| « Back to article | Print this article |

Should you play the pre-election rally?

Tinker a little with sectoral funds or stocks. You can start an SIP but don't overhaul the portfolio, says Joydeep Ghosh.

After a good six years, retail investors have some reason to be happy. The BSE exchange's Sensitive Index, or Sensex, hit 22,000 on March 10.

It had hit 21,000 in January 8, 2008.

This rise is being primarily attributed to speculation that there will be a stable government (read Narendra Modi-led) at the Centre on May 16.

If there is a hung Lok Sabha, most wealth managers and stock market traders feel the correction could be 20-25 per cent, unprecedented for 23 years.

Click NEXT to read more…

Should you play the pre-election rally?

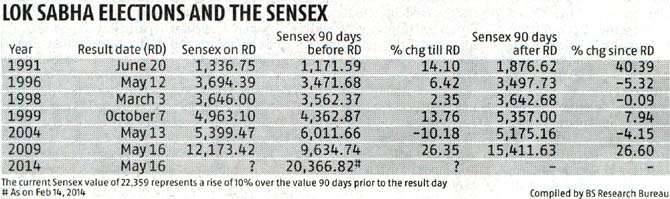

Since the opening of the economy in 1991, the stock market has only twice rewarded any new government with a 20 per cent rise in the next three months.

In 1991, the Sensex rose 40 per cent in the first three months after election results; in 2009, the benchmark index rose 26 per cent in the same time period (see table).

The reaction of markets after the results in the other four elections was tepid, to say the least. It fell by one-five per cent three times and rose by eight per cent in 1999.

While the election risk for the market is high this time, one really does not know what will happen. But in the next month or so, there could be opportunities to buy and sell.

While the election risk for the market is high this time, one really does not know what will happen. But in the next month or so, there could be opportunities to buy and sell.

Click NEXT to read more...

Should you play the pre-election rally?

Some questions investors need to ask their advisors or decide:

If you have invested in a Sensex/Nifty-based exchange-traded fund six years earlier, should you exit now and wait for better opportunities?

If your sector fund - infrastructure, real estate, etc - has suddenly turned around and is giving positive returns, should you sell and move into safer blue-chip stocks or diversified equity funds?

Should you start buying information technology (IT) or pharma funds that have fallen in this rally?

Should you simply start a systematic investment plan (SIP)?

Click NEXT to read more...

Should you play the pre-election rally?

Hemant Rustagi, chief executive, WiseInvest Advisors, believes even if you invested in an exchange-traded fund (ETF) and are stuck, long-term investors might as well give it some more time. "If you don't need the money immediately, there is no harm in letting it grow," he says.

Some tinkering is possible, especially in sectors such as real estate and infrastructure which are finally seeing some action. For example, with returns of 12.3 per cent, infra funds are the top performers in the past three months. Investors who went overboard on these funds or stocks have an opportunity to cut losses or exit with small gains.

Click NEXT to read more...

Should you play the pre-election rally?

Views are divided about the strategy to follow. Some feel if you are sitting on profits, it could be a good time to exit. However, both Rustagi and investment consultant Gul Tekchandani feel one should wait.

"Since most of these stocks/funds were at 80-90 per cent of their 2008 values, holding on might mean better prospects," says Tekchandani.

He believes irrespective of the political situation before or after elections, while investing one has to look for reasonable valuation in the stocks they are buying. "If you understand the business and there is a stock at a sub-10 price to earnings ratio, it is a good time to buy it. However, the key is understanding the business."

Click NEXT to read more...

Should you play the pre-election rally?

Some also believe that as the fast moving consumer goods (FMCG), pharmaceutical and IT sectors have corrected after a long time, there could opportunities there as well.

Technology funds are among the worst performers in the past three months, falling 1.6 per cent.

FMCG and pharma funds, though in the green with returns at 5.6 per cent and 4.5 per cent, can be looked at again.

Click NEXT to read more...

Should you play the pre-election rally?

Still, as over five years the category average returns of these funds are a 30 per cent compounded annual rate of growth, there could some correction.

"I believe investors can realign their portfolios from stocks which have moved up to ones which haven't," adds Tekchandani.

Vinod Sharma, head, private broking and wealth, HDFC Securities, is betting on public sector banks (PSBs). He says the current rally in the market is largely due to foreign institutional investor inflows pouring in, as India is seen as a better destination among emerging markets.

Click NEXT to read more...

Should you play the pre-election rally?

"PSBs are the best bets for riding the Bharatiya Janata Party-led revival of the economy. We believe the BJP will continue with its policy of strategic disinvestment of public sector units, something they'd done with Hindustan Zinc and VSNL (Tata Communications). We believe the residual stake sale of these companies will happen under the new regime," he adds.

Starting an SIP is perhaps the easiest decision to make. You can start one anytime because it is not dependent on market conditions and is suited for volatile conditions. Even if the market falls after elections, you will get more units for your SIP.

These additional units will later translate into better returns.