Photographs: Reuters Dev Chatterjee in Mumbai

In February this year, Aam Admi Party leader Arvind Kejriwal targeted Narendra Modi, accusing him of links with Reliance Industries Chairman Mukesh Ambani.

Hours later, Bharatiya Janata Party leader Chandan Mitra told a television channel that the party opposed the Rangarajan formula on gas price hikes that Kejriwal alleged was in favour of Ambani.

No one gave much importance to Mitra’s statement because of the perception that relations between RIL and the Central government would improve dramatically once the United Progressive Alliance, with which India’s largest private company had a lot of run-ins, was voted out of power.

However, four months later, Mitra has proved to be spot on.

Please . . .

It's raining bad news on Reliance

Image: Mukesh Ambani (extreme right) with his son Akash (extreme left), mother Kokilaben and wife Nita.Photographs: Reuters

There is no evidence to suggest any warmth in the relationship between the new government led by Modi and RIL.

The first of the bad news was the government’s decision to defer the decision on higher gas prices.

This is a huge setback for RIL as in April this year, the company had asked the oil ministry to announce the new price immediately after polling ended on May 12, saying this was necessary to avoid ‘irreparable’ loss to all parties, including the government.

The new pricing formula arrived at by the United Progressive Alliance government almost doubled the price of natural gas to about $8.34 per million British thermal unit and was to be implemented from April 1.

Please . . .

It's raining bad news on Reliance

But it was put in abeyance following a directive of the Election Commission.

To make matters worse, the new government has also maintained the previous regime’s policy of imposing penalties on RIL for failing to meet a predetermined level of production.

The latest penalty takes the total to more than $2.3 billion.

The bad news is not coming from the government alone.

The Comptroller & Auditor General has drafted a report to the telecom department, suggesting cancellation of the nationwide broadband spectrum allotted to Reliance Jio in 2010 on the grounds that the company violated rules.

Please . . .

It's raining bad news on Reliance

Image: Mukesh Ambani with wife Nita.Photographs: Reuters

In its draft report, CAG said that DoT failed to recognise the rigging of the auction right from the beginning in which a small ISP, Infotel Broadband Services (later acquired by RIL) emerged winner of pan-Indian broadband spectrum by paying 5,000 times of its net worth.

When contacted, RIL, however, said any reference to a ‘CAG report’ or even a ‘draft CAG report’ in the ongoing audit would be incorrect.

“For that, fundamental conditionalities like rights available to auditees to place their rejoinder before the CAG process, and then for the CAG to finalise his organisation’s collation, read with explanations of the auditees, put together under one final report to Parliament have not been completed,” says the RIL statement.

Please . . .

It's raining bad news on Reliance

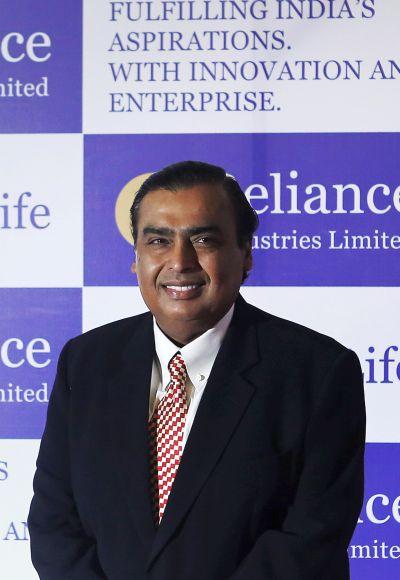

Image: RIL chairman Mukesh Ambani addressing shareholders during the firm's AGM held in Mumbai recently.Photographs: Reuters

And then there came reports of the anti-corruption bureau of the Delhi government investigating the complaint by former Delhi Chief Minister Arvind Kejriwal on gas pricing.

Meanwhile, the market regulator is starting its investigations into the alleged fraudulent trades by the company in the shares of subsidiary Reliance Petroleum just before its merger with RIL.

And if this was not all, just a few days before the Lok Sabha election results, government-owned ONGC sued RIL in the Delhi High court, alleging that RIL drew gas from its fields in the Bay of Bengal.

Please . . .

It's raining bad news on Reliance

Image: Mukesh Ambani.Photographs: Reuters

It’s not that Reliance is not fighting back.

The company has hired some of country’s best legal brains to present its side of the story to the courts and restructured its communications team.

Though operationally, the company is doing well and is investing a massive Rs 1,80,000 crore (Rs 1,800 billion) in the next three years to increase its petrochemicals and oil and gas business, the negative news -- like a bad penny -- keeps coming back.

Unlike the Tatas and Birlas, both of which earn sizeable revenues from abroad, RIL’s success story is mainly India-centric.

But it is taking steps and is investing more abroad.

Please . . .

It's raining bad news on Reliance

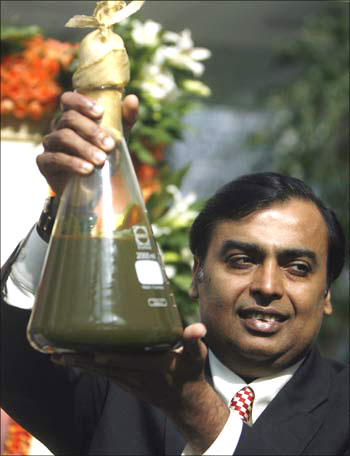

Photographs: Reuters

A detailed RIL statement on the issues said the company always had a robust and composite relationship of transparency with several hundred governmental agencies ranging from those residing at the ground level to public sector units to various state governments to, of course, individual ministries in the central government and sectoral regulators.

“As for matters pertaining to MoPNG, the matter is under arbitration, a process duly provided for in our rights as contractors.

To represent it in any other manner would be wrong and prejudicial to our rights and contentions, as also our reputation in the eyes of known and unknown persons in geographies you are distributed,” the RIL statement added.

Please . . .

It's raining bad news on Reliance

Image: Mukesh Ambani along with his wife, mother and daughter at the company's annual general meeting in Mumbai.Photographs: Reuters

RIL, which has presented its case on its website, said the first gas price was approved in 2007 when the crude oil price was hovering at $30 a barrel.

Crude oil prices have moved up to over $100 a barrel and imported LNG from around $4 to over $14 a unit.

It also says the charge of hoarding gas by the company is technically impossible.

The decline in production in D1-D3 fields in the KG-D6 block is due to reservoir complexity and geological surprises and not due to hoarding.

Peers agree.

A former CEO of a multinational oil company said RIL was not at fault as far as the fall in production of gas from KG-D6 fields was concerned.

All over the world as the production of oil and gas is highly uncertain and a highly complex process, production can meet any unexpected hurdle and it is very difficult for a lay person to understand the complexities of a field.

Please . . .

It's raining bad news on Reliance

Photographs: Reuters

“I don’t think RIL can be blamed for a fall in gas production. The government is the owner of the gas assets and it can take any step as it deems fit in the national interest,” he says, asking not to be identified.

“But to single out RIL for the fall (in gas production) is not correct,” he adds.

Meanwhile, riding on a 16 per cent rise in RIL shares since January this year (the BSE Sensex is up 24 per cent in the same time), large investors and analysts say the worst is now behind the company.

In a report, multinational bank UBS says it expects a gas price hike at $7.5 a unit from October this year and a gradual recovery in KG-D6 output to 15 mmscmd.

Analysts are also expecting a ramp-up of gas production post arbitration, which is expected to be resolved by 2015.

Please . . .

It's raining bad news on Reliance

Image: Mukesh Ambani.Photographs: Reuters

“We expect RIL premium gross refining margins to go up by $1 a barrel from pet-coke gasifier in 2016, and growing US shale profits to contribute over the next two years,” says UBS analyst Ashish Jagnani in a report dated July 21.

That’s good news for the company which has been plagued by bad news for quite some time.

Not an easy day for RIL

- Feb 11, 2014: Former Delhi CM Arvind Kejriwal orders probe by anti-corruption bureau against RIL and policymakers over gas pricing

- May 15: ONGC sues RIL for drawing gas from an offshore block the company controls in Bay of Bengal

- June 25: CCEA defers gas price hike by 3 months

- June 29: CAG suggests cancelling nationwide broadband spectrum allocated to Infotel Broadband Services for allegedly rigging the auction and violating rules

- June 30: SAT dismisses RIL appeal against Sebi order, rejecting RIL’s consent application in alleged fraudulent trading in shares of group company, Reliance Petroleum, in 2007

- July 14: Govt slaps additional penalty of Rs 3,500 cr on RIL for producing less than targeted natural gas from its KG-D6 block

article