Photographs: Krishnendu Halder/Reuters

Two more institutions joined the growing list of analysts expecting sub-6 per cent growth for India this fiscal, with American banking major Citi and global brokerage CLSA on Wednesday cutting their estimates to 5.4 and 5.5 per cent respectively.

"The stars just don't seem to be aligning for India, with almost all the growth drivers being hit. . .the government needs to get down to serious business with more action to stem a further deceleration in growth," a note from Citi said, adding that it is scaling down its FY'13 growth estimate to 5.4 per cent from the earlier 6.4 per cent.

The report, authored by Citi India chief economist Rohini Malkani, further said if the drought conditions worsen, growth may slip further to 4.9 per cent.

. . .

Now Citi, CLSA trim India's growth to 5.4%

Photographs: Reuters

Meanwhile, the global brokerage firm CLSA also cut its gross domestic product growth estimate to 5.5 per cent from the earlier 6 per cent, stating, 'the revised forecast assumes lower growth of zero percent (from a 'normal'" 3 per cent) for the agriculture and allied sector.'

The brokerage's senior economist Rajeev Malik said this may not be a final revision as the monsoon is not yet over.

Last week, the Met department said the monsoons will be below normal by 9-10 per cent of the long period average.

The twin downward revisions come within a day of ratings agency Crisil going public with its estimate of a 5.5 per cent growth, while some others, notably JP Morgan with 5.3 per cent, had earlier forecast lower growth.

. . .

Now Citi, CLSA trim India's growth to 5.4%

Photographs: Reuters

In its quarterly policy review on July 31, the Reserve Bank also cut its growth expectations to 6.5 per cent from the earlier 7 per cent, blaming high fiscal deficit, sticky inflation and a possible drought.

In the Union budget in February, the government had targeted a 7.6 per cent growth.

Notably after record growth, GDP for FY12 came down to 6.5 per cent, which was 2 per cent lower than in FY'08.

That growth was driven down by the global credit crisis following the fall of Lehman Brothers in September 2008.

. . .

Now Citi, CLSA trim India's growth to 5.4%

Photographs: Reuters

Citi listed the following factors for pulling down growth: drought fears, non-conducive politics and policy atmosphere for investments, power outages, lower consumption because of dented confidence and the likely slowdown in exports following weakness in global economy.

Last fiscal the merchandise exported crossed target of $300 billion by a tad at $303.8 billion.

Citi said the lower rainfall will impact food prices and push up the average inflation higher to 8 per cent from the 7.5 per cent.

. . .

Now Citi, CLSA trim India's growth to 5.4%

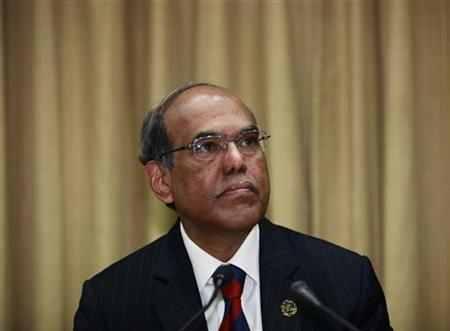

Image: RBI Governor D Subbarao.Photographs: Reuters

Even Reserve Bank of India in its first quarter policy review increased its March-end inflation target to 7 per cent, even though the core inflation has been on a southward-ho and stayed at 4.6 in June, while headline inflation inched downed to 7.25 per cent for the month.

Citing inflation for two consecutive reviews, RBI left the key policy rates unchanged, to everyone's disappointment.

This will hold back the RBI from cutting rates and Citi revised its estimate of up to 0.75 per cent cut in key rates by RBI to 0.50 per cent, without giving a timeline.

. . .

Now Citi, CLSA trim India's growth to 5.4%

Image: Indian Parliament.Photographs: Reuters

CLSA also said the poor rainfall will impact inflation but mentioned that the RBI will maintain its elevated rates in the absence of fiscal correction by the government.

Both CLSA and Citi said the current scenario will have an adverse impact on the fiscal deficit and took their FY13 estimates on that front to 6 per cent and 5.9 per cent, respectively.

The leadership change at the Finance ministry, where P Chidambaram has taken over, is a positive, but "actions may be less than words given the continuation of the dual leadership model and all eyes on the next polls," Citi said.

. . .

Now Citi, CLSA trim India's growth to 5.4%

Photographs: Reuters

On the current account deficit front, Citi said it will improve to around 3 per cent of GDP from the last fiscal's record high of 4.2 per cent on a sharper fall in imports, although exports will also contract.

CLSA said with this revision, the country loses the coveted position of being the second fastest growing economy in Asia, behind China.

The growth estimates of Indonesia (6.2 per cent) and the Philippines (5.8 per cent) have pushed India with 5.5 per cent at the fourth place in the order, it said.

The Citi report, however, gave some optimism saying, "the India story is 'dented' but not 'broken'."

Many structural drivers, domestic-driven economy, demographics and relatively high saving rates continue to exist in the country, it said, calling for urgent steps from the government to revive growth.

article