| « Back to article | Print this article |

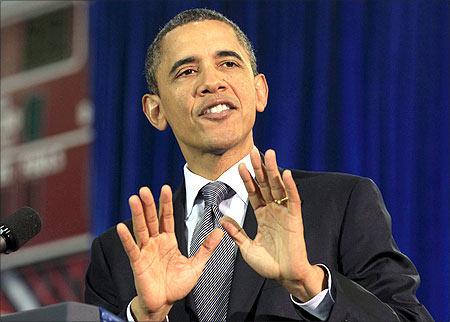

Obama proposes minimum taxes on foreign earnings

US President Barack Obama has proposed to establish a new minimum tax on foreign earnings while repealing benefits for outsourcing jobs overseas and providing new incentives for bringing jobs back home.

The proposed move would make it a bit tough for US multinationals to ship jobs overseas and will give incentives to those who bring operations back into the US.

The Treasury Department said that the US business tax system does too little to encourage job creation and investment in the US and creates too many opportunities that encourage shifting production and profits overseas.

For Rediff Realtime News, click here!

Click NEXT to read more...

Obama proposes minimum taxes on foreign earnings

In a statement, Obama said the current corporate tax system is outdated, unfair, and inefficient.

"It provides tax breaks for moving jobs and profits overseas and hits companies that choose to stay in America with one of the highest tax rates in the world. It is

unnecessarily complicated and forces America's small businesses to spend countless hours and dollars filing their taxes," he said adding that this needs to change.

He said the tax system should not give companies an incentive to locate production overseas or engage in accounting games to shift profits abroad, eroding the US tax base.

Click NEXT to read more...

Obama proposes minimum taxes on foreign earnings

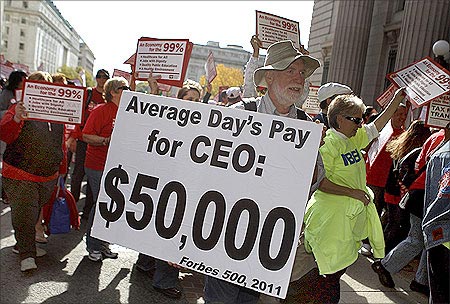

"Introducing the principle of a minimum tax on foreign earnings would help address these problems and discourage a global race to the bottom in tax rates," it said.

The Treasury on Wednesday released the President's framework for reforming the US business tax system, which would enhance American competitiveness by simplifying the tax code and eliminating dozens of tax loopholes and subsidies, incentivising job creation and investment here at home and lowering the business rate while broadening the tax base.

Click NEXT to read more...

Obama proposes minimum taxes on foreign earnings

"Evidence suggests that high statutory tax rates may also affect a company's willingness to locate in the United States following mergers and acquisitions," it said.

Proposing to reduce the corporate tax rate from 35 per cent to 28 per cent, the Obama Administration said this reduction in the rate would put the US in line with other advanced countries, help encourage greater investment in the US, and reduce the tax-related economic distortions.

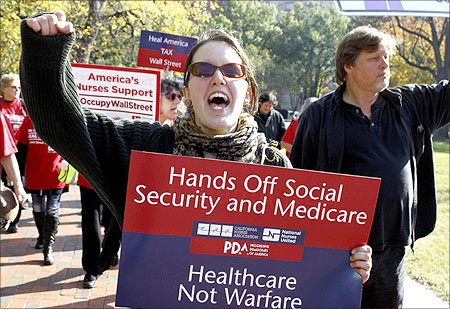

The presidential framework said it should properly balance the need to reduce tax incentives to locate overseas with the need for US companies to be able to compete overseas; some overseas investments and operations are necessary to serve and expand into foreign markets in ways that benefit US jobs and economic growth.

Click NEXT to read more...

Obama proposes minimum taxes on foreign earnings

"This will be a difficult and complex undertaking, but one guided by the sole criteria of promoting growth in the jobs and standard of living of American workers and their families," it said.

"Evidence suggests that high statutory tax rates may also affect a company's willingness to locate in the United States following mergers and acquisitions," it said.

Proposing to reduce the corporate tax rate from 35 per cent to 28 per cent, the Obama Administration said this reduction in the rate would put the US in line with other advanced countries, help encourage greater investment in the US, and reduce the tax-related economic distortions.

Click NEXT to read more...

Obama proposes minimum taxes on foreign earnings

The presidential framework said it should properly balance the need to reduce tax incentives to locate overseas with the need for US companies to be able to compete overseas; some overseas investments and operations are necessary to serve and expand into foreign markets in ways that benefit US jobs and economic growth.

"This will be a difficult and complex undertaking, but one guided by the sole criteria of promoting growth in the jobs and standard of living of American workers and their families," it said.