Photographs: Truth Leem/Reuters Rajesh Bhayani in Mumbai

In the last few years, investment experts have aggressively started advising gold.

And, for a good reason as well.

With annualised returns of 23.6 per cent in the last five years, it has consistently beaten inflation.

Yet, often there are murmurs amid market players, on whether the time has come to sell or exit the yellow metal.

For retail investors, there should be little doubt.

For decades, it is been the only solace when equity or currency markets went completely haywire.

. . .

Invest in gold; Prices don't matter

Image: A customer tries on a gold necklace at a gold shop in Hanoi.Photographs: Kham/Reuters

For instance, gold came to the rescue of people both in Vietnam in the 1960s and the South-east Asian crisis in late 1990s.

So, if you have not bought gold still, enter now.

And prices really don't matter.

While it is true that falling prices would have made it more attractive to enter, but if you want hold it for a long time -- a typical Indian attitude -- delaying the decision may make little sense.

Gold has other features as well -- hedge against inflation, store of value and of course, high liquidity.

. . .

Invest in gold; Prices don't matter

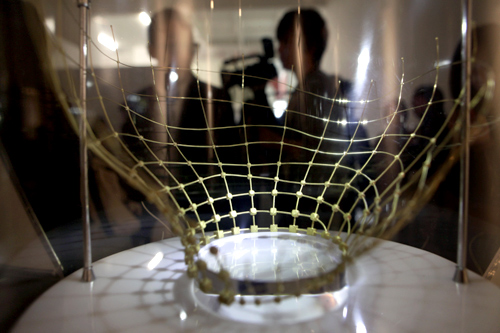

Image: A gold necklace creation for the 3rd Auditions China gold jewellery design competition is displayed in Beijing.Photographs: Jason Lee/Reuters

But in what form should you own it?

If you have liquidity and investment purposes, go for gold exchange-traded funds.

The entry and exit cost in ETFs is nominal.

The good part: You can invest small amounts every month through a systematic investment plan.

The expense ratio is as low as 0.17 per cent to 1.5 per cent.

There are tax benefits as well.

If you sell ETFs after one year, there will be a tax of 10 per cent without indexation and 20 per cent with indexation.

. . .

Invest in gold; Prices don't matter

Image: An employee holds a gold key during a photo opportunity at a jewellery shop in Seoul.Photographs: Truth Leem/Reuters

That makes it much more liquid than physical gold, where one has to hold for three years for these benefits.

Otherwise, the capital gains will be added to income and taxed, as per income bracket.

As a store of value, you could either go for jewellery.

Don't buy jewellery for investments purposes, as the liquidity becomes lower.

Also, the making charges -- as high as 20-25 per cent -- don't make it a good investment avenue.

Between 1962 and 1992, people were forced to buy gold jewellery as an investment option because the Gold Control Act prohibited people from holding gold in the bar or coins format.

. . .

Invest in gold; Prices don't matter

Image: Five-tael (6.65 ounces or 190 grams) gold bars are seen at a jewellery store in Hong Kong.Photographs: Bobby Yip/Reuters

But things have changed in the last two decades making investing much simpler.

As a hedge against inflation, both ETFs and coins make good sense.

As our numbers show earlier, gold has consistently beaten inflation numbers over five years.

Coins do make good sense, both from jewellers and banks, despite a little mark-up that is charged because one gets good returns over time.

Liquidity is an issue with coins because all jewellers may not buy the coins at the same price at which it was bought.

Also, banks aren't allowed to buy back gold.

Despite all this, any investor should have at least 10-15 per cent in gold.

No wonder, the government's decision to raise excise and customs duties on the yellow metal hasn't met with too-much enthusiasm.

article