Photographs: Sahil Salvi Puneet Wadhwa in New Delhi

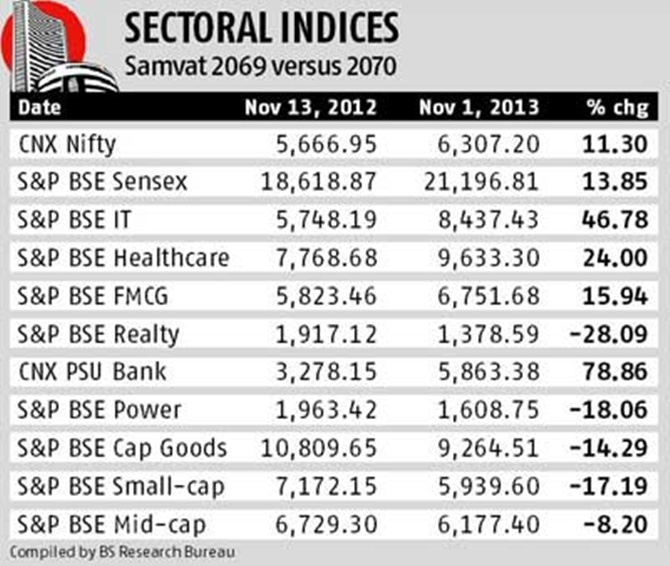

It has been a choppy Samvat 2069 for the global markets.

Foreign institutional investors (FIIs) have been aligning their investment strategies across asset classes, in the backdrop of the US Federal Reserve’s outlook for the $85-billion monthly bond buying programme, known as the third round of quantitative easing (QE3), and economic data from key economies such as China, Japan and the euro zone.

FIIs made a net investment of $21,966 million in Samvat 2069 in Indian markets as compared to $18,396 million in the previous corresponding period.

What does Samvat 2070 look like?

...

Where to invest in Samvat 2070?

Photographs: Reuters

Equities

The Sensex has hit an all-time high of 21,293.88 after five years and 10 months. Given this and the uncertainty on the outcome of key global (US debt ceiling negotiations in February, bond buying taper, recovery in the euro zone and Japan, growth rate in China) and domestic events (outlook for interest rates, inflation, rupee, outcome of assembly and general elections), investors need to be careful of how and where they invest.

Says Neelkanth Mishra, India equity strategist, Credit Suisse, in a recent report: “Together with changing perceptions around global liquidity (now most expect the feared ‘taper’ to not start till next year), the results of opinion polls for the coming general elections (predicting steadily improving chances of the Narendra Modi-led NDA winning), create a potent mix for a beta rally.”

Deven Choksey, managing director (MD) and chief executive officer (CEO) at K R Choksey Shares and Securities, believes a secular bull run will resume in Samvat 2070, which should last the next four years.

...

Where to invest in Samvat 2070?

Photographs: Reuters

Debt

With the Reserve Bank of India (RBI) going all-out to control inflation and fine-tuning its monetary policy stance accordingly, analysts suggest the yields of long bonds will be under the threat of further rate increases over the coming months.

Yadnesh Chavan, head of fixed income, Mirae Asset Global Asset Investment Management, expects the 10-year GOI bond to be range-bound at 8.2-8.7 per cent, with an upward bias, mainly because of high supply of government debt and fiscal concerns because of the general elections.

“I expect debt funds to generate a return of 8.5-10 per cent over the next one year,” says an analyst from a local brokerage.

...

Where to invest in Samvat 2070?

Real estate

Given how the key macros have shaped, the recent months has been a double whammy for real estate entities.

While developers are saddled with high inventory levels, given the current macro economic condition, the recent announcement by RBI to bar banks from lending to the sector under the 80:20 or 75:25 schemes has also impacted sentiment.

Analysts suggest there can be a correction in real estate prices on a pan-India basis, albeit selectively.

Hansraj Singh, an analyst with IDBI Capital, is positive on the Bangalore market but not on Mumbai and Gurgaon. “In Mumbai, the developers are not ready to slash prices and the property market remains sluggish. It is very difficult to give the quantum of correction. Although the quoted rates may have not come down, actual transactions are happening at lower prices,” he says.

According to Parikshit Kandpal, an analyst with Karvy Institutional Equities, markets in southern India continue to remain healthy, with price points largely stable. The market remains affordable and the prices have not skyrocketed. Quality developers such as Puravankara, Sobha and Prestige have still been able to sell.

...

Where to invest in Samvat 2070?

Photographs: Reuters

Precious metals

The US Fed’s inaction as regards the taper has seen investors shun safer havens like gold for high beta assets.

Since late July, Indian gold demand has been stressed by a sharp slide in the rupee, domestic economic weakness, and an unprecedented regulatory initiative to cut the rate of gold imports.

Policy measures seem to have paid off, with a 77 per cent drop in gold imports in value terms and 28 per cent in volume terms during the quarter ended September.

According to Shriram Pitre, senior vice-president and head, commodity & currency research, at Anand Rathi, the investment appeal for gold has weakened steadily this year and shows no signs of picking up.

“Prices of gold and silver are likely to head lower in the medium term. Once there is some clarity on the timing of the Fed scaling back its stimulus, we expect outflows from gold exchange traded funds to resume and drag prices lower,” he says.

Adding: “Indian government policies to restrict gold imports are likely to keep prices under check. As such, we expect gold and silver to head lower by December 2014-end. The target for gold is seen around $1,100 per troy ounce, while that for silver is seen around $16 per troy ounce by the end of next year.”

...

Where to invest in Samvat 2070?

Photographs: Reuters

TOP PICKS: EQUITIES

Angel Broking: Wipro, ICICI Bank, Hindustan Zinc, Cipla, Tata Steel, Cadila, United Phosphorus, Aurobindo Pharma and Crompton Greaves

Aditya Birla Money: Godrej Consumer Products (GCPL), GujaratPipavavPort, Infosys, ITC, KPIT Technologies, M&M and YES Bank

Centrum Broking: Karur Vysya Bank, Clariant Chemicals, BASF

KR Choksey Securities: IDFC, LIC Housing Finance, Tata Motors, Adani Enterprises, State Bank of India (SBI)

Motilal Oswal Research: GRUH Finance, Bajaj Corp, Supreme Industries, United Phosphorous, Unichem Labs, Swaraj Engines, WABCO India and Berger Paints, Infosys, Bharti Airtel, ICICI Bank, Hero MotoCorp, NMDC

IIFL: Cipla, Emami, HDFC Bank, Hero MotoCorp, Hindalco, Idea, Infosys, ING Vysya, Mahindra & Mahindra, Reliance Industries, Shriram Transport Finance, Wipro

IndiaNivesh Securities: Bajaj Finance, Coal India, J B Chemicals & Pharmaceuticals, Mastek, Reliance Industries, BASF India, GIC Housing Finance, Jaiprakash Associates, Nesco

Prabhudas Lilladher: Infosys, Wipro, Larsen & Toubro, ING Vysya Bank, KSB Pumps

article