| « Back to article | Print this article |

A quick guide to online filing of tax returns

Easier access, less time consumed and agency assistance at a small cost have helped online filing of income tax returns catch up in the past couple of years. Tax experts say about one in three returns are now filed online. Experts expect this to rise to 50 per cent.

However, online return filers are taking longer to understand the entire procedure and, more often than not, end by not completing the process.

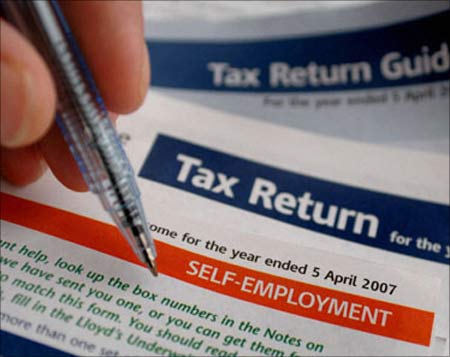

"Most people don't know that they need to send the Income Tax Return-V (ITR-V) to the tax department's Bangalore office after filing returns online. We need to keep reminding customers and still many end up not doing it in time," rues Sudhir Kaushik, co-founder and chief financial officer, Taxspanner.com, a Delhi-based income tax (I-T) department-authorised e-return intermediary (ERI). ITR-V is an acknowledgement of the income tax return filed.

Click NEXT to read more...

A quick guide to online filing of tax returns

Another problem faced by most ERIs is that tax payers do not send the acknowledgement in time. The I-T department allows you to send ITR-V within 120 days of filing your returns online. If not done, your registration with the I-T department is cancelled and your returns considered not filed.

To encourage e-filing, the department may extend the 120-day period, like it did last year. Those who had e-filed returns in 2010 were allowed to send acknowledgements till July 2011, says Kaushik.

The department, in this case, notified all those who had filed returns online about the extension.

There are times when many filers have sent ITR-V at the last minute by courier. However, the department accepts acknowledgements received only through speed post or ordinary post.

Click NEXT to read more...

A quick guide to online filing of tax returns

Many send the acknowledgement but without signing it. The I-T department accepts ITR-V only when signed by the filer.

"And, the signature should be in blue ink. Acknowledgements signed in black ink are considered scanned copies or photocopies of ITR-V and have high chances of getting rejected," warns Nagaraju P S, director of etaxmentor.com, a Hyderabad-based ERI. As a habit, many acknowledgements are folded, which should be strictly avoided.

It has been noticed by experts that the ink gets erased on the creases or folds, leading to rejection of ITR-V. Specially, do not fold ITR-V on the bar code (on the right hand lower corner), because it gets destroyed.

Click NEXT to read more...

A quick guide to online filing of tax returns

You need to be more careful about these because the department may inform about this by ordinary post. And, this may not reach you in time to act within 120 days.

Nagaraju recalls many customers' returns got cancelled because the letter informing about the rejection came after 120 days. Hence, be careful about your address of correspondence. Also, check the electronic mail address (e-mail) provided on registration.

The acknowledgement for receipt of ITR-V at the Centralised Processing Centre (CPC) is sent to this e-mail address.

Click NEXT to read more...

A quick guide to online filing of tax returns

"Typically, an acknowledgement for receipt of ITR-V comes in 10 days. If one does not get an acknowledgement within this period, he/she should either check with the I-T Department or resend ITR-V," says Kaushik.

If your registered e-mail address is wrong, you cannot make the changes once ITR-V is generated. The option is to file revised returns, but experts advise against it, because chances of landing a scrutiny becomes higher.

"And, since tax returns serve as an important document, revised returns always need to be backed by the original returns, which you won't get here," cautions Nagaraju.

Click NEXT to read more...

A quick guide to online filing of tax returns

Things to Remember:

- You need to send ITR-V to the I-T department in 120 days;

- But, the department accepts acknowledgements received only through speed post or ordinary post;

- Many send the acknowledgement but without signing it;

- Do not fold ITR-V; if the ink gets erased, specially on the bar code, it will be rejected;

- Check your registered e-mail, as the acknowledgement for receipt of ITR-V will be sent to it;

- If your e-mail is wrong, you cannot make the changes and will have file revised returns;

- Be careful, as the department may not inform you about rejections in time.