oil prices have remained firm, which is adding to the inflationary pressures," he said.

Subbarao said financial stability is one of the goals of all public policy and more important for monetary policy.

Regarding infrastructure financing, he said banks in the country would have to do the job, which is a big challenge.

"We will have to ensure that banks remain safe and also take care of the asset-liability mismatch," he added.