Priya Nair in Mumbai

If your credit card payment is delayed, you will now get more time before the bank charges a late payment fee, as the Reserve Bank of India has asked lenders to relax the norms in this regard.

Now you have time till the next billing cycle to pay the money, without late payment charges.

But the bank can still report you to the credit bureau.

Customers have to make credit card payments by the due date, failing which they have to pay the dues, along with a late payment fee, interest on past transactions (from the date of purchase), interest on any new transactions (till the time one doesn’t make the entire payment), and service tax of 12.36 per cent on the late payment fee and interest.

Please . . .

How to avoid late fees on credit card dues

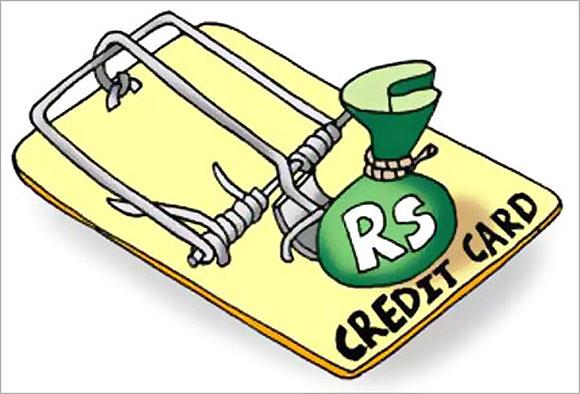

Photographs: Illustration, Uttam Ghosh/Rediff.com

The interest is charged on all cash advances from the date of the transaction till the payment date.

Together, all these can amount to a substantial sum.

If you pay the minimum due, you will not have to pay the late payment fee, though interest will be charged.

According to data provided by Bankbazaar.com, for most banks, late payment fees range from Rs 100 to Rs 1,000, depending on the dues.

Some banks charge a flat fee, while some charge a particular percentage of the minimum due, subject to a certain range.

Please . . .

How to avoid late fees on credit card dues

Image: The interest varies from two per cent to four per cent, on a daily basis.Photographs: Reuters

Along with the late payment fee, one is also charged interest on all transactions from the date of a purchase till the entire dues are paid.

The interest varies from two per cent to four per cent, on a daily basis.

Assuming your bill is generated on the 14th of every month (for instance, June 14), the due date is 30th (in this case June 30) and the amount outstanding is Rs 15,000, you have to make a late payment fee of Rs 600 (for most banks), along with interest on the dues. Now, however, the late payment fee will not be charged until the next billing date (July 14).

So, you will 14 more days to pay, without having to pay the late payment fee.

Please . . .

How to avoid late fees on credit card dues

Image: Based on the date of a purchase, it is possible to avail of an interest-fee credit period of up to 50 days, depending on the credit cycle.Photographs: Reuters

Adhil Shetty of Bankbazaar.com says, “With exorbitant rates and charges, a credit card is one of the most expensive borrowings available in the market.

“Regulating the late payment fees is a relief for card holders who choose to repay the money over time.

“After all, it makes no sense to charge dual penalties in terms of late fees and interest charges.

“Besides, their account is not delinquent until the next bill is unpaid.”

Based on the date of a purchase, it is possible to avail of an interest-fee credit period of up to 50 days, depending on the credit cycle.

Please . . .

How to avoid late fees on credit card dues

Image: Prudent use of the credit period is very important in the case of credit cards.Photographs: Reuters

Prudent use of the credit period is very important in the case of credit cards.

This can be done by ensuring all the spending is at the beginning of the billing cycle. “Most banks give you a month, along with the time taken to send the bill, to clear your dues.

So, this gives customers 48-50 days to pay,” says Mohan Jayaraman, managing director, Experian Credit Information Company.

Customers should also check the credit limit available on a card and ensure she/he doesn’t spend beyond the limit, says an official at a leading private bank.

“If you don’t pay your entire balance on time, your credit limit will be restricted by that amount until you clear the dues,” he says.

article