| « Back to article | Print this article |

Murthy makes presence felt in Infosys results

Infosys on Friday posted healthy growth in earnings for July-September 2013, and raised the lower end of its FY14 revenue guidance, indicating the company had regained its momentum.

The performance of India’s second largest information technology (IT) services firm in the second quarter assumes significance as this was the first full financial quarter after the return of co-founder N R Narayana Murthy as executive chairman, in June. He had then said the company would focus more on winning large deals and cutting costs.

Experts said Infosys’s performance reflected a statement made by Murthy last month: “Bad news will come to shareholders via the elevator, while good news will have to take the staircase route.”

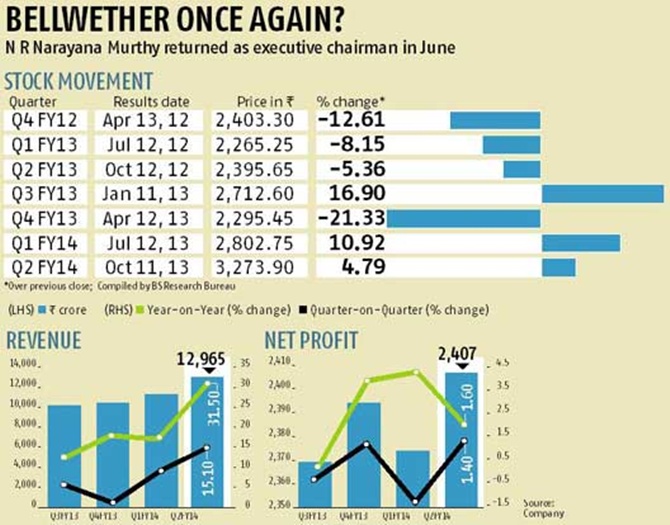

The Street cheered the numbers delivered by the Bangalore-based company. Infosys’s stock rose 4.79 per cent on the BSE to close at Rs 3,273.90, pulling the IT index up 3.12 per cent.

Click NEXT to read more…

Murthy makes presence felt in Infosys results

The improvement in Infosys’s momentum was visible not just from the numbers and facts that the company shared on Friday, but even from the top management’s commentary.

After many quarters, Chief Executive Officer and Managing Director S D Shibulal moved away from words such as “cautiousness” and “concern”, and stressed more on “broad-based growth” and “increased momentum”. Murthy was absent at the results announcement.

“The growth in Q2 was all-around. Our top client grew by 3.3 per cent, top 25 grew by 3.8 per cent, and the non-top 25 clients grew by 3.7 per cent .... We are definitely winning more large deals than what we have been winning before. Comparatively, our performance of winning large deals has improved but we need to win a lot more,” Shibulal said.

Backed by an uptick in demand and depreciation of the rupee, the IT major posted 1.4 per cent growth in net profit from the corresponding quarter of the previous financial year, at Rs 2,407 crore.

The revenue for July-September 2013 rose 31.5 per cent on an year-on-year basis at Rs 12,965 crore (Rs 129.65 billion). On a sequential basis, net profit increased 1.6 per cent and revenue 15.1 per cent.

Click NEXT to read more…

Murthy makes presence felt in Infosys results

The bottom line for the quarter took a hit primarily due to a $35-million provision towards a US probe into its use of business visas. Due to this, revenues in dollar-terms fell 11.1 per cent on a Y-o-Y basis and 8.4 per cent sequentially to $2,066 million.

Chief Financial Officer Rajiv Bansal said: “This is something for which we received a subpoena in May 2011, and discussions are on with the government agencies and departments for the past two years. Based on the way the discussions are today, we felt it’s necessary to make the provision. We might not use a dollar out of it, or we may spend more on it.”

Despite this hit on bottom line, observers were of the view that there was no reason to worry. In line with expectations, the Bangalore-based company raised the lower-end of its revenue guidance for FY14, and it now expects revenue growth of 9-10 per cent, against 6-10 per cent it had estimated at the beginning of the financial year.

Shibulal said: “There are multiple factors which influence our guidance, which is a statement of facts. We consider the deal wins, the pipelines, the client velocity, environmental factor as well as internal challenges when we come out with our guidance.”

Click NEXT to read more…

Murthy makes presence felt in Infosys results

While some observers said Infosys was being “over conservative” in its guidance, Shibulal said the company was factoring in the seasonal weakness that traditionally sets in during Q3 and Q4.

Dipen Shah, head of private client group research, Kotak Securities, said: “We believe that the company should be able to do better than the guidance given for FY14, which, we feel, is conservative. The company has reported consistent revenue growth performance over the past couple of quarters and it has levers to improve margins further from current levels.”

Operating profit margins during July-September remained unchanged from a quarter ago at 23.5 per cent, as the positive impact of the weakness in rupee during July-September was mitigated by the negative impact of wage increases announced in June 2013.

Click NEXT to read more…

Murthy makes presence felt in Infosys results

The company added 68 clients during July-September, including five large deals, and a 3.1 per cent sequential growth in volumes (billed man-hours in a quarter) during July-September.

It also improved on the employees’ utilisation front, which rose to 77.8 per cent (including training) from 75.9 per cent in the previous quarter.

All industry verticals showed growth. Manufacturing was in the lead, posting 6.8 per cent sequential growth, followed by energy and communication services (4.7 per cent) as well as banking, financial services and insurance (2.9 per cent). Among geographies, Europe grew the fastest at a sequential growth of 5.2, followed by North America at 3.9 per cent.