Photographs: Jim Young/Reuters

Twenty-five years of Wall Street deregulation, started under the auspices of then US President Ronald Reagan, culminated last year in the meltdown of the world financial markets.

Ever since, the debate has raged in business magazines and boardrooms over what role this deregulation played in the catastrophic collapse of iconic institutions like Bear Stearns and Lehman Brothers.

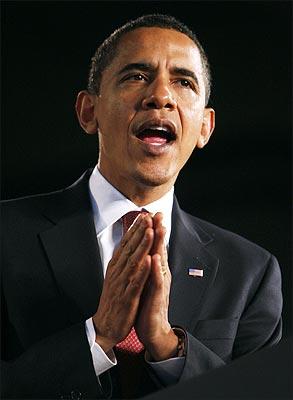

Wednesday, June 17, US President Barack Obama weighed in on the matter, and made his opinion and agenda clear: Wall Street, it's time to take your medicine. Federal institutions will no longer work to protect your interests ahead of consumer interests. Tough regulation is coming.

"It is an indisputable fact that one of the most significant contributors to our economic downturn was an unravelling of major financial institutions and the lack of adequate regulatory structures to prevent abuse and excess," the President said in his White House speech.

Inviting a firestorm of criticism from American free market purists, and most of the Wall Street crowd, Obama unveiled proposals that would overhaul the United States government's role in almost every aspect of the financial services industry.

Internationally, where the common belief is that lack of regulation of US banks allowed hyper-risk scenarios to creep into everyday lending practices, the response has been largely 'wait and see', but initial reactions were mostly positive.

Although Obama's 85-page plan does not attempt to completely wipe out the deregulation of the 1980s, 1990s and early 2000s, it clearly pushes the government's watching eye into private markets, despite Obama's pledge to use a 'light touch' and not a 'heavy hand' in pursuing reform.

Moreover, pundits in the media and experts in and around Wall Street and Capitol Hill believe this to be just Obama's first step of a long journey to reregulating Wall Street. Read on. . .

Reigning in risk

Image: A Lehman Brothers Holdings Inc employee writes a message on a portrait of Dick Fuld in New YorkPhotographs: Joshua Lott/Reuters

Obama's agenda could be described thus: to shine light on darkened corners of the financial services that allowed banks to hide and disguise risk. The Federal Reserve, which will clearly be strengthened under Obama's plan, will be given enhanced tools to supervise major Wall Street firms and, in turn, will be advised by a council of regulators that will gauge scenarios in terms of risk.

The plan also asks Congress to ensure that the Federal Reserve must get Treasury Department approval before it can lend funds to a company, under the controversial 'unusual and exigent circumstances' clause of its charter.

Moreover, and perhaps most importantly, firms will be required to hold more liquidity and capital to prevent another 'Lehman Brothers' situation. Last year, so overleveraged was Lehman that, when its big bets all went bust, it literally did not have enough capital to cover its rapidly mounting losses, leaving bankruptcy or bail-out the only options.

There's also an effort to reign in the packaging of loans together for sale in securitisations. Now, firms will have to disclose more about such deal, and will also have to keep 5 per cent of any deal to promote more secure underwriting. Over-the-counter Derivatives like credit-default swaps have been brought into the light as well, as those not traded on exchanges or cleared centrally will face higher capital charges.

Securities and derivatives and other controversial financial instruments have been blamed in part for last year's Wall Street meltdown.

Wall Street's new watchdog

Image: Barack Obama at Lincoln Memorial, Washington DC.Photographs: Jim Young/Reuters

Perhaps the most newsworthy and eye-catching item included in Obama's agenda is the creation of the Consumer Financial Protection Agency (CFPA). Though many on Wall Street are already grumbling about the addition of another 'government-run acronym', the CFPA will likely prove popular with the American people. It will consolidate power from many disparate bank regulators and partially put them into one central agency with an emphasis on rule-writing and enforcement powers in mortgages, car loans and credit cards firm.

As its name implies, it's been designed to protect consumers from deceiving practices and confusing loan agreements.

"The most unfair practices will be banned," Obama said. "Those ridiculous contracts with pages of fine print that no one can figure out, those things will be a thing of the past. And enforcement will be the rule, not the exception."

While it's difficult to argue against increased transparency and regulation in the wake of the financial tsunami that wiped out Wall Street, already dissenters are arguing that the CFPA is a drastic, sweeping move that would ultimately restrict 'good' innovation in the markets without necessarily doing enough to stomp out the 'bad' innovation that caused the whole system to stagger.

There are also complaints that Obama's plan doesn't do enough to streamline and simplify already existing regulatory agencies. There is a fear that the CFPA will only add another layer of bureaucracy to an already confusing system. Initially, when Obama set out to overhaul the regulatory system, he wanted a single bank regulator and a complete merger of agencies that oversee securities and derivatives. But that idea has fallen by the wayside in the face of presumed opposition from both sides of the aisle in the US Congress.

Although some argue it's a good thing to have multiple regulators, as one might catch a risky situation that another is oblivious to, others feel leaving the existing regulatory infrastructure intact is a bad move, as disputes among various regulatory bodies can lead to a lack of consensus and unclear message to 'The Street'.

Lay off private sector, say Republicans

Image: The American International Group building in New York.Photographs: Shannon Stapleton/Reuters

For all the talk of runaway executive control under Obama, in a move to give a show of bipartisanship, he has intentionally set up this new scheme to require US Congress approval. And since big business interests will most probably find a friend in Republican representatives, expect to see some of the bill pared down and with a few of its teeth removed.

The tough talk against the hugely lucrative but hugely risky over-the-counter derivatives (which burned insurance giant AIG), for example, should meet stern resistance in the form of Republican lawmakers, backed by Wall Street.

"The American people don't want Washington to get more involved in the private sector; they want an exit strategy to get Washington out of the bailout business," US House of Representatives Republican leader John A. Boehner (Ohio) reportedly said in response to the plan.

Put simply: Republicans don't want government involved in the financial markets.

Also, there are rumblings on Capitol Hill over the expanded role of the Federal Reserve. The shadowy semi-public, semi-private central bank -- initially created by Congress in 1913 during a time of financial crisis -- has a less than impressive track record when it comes to preventing system-wide meltdown.

In the Savings and Loan crisis, the dot-com bubble burst crisis and the current sub-prime mortgage crisis, the Fed was not able to successfully intervene.

Even Democrats show a little pause at the idea of a Fed with heightened powers, as prominent Democrat and US Senator Chris Dodd said he was apprehensive about the Fed's role in Obama's agenda.

'Reward innovation and responsibility, not greed'

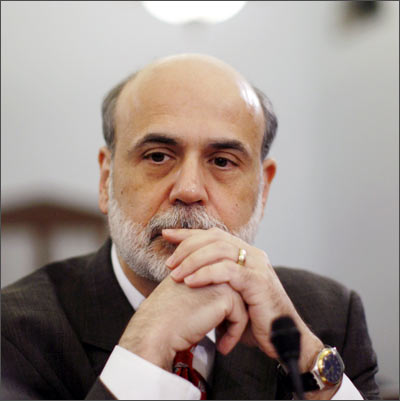

Image: U.S. Federal Reserve Chairman Ben Bernanke testifies before the House Budget CommitteePhotographs: Jim Young / Reuters

Obviously, in attempting such an ambitious task as overhauling the regulation of US financial markets, Obama must practice pragmatism and balance the countervailing interests involved. The plan seems to set the framework for sweeping changes, but taken alone will not achieve them.

Getting Congress to pass even what has been proposed already will take a lot of effective salesmanship, which explains why many of Obama's original ideas have taken a backseat to cold-blooded politics. It is US Treasury Secretary Timothy F. Geithner who has the unenviable task of selling the plan, which he will begin this week on Capital Hill in testimony in both houses of America's bicameral legislative body. He'll try to convince lawmakers that the White House's plan works for the benefit of both consumers and big banks.

As Obama himself said Wednesday, "That's our goal -- to restore markets in which we reward hard work and responsibility and innovation, not recklessness and greed; in which honest, vigorous competition in the system is prized, and those who game the system are thwarted. With the reforms we're proposing today, we seek to put in place rules that will allow our markets to promote innovation while discouraging abuse."

article