| « Back to article | Print this article |

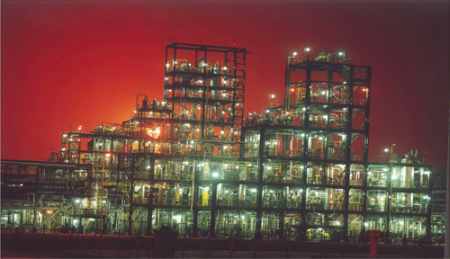

No end in sight in battle over Haldia

A 7-yr legal tussle over Haldia Petrochemicals looked close to being resolved. But when Mamata Banerjee upped the ante, it was back to square one for investor Purnendu Chatterjee.

It was January 2005. Industrialists, chief executive officers (CEOs) from across the country and representatives from 23 nations, were seated in the makeshift hangar on the sprawling National Library grounds in Kolkata, the venue for the 10th CII Partnership Summit. The speaker was none other than Prime Minister Manmohan Singh.

As the "best chief minister" (that's how he used to be described back then) Buddhadeb Bhattacharjee dominated Singh's speech. Among the couple of other people who found mention in the Prime Minister's speech was NRI investor, Purnendu Chatterjee.

Click NEXT to read more...

No end in sight in battle over Haldia

Even weeks after the summit, Chatterjee's achievement of making it to the Prime Minister's speech was much discussed in the industry circles of Kolkata.

From then on, Bengal's showcase project, Haldia Petrochemicals (HPL) has been marred by protracted legal battles. Last month, The Chatterjee Group (TCG) dragged the government to the International Court of Arbitration (ICA), under the International Chamber of Commerce (ICC).

Last week saw the state industries and commerce minister Partha Chatterjee dramatically taking charge as the chairman of the company, toppling the TCG chief Purnendu Chatterjee in a fiercely fought board room battle.

Click NEXT to read more...

No end in sight in battle over Haldia

The seeds of the battle may have been sown during the Partnership Summit, about seven years back. A high-profile meeting was held alongside the summit between Tata group chairman Ratan Tata, Haldia Petrochemicals chairman Tarun Das, West Bengal commerce and industry minister Nirupam Sen apart from Purnendu Chatterjee and Buddhadeb Bhattacharjee.

It marked a truce between the two warring promoters --Purnendu Chatterjee and the government of West Bengal -- of Haldia Petrochemicals, but only temporarily.

It was decided that the state would hand over its shares to Chatterjee, but the decision also paved the way for more battles. Seven years on, Chatterjee is still fighting the state government, albeit ruled by a different party now, over Haldia Petrochemicals.

Click NEXT to read more...

No end in sight in battle over Haldia

In 1994, when Chatterjee was funding several ventures with the legendary business magnate George Soros, he was summoned by Bengal's longest serving Chief Minister (in fact, India's) Jyoti Basu to bail out the state government over Haldia Petrochemicals. Chatterjee became the white knight and was likened to industrialists like the Ambanis, Mittals and the Tatas.

Over the years, the TCG group has invested close to Rs 10,000 crore (Rs 100 billion) in India, of which HPL accounts for Rs 600-800 crore (Rs 6-8 billion). But in terms of revenues, next to HPL, real estate development would probably account for the lion's share.

Critics point out that Chatterjee's incapability of living up to the exalted reputation could probably be a result of an endless pursuit for the right price and management skills, with the impact clearly showing on petrochemical company's bottom line.

Click NEXT to read more...

No end in sight in battle over Haldia

Never ending legal tussles over ownership and board room battles have choked HPL to the extent that it came close to being reported to the Board for Industrial and Financial Reconstruction (BIFR) as a potentially sick company.

Though olive branches were shown after the Mamata Banerjee government took office, replacing the 34-year-old Left regime, the battle between the two promoters just got murkier showing no "Parivartan" on HPL's state of affairs.

Click NEXT to read more...

No end in sight in battle over Haldia

What went wrong?

The greenfield project was conceived in 1985 as a joint venture between the the West Bengal Industrial Development Corporation (WBIDC) and the R P Goenka Group. But it did not take off for almost nine years, even though Tata Chemicals and Tata Tea were inducted, replacing the Goenkas.

The project started making headway once the Chatterjee Petrochem (Mauritius) Company (CPMC) stepped into the project on May 3, 1994.

"We took up the project after even Tatas and Goenkas came, and had little success. Once we were in, the project was commissioned in quick time," said Anirudha Lahiri, chief executive officer and president at TCG.

Click NEXT to read more...

No end in sight in battle over Haldia

The crux of the dispute hinges on the ownership of 155 million shares (about 10 per cent of the total shareholding), which is key to majority control over the company. TCG has also contested the government's sale of 150 million shares to Indian Oil Corporation (IOC).

As per an agreement of 2002, the state had agreed to sell 155 million shares at a price of Rs 10 per share for Rs 155 crore (Rs 1.55 billion).

"The government had transferred those 155 million shares but it was not registered," Lahiri said. In fact, WBIDC had given a loan of Rs 147 crore (Rs 1.47 billion) to TCG to buy those shares.

Click NEXT to read more...

No end in sight in battle over Haldia

While in 2005, the government decided to completely exit from the company by selling the 520 million shares, this ultimately did not happen due to valuation issues and the deal was called off.

According to TCG, the government was also trying to sell shares to IOC through the back door, for which TCG had the first right of refusal, according to the agreement. The state government's version is that IOC was mooted by TCG, but the Navratna company wanted 26 per cent equity as well as management control.

Handicapped by the agreement, the state government instead gave it in writing to IOC that if TCG failed to buy out the state's shares then it would be handed over to IOC.

Click NEXT to read more...

No end in sight in battle over Haldia

Adding fuel to the war, the government came in the way of Chatterjee's plans to leverage HPL's assets for a $5.7-billion takeover bid for European petrochemical giant Basell Polyolefins in 2005.

TCG lost no time in moving the Company Law Board (CLB).

The CLB ruling went in favour of TCG, which said that not just the 155 million shares but the government should sell 520 million shares to TCG at a price of Rs 28.80. The state approached the Calcutta High Court which set aside the CLB order. Last year, the Supreme Court, too, dismissed a TCG petition and upheld the High Court order.

For the TCG chief, the 155 million shares continue to be elusive.

Click NEXT to read more...

No end in sight in battle over Haldia

Turning point

The current battle is curious given that Chatterjee happened to be one of the few investors who actually announced fresh investment proposals after the new government was sworn in. Apart from Rs 4,000 crore (Rs 40 billion) of downstream petrochemical projects, Chatterjee was even mulling a Bank of Bengal.

And after many years, the otherwise reticent "PC" (Purnendu Chatterjee), as he is popularly known, was more visible and audible. The courtship, however, turned out to be short lived.

It was the Bengal government's pledge to protect the interests of the company, by way of an auction of the government's shares that ultimately rattled the TCG supremo. It was common knowledge that Reliance Industries, IOC and GAIL were more than interested in HPL.

Click NEXT to read more...

No end in sight in battle over Haldia

"My aim is to turn around the company. We are already working on austerity measures, and various other projects to see how the company can be revived," the newly elected HPL chairman, Partha Chatterjee, said.

Chatterjee won the resolution with nine votes. "They got just three votes, all the lenders are with me. Together we have well over majority," he said.

The fourteen-member board against includes four TCG nominees: Purnendu Chatterjee, Subhasendu Chatterjee, Vijay K Chaudhry, and R Vasudevan. The latter was not present at the momentous meeting.

Click NEXT to read more...

No end in sight in battle over Haldia

HPL managing director, Partha S Bhattacharyya, who was hand-picked by Purnendu Chatterjee last year also cast what he called a "conscience" vote against him.

That matters were not going Purnendu Chatterjee's way became clear when the West Bengal Industrial Development Corporation (WBIDC) recently sent back a cheque of Rs 17 crore (Rs 170 million) by TCG, which cited an agreement of March 2002 based on which the state had to sell 155 million shares to the group.

If WBIDC had accepted the cheque, it would have established TCG's dominance in HPL.

Click NEXT to read more...

No end in sight in battle over Haldia

Bleeding books

Last week, the company board cleared a proposal in order to save the firm from reporting to BIFR by converting Rs 128 crore (Rs 1.28 billion) debt into equity at par basis (Rs 10), through which the lenders will get about an eight per cent stake.

HPL has an accumulated loss of more than Rs 1,000 crore (Rs 10 billion) against a peak networth of Rs 2,844 crore (Rs 28.44 billion), while the total debt is around Rs 3,700 crore (Rs 37 billion).

The main lenders of HPL are IFCI, IDBI Bank, ICICI Bank, PNB, SBI, Allahabad Bank and Union Bank of India. During the last financial year, HPL had made a net loss of around Rs 250 crore (Rs 2.5 billion).

Click NEXT to read more...

No end in sight in battle over Haldia

"This year, technical faults had caused stoppage of work and a loss of about Rs 200 crore (Rs 2 billion). We hope that things will be better in the coming days," said Bhattacharyya.

"HPL needs equity infusion at the earliest. The Left Front government wanted to set up a Petroleum, Chemicals and Petrochemical Investment Regions (PCPIR), the biggest beneficiary would have been HPL by way of backward and forward linkages," Nirupam Sen said.

When the TCG chief was contacted, he refused to answer several questions regarding HPL that Business Standard had posed to him. The only thing screaming out now is HPL's sagging bottomline.